Donald Trump’s Impact on U.S. Economy

Two weeks ago, a true-to-form Donald Trump signed an executive order which could spark the U.S. financial crisis 2017. The risk does not need all 450 pages of your average Joseph Stiglitz book to understand. Three words will do: Wall Street deregulation. The president wants to “amend”—read “scrap”—the Dodd–Frank Wall Street Reform and Consumer Protection Act.

For those, who don’t know, Dodd-Frank is the code of conduct that President Barack Obama—and much of Congress—imposed on the U.S. financial industry after the Great Recession of 2008. It’s no hyperbole to suggest that this move alone could be enough to spark the U.S. financial crisis 2017. By wanting to get rid of it, Trump shows he’s willing to gamble, no matter how high the stakes.

Such local-level Donald Trump policies could spark a global financial crisis. It’s not possible to contain a contagion that starts right on Wall Street, as with the last financial crisis. By the way, the lifting of Dodd-Frank is being brought to you by the same man who ran a campaign castigating the financial establishment and the “globalized elites.”

This doesn’t bode well for Donald Trump’s next policies to prevent the financial establishment from leading America toward another financial collapse. President Trump did exactly what he accused Hillary Clinton of doing. He has let the banksters and hedge fund managers right into the White House, not even at arm’s-length from it.

The U.S. needs such regulations. For all the haughty concerns about how Europe, China, or Japan might run their economies, the domino effect from next global financial crisis will begin on Wall Street. It could happen as a result of Donald Trump policies. In fact, previous episodes of financial collapse have their origin in what polite society calls “deregulated capitalism.”

Realists call it for what it is: “wanton capitalism.” After all, it was on Wall Street that the market crashed in 1929. This sparked a depression, while arguably setting the stage for World War II in Europe.

What Would Trump’s U.S Financial Market be Like?

The Dodd-Frank Act, introduced by Obama after millions of hours of negotiations in Congress, was far from perfect. But it at least had the merit of keeping some of the muddiest practices in check. It allowed for a more-than-reasonable market performance, while preventing the causes of U.S. financial crisis 2008 from resurfacing.

Dodd-Frank, like other regulatory tools, intends to protect you, the citizen, from the next global financial crisis. The true populist and popular thing to do would have been to regulate the bankers more, not less. After all, the Dow Jones had reached record highs under Obama. So what if Trump’s promises have pushed it above 20,000? How has that affected you, in particular?

It’s the usual bunch who has gotten richer. Most people don’t benefit from the Dow’s records. It’s not part of the “real economy.” Thus far into Donald Trump’s presidency, his policies have doubtless helped make the rich richer. They seem to be intent on strengthening banks rather than protecting consumers. This could prompt a U.S. financial crisis 2017.

It certainly seems like Trump might be more interested in rewarding Wall Street than Main Street. Fewer than 10 years after Lehman Brothers Holdings Inc. cracked, setting off a global financial crisis whose effects linger, Trump wants to shock the system again. Ultimately, after stripping the peculiarities of the age, the causes of a financial crisis result from investors taking excessive risks.

One wonders if the electoral slogan “America First” was more about “American banks first,” rather than the American people first. Limiting certain categories of immigrants and refugees won’t help anyone, whereas allowing banks to release the shackles of regulation would unleash the kind of risk that could hurt you.

Credits: Pixabay.com/geralt

Here’s how the potential U.S. financial crisis 2017 could explode to global financial crisis 2017. If Trump deregulates Wall Street, other countries’ governments, given the interconnected nature of finance, will face pressure to do the same. The result would be one domino effect of wild deregulation, favoring those who take risks, not with their own money, but yours! That’s what banks do.

That would be a rather unpleasant turn of events, given the precariousness of the financial system today. The world is still repairing the damage from the last financial collapse. Thus, like a patient who has just been released from surgery, needing care, the financial system is still vulnerable to new shocks.

But it’s more than that. Trump has added a new risk to the global financial framework. He wants to reverse the globalization trend that has shaped the economy for the past 25 years, for better or worse. It all goes back to the problem of shocking a weak system. Trump is shocking it twice, because, without the international framework to support it, the next financial crisis could be fatal.

Is Donald Trump Good for U.S Economy?

In a more populist and fragmented world—something that a few European countries are likely to experience this year—there’s nobody left to clean up the mess of a financial collapse. Rather than have China as an ally, Trump has accused it of manipulating its currency.

How likely is it that the world’s second-largest economy—which would like nothing more than to surpass the U.S.—will come to America’s aid? Like many, I thought that Trump’s exaggerations, accusations, and blaming were mostly just part of his election campaign. I thought that the boasting and accusatory tones would dissolve the instant Trump moved into the White House.

My logic was that, no matter how bombastic the campaign was, as Trump took his seat in the Oval Office, pondering the responsibility of his office, his tone would moderate. I really thought he would do the right thing and look out for the interest of the average American.

Trump has chosen division as his strategy. That’s a standard of the “imperial” repertoire: “divide et impera,” divide and conquer. Instead, Trump should have tried—I’m not even suggesting achieve— to reach a constructive relationship with all Americans, regardless of how they voted.

Trump, after all, was elected because he promised to give what Hillary Clinton did not and could not. Clinton represented a part of the financial establishment that both caused and gained from the financial crisis. Trump was elected to help the American middle class recover from the excesses of financial gambling in the world of the post-2008 crisis.

It should be clear to everyone that the 2008 financial crisis brought down any illusions that the market is the solver of all problems. It marked the end of an era of risk-taking that crossed criminal lines.

Trump proposes protectionism. Some form of protectionism might be desirable, in fact. Encouraging American companies to employ more people at home has merit, but deregulating finance does not. Frankly, many will be left wondering how Trump managed to obtain, with resounding success, so many votes from the lower middle class.

Time to Take Cover

In the few weeks he’s been president, Trump’s economic program has finally revealed itself. It’s different than the European populists, in that Trump wants to cut social spending. Trump wants to pull away the social safety net and leave everything to the market. It’s like October 28, 1929, the day before the big crash of 1929, all over again.

To better grasp how precarious the economy is today and the extent of a possible financial crisis 2017, consider this. Should Trump resign, there’s no alternative that could fix the system, even with the Dodd-Frank regulations in place. Certainly, the alternative to Trump could not come from a return to the status quo in the form of Hillary Clinton.

The type of globalization that Clinton represents is gone. Trump still has time to find a middle way, rather than impose a radical departure, which looks after everything but the interests of the working man and woman. All Trump had to do was to stick to his electoral program. Financial deregulation was not part of it.

In the United States, where the lowest incomes rise slower than the highest ones, perhaps the proposal for greater government involvement in sensitive areas such as health and education—to compensate some level of financial deregulation—might have been a better idea. As things stand now, Trump could cause huge economic and social crisis, much deeper than in 2008.

U.S. National Debt

There is a real concern that Trump’s approach on trade and financial rules are repeating the causes of the U.S. financial crisis 2008. The last thing the markets needed is the loosening of the rules. Then there is the issue of how deregulation plays in the context of the U.S. national debt.

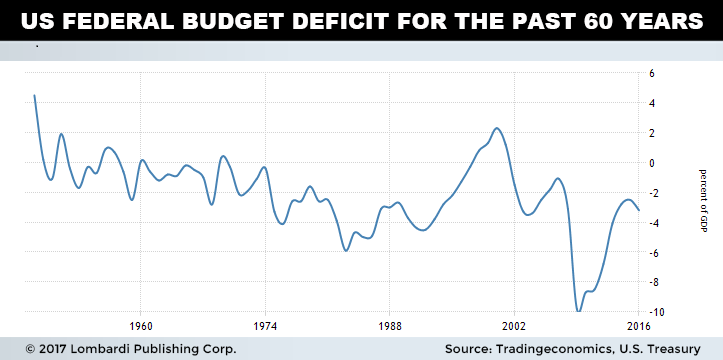

The United States recorded a federal government budget deficit of 3.2 percent of the country’s Gross Domestic Product (GDP) in fiscal year 2016. It is the biggest deficit in 3 years. The budget in the United States averaged -2.11% of GDP from 1948 until 2016, reaching an all-time high of 4.50% of GDP in 1948 and a record low of -9.80% of GDP in 2009. See chart below:

There was a budgetary surplus in 1960 but, since 1971, U.S. debt has increased by an average of nine percent annually. Obama followed the trend and added about $10.0 trillion to the U.S. national debt, according to some measures. (Source: “National Debt Under Obama,” The Balance, January 30, 2017.)

Neither Hillary Clinton nor Donald Trump had plans to reverse this trend of massive expansion of debt. They barely mentioned it. Both promised tax cuts and greater investment in infrastructure, which will add to the debt. Meanwhile, we know that the U.S. Federal Reserve will increase in interest rates.

We can also speculate that the greater financial deregulation will cause havoc in the world financial system, which could in itself increase the U.S. public debt levels. Trump will find it hard to reverse the debt expansion. He needs debt to fulfill his election promises and the most important part of his electoral program. That is, to revive the U.S. economy.

Trump wants to do that by pulling away from world trade, which restricts markets for U.S. goods. Trade restrictions are a two-way street; you can’t impose barriers and then expect others not to reciprocate. Trade is falling and is likely to decline significantly in the coming years. With all these problems, it is not the best time to tempt debt.

Trump is determined to succeed, but directing an indebted economy into the world will be much more difficult than building his real estate empire. He was very clear about the fact that he will do everything to stimulate the U.S. economy, at whatever cost. The problem is that it will take exactly that: more cost. His plan involves spending more money than he ever imagined.

Could Donald Trump Trigger U.S. Financial Crisis in 2017?

From a macroeconomic point of view, the Trump economic plan based on the dual strategy of lowering taxes while increasing employment (through infrastructure) cannot but increase both the federal budget deficit and the trade deficit. That’s because Germany, China, and Japan will not wait long to retaliate with tariffs of their own. After all, they have international trading blocs with which to cooperate.

That, combined with the abolition of the Dodd-Frank Act, will have devastating effects on the stability and security of the global and American financial systems.