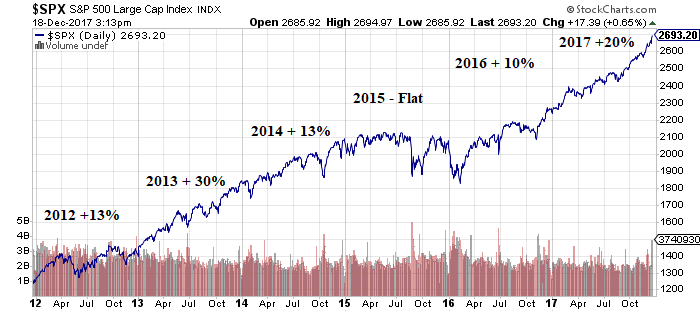

Virtually no one is bearish on the U.S. economy or stock market in 2018, so the idea of a U.S. economic crash in 2018 may seem utterly ridiculous. In fact, 2017 looks as though it will go down as one of the most profitable for the S&P 500, with the index notching gains of around 20%.

This means the bull market will enter its 10th year in March 2018. And, thanks to investors’ unbridled optimism, there’s no reason to think that the markets won’t continue to soar in value throughout 2018. The S&P 500 has hit more than 2,700, the NASDAQ has crossed over 7,000, and the Dow Jones Industrial Average has passed 25,000.

To put that into perspective, since the markets bottomed in March 2009, the S&P 500 has advanced north of 300%, the NASDAQ is up more than 450%, and the Dow has soared more than 280%.

Yes, most of those gains came before President Donald Trump entered the Oval Office, but the stock market and the U.S. economy has continued to expand because of what Trump promised, not what he has accomplished.

On the campaign trail, Trump promised to kill “Obamacare,” withdraw the U.S. from a nuclear accord with Iran, dismantle NAFTA, invest $1.0 trillion into infrastructure, build a Mexican border wall, crack down on immigration, and introduce the biggest tax overhaul since Ronald Reagan—one that would significantly benefit America’s vanishing middle class. None of this has happened.

This might explain why the next economic crash will be worse than the 2008 financial crisis.

Financial Crisis 2008 Explained

The Great Recession came on the heels of the 2008 financial crisis. What caused the 2008 financial crisis, and could the same thing be responsible for an economic crash in 2018?

For the most part, bankers on Wall Street fueled the 2008 financial crisis: irresponsible mortgage lending, securitization of loans, credit default swaps, off-balance-sheet risk, etc. In an effort to make as much money as possible, as banks are wont to do, they took on way too much risk, feigned indifference, and passed that risk on to others.

But there are always consequences to one’s actions. The walls came crumbling down, the stock markets crashed, and the U.S. entered the Great Recession. Wall Street didn’t feel the pangs of guilt for too long, though.

The Federal Reserve stepped in and introduced three rounds of quantitative easing. The central bank artificially lowered interest rates to zero in an effort to stimulate the U.S. economy, and it purchased trillions of dollars’ worth of bonds.

This might have made it easier for businesses and individual Americans to borrow money, but barely-there interest rates also gutted retirement portfolios that relied on fixed-income investments like bonds, certificates of deposit, and Treasuries.

With the Federal Reserve cornering the bond market, income-starved investors had to find somewhere else to make their money work for them. After corporate bond yields plunged, the only game left in town was the stock market. Investors poured in at any cost, and who could blame them? Thanks to financial engineering, Wall Street was churning out decent numbers. Unfortunately, it was all smoke and mirrors.

Because it was cheap to borrow, companies propped up their corporate earnings thanks to cost-cutting measures and record share buyback programs. Revenues may have been tanking, but financial engineering made it look as though corporate earnings were okay.

Between 2010 and 2016, U.S. companies repurchased nearly $3.0 trillion of their own shares and spent almost $2.0 trillion on dividend payments. Investors rewarded these companies with higher stock prices.

And yet the market continues to act as though it has recovered, soaring higher and higher. While rising stock valuations make sense when the economy is doing well, like it has been in 2017, it doesn’t account for the meteoric rise that stocks made when earnings and profits were way, way down and the S&P 500 was in an earnings recession.

Investors rewarded stocks during the halcyon days of quantitative easing for not losing as much money as they thought they would. This might explain why it’s been win-win for the stock market since it bottomed in March 2009.

Chart courtesy of StockCharts.com

But that’s only part of the story. Despite a weak economic climate and falling revenues and earnings, investors continued to reward Wall Street. Consider that, in 2013, the S&P 500 soared almost 30%. But that growth didn’t come from strong quarterly results; it was because losses weren’t as bad as forecasted.

In each successive quarter in 2013, a larger percentage of companies revised their earnings guidance lower. During the first quarter of 2013, 78% of S&P 500 companies that provided pre-announcements issued negative earnings guidance. That number climbed to 81% in the second quarter, 83% in the third quarter, and a record 88% in the fourth quarter.

Still, the S&P 500 marched higher and higher. It’s one thing to reward stocks when they do well, but to send them higher because they missed a worst-case scenario is dangerous, and has helped send stock valuations into nosebleed territory.

Stocks haven’t taken a real breather since the bull market started in 2009. Unfortunately, that means today’s stock valuations have been built on a foundation of sand.

The most popular measure of stock market valuations is the cyclically-adjusted price-to-earnings (CAPE) ratio, also known as the Case Shiller PE ratio. The CAPE ratio, which helped Robert Shiller win the Nobel Prize for Economics in 2013, compares the valuation of inflation-adjusted earnings of S&P 500 companies and assesses whether stocks are cheap or expensive, relative to their long-term averages.

At the beginning of January 2018, the CAPE ratio stood at 33.19; the long-term average is 16. This means, for every $1.00 in earnings a company makes, investors are happy to pay $32.66. It also means that stocks are overvalued by 104%.

Stocks have only been more overvalued once, during the dotcom era. In December 1999, the CAPE ratio hit a peak of 44.20. The ratio is now even higher than it was right before the Great Depression. In September 1929, just before Black Tuesday, it hit 32.56. In both 1999 and 1929, the high CAPE ratios were followed by stock market crashes.

Is Another Economic Crash Coming in 2018?

Is an economic crash coming in 2018? Stock market valuations may be in the stratosphere, but there is too much euphoria about the U.S. economy to realistically call for an economic collapse in 2018. That doesn’t mean there won’t be serious bumps that will see stocks give up 10% losses throughout the year.

Many on Wall Street expect Donald Trump’s proposed tax cuts to fuel the country’s gross domestic product (GDP) growth and send stocks into record territory in 2018.

When it comes to forecasts for the S&P 500, most analysts are very bullish:

- Merrill Lynch, which is part of Bank of America Corp (NYSE:BAC), is forecasting a 2018 year-end target for the S&P 500 of 2,800. “Optimism was building this year, and we think 2018 could be the year of euphoria,” said Savita Subramanian, the head of U.S. Equity and Quantitative Strategy at Merrill Lynch.

- Canaccord Genuity Group Inc (OTCMKTS:CCORF, TSE:CF) is forecasting 2,800. “There’s nothing in the evidence that I can find at this point that would suggest the backdrop is ripe for any kind of significant, sustainable drop in economic activity,” said Tony Dwyer, Chief Market Strategist at Canaccord.

- Goldman Sachs Group Inc (NYSE:GS) is forecasting 2,850. “The bull market will continue in 2018,” said David Kostin, Chief U.S. Equity Strategist at Goldman Sachs. “Our ‘rational exuberance’ rests on a combination of above-trend US and global economic growth, low albeit slowly rising interest rates, and profit growth aided by corporate tax reform likely to be adopted by early next year.”

- UBS Group AG (NYSE:UBSG) is forecasting 2,900. “We think our upside case, based on Congress delivering a tax cut, is more likely than our downside scenario and upside potential (S&P 500 at 3300) outweighs the downside case by 2x,” said Keith Parker, the head of U.S. Equity Strategy at USB.

- JPMorgan Chase & Co (NYSE:JPM) is forecasting 3,000.”The upcoming reduction of US corporate tax rates may be one of the biggest positive catalysts for US equities this cycle,” said Dubravko Lakos-Bujas, U.S. Equity Strategy head at JPMorgan.

But here’s the thing: while many economists are predicting that the markets and U.S. economy will remain robust in 2018, just like in 2008, the next financial crisis and economic crash will happen when everyone least expects it.

Lest we forget when Jim Cramer famously told a viewer on March 11, 2008 that The Bear Stearns Companies, Inc. was doing fine. “Do not take your money out. Bear Stearns is not in trouble. If anything, they’re more likely to be taken over. Don’t move your money from Bear. That’s just being silly. Don’t be silly.”

Fast-forward three days to March 14, 2008, and Bear Stearns worked out a rescue deal with JPMorgan and the Federal Reserve to help keep it afloat. The Bear Stearns CEO said at the time, “…our liquidity position in the last 24 hours had significantly deteriorated. We took this important step to restore confidence in us in the marketplace, strengthen our liquidity and allow us to continue normal operations.”

This is obvious in hindsight, but it also goes to show that even Wall Street can give terrible advice.

For years, analysts were telling investors that Enron Corporation was a stock for the ages. Even Fortune magazine voted Enron “Americas Most Innovative Company” for six consecutive years (1996 to 2001). Between August 2000 and December 31, 2001, Enron’s share price cratered from $90.00 per share to $0.062 per share. Even with its share price sliding, 16 analysts had “buy” ratings as late as September 2001.

And famously, in 1929, Yale University economist Dr. Irving Fisher predicted, “Stock prices have reached what looks like a permanently high plateau. I do not feel there will be soon if ever a 50 or 60 point break from present levels, such as they have predicted. I expect to see the stock market a good deal higher within a few months.”

Just a few days later, Black Tuesday happened and, along with it, the Great Depression.

Again, you can’t predict with 100% certainty that the stock market and U.S. economy will or will not crash, or when the next financial crisis will occur. However, there are historical telltale signs that investors can look at to determine the likelihood of a U.S. economic collapse, or when the next financial crisis will be.

By all accounts, the danger signs for an eventual U.S. financial crisis and stock market crash are aligning.

Experts Predict a Major Financial Crisis by 2018

The U.S. economic outlook remains healthy, GDP growth has been solid, inflation is in check, and unemployment is at a 17-year low. These are not the kind of economic indicators that point to a financial crisis in 2018, but there is more here than meets the eye. Not all so-called experts think 2018 will be a banner year for the U.S. economy and the stock market, and history is on their side.

The economic expansion that helped fuel record stock market levels will turn 10 years old in March 2018. This is an important milestone for many reasons. Historically, the cyclical nature of the economy points to an economic downturn every 10 years or so. The last one, in 2008, led to the Great Recession; unemployment soared, savings were depleted, and stocks plunged.

Over the last 10 years, the stock market and U.S. economy has benefited from the Federal Reserve’s generous $1.0-trillion bond-buying program. Artificially low interest rates helped businesses and consumers borrow money cheaply. The Fed also sent investors flocking into the stock market.

Ten years later, and where are we now? Stock valuations are at their second-highest level ever, investors are complacent, the U.S. dollar is down from its lofty levels, U.S. household debt is in record territory, wages are stagnant, and interest rates are on the rise.

Further, a decade of quantitative easing-style experiments by central banks around the world has resulted in a $20.0-trillion monetary stimulus which threatens financial stability.

The economy may be doing fine, but U.S. financial conditions are a lot worse than they were in late 2016. As a result, there continues to be a risk of market crashes in stocks, bonds, and credit markets.

What can the Federal Reserve do to prevent another recession or to combat another financial crisis? We’ve seen that quantitative easing is no quick fix. But what other tricks do they have? Do central banks, politicians, and bankers think the U.S. and global economies will simply muddle through this mess and come out the other side in a better position?

In addition to these constant, interactive financial stresses that have been under pressure for a decade (and which will eventually fracture), there are other issues that could derail the U.S. economy and stock market in 2018.

Analyst Forecasts

A number of well-known analysts have provided a bearish outlook for 2018.

- Famed Quantum Fund co-founder Jim Rogers predicts that Bitcoin is in a bubble and on the verge of popping, but that soaring U.S. stocks will continue to rise before falling later in 2018.

- “Bond King” Bill Gross is also issuing a warning for 2018. In his December 2017 monthly memo, Gross said we should invest more cautiously in 2018.

- Ray Dalio, founder of the world’s biggest hedge fund firm, Bridgewater Associates, LP (with assets of $160.0 billion), thinks Bitcoin is in a bubble and that the markets are set for a correction. In the third quarter of 2017, Bridgewater increased its holdings in SPDR Gold Trust (NYSEARCA:GLD) to almost four million shares, valued at roughly $480.0 million. Bridgewater also increased its holdings in iShares Gold Trust (ETF) (NYSEARCA:IAU) to more than 11 million shares, valued at more than $133.3 million.

- Meanwhile, stock market analyst John Hussman said the present valuations of S&P 500 companies “are at the most offensive levels in history” and that the S&P 500 is ripe for a 64% correction. On top of that, over the next 10 to 12 years, the S&P 500 will offer up negative returns.

Trump’s Tax Plan

iStock.com/Stas_V

President Trump’s tax and deregulation plans will help fuel an already overvalued stock market—the same stock market that Trump said, during the first presidential debate in April 2016, was, “in a big fat ugly bubble.”

Trump’s trickle-down tax plan is not expected to help the middle class. But it will provide economic benefits to the wealthy. This is not lost on the average American; just 33% of Americans are in favor of the plan, while 55% are against it. An even greater 66% say it will benefit the wealthy more than the middle class.

And they’re right. Trump’s plan permanently slashes corporate tax rates, offers temporary cuts for individuals, and will leave 13 million more Americans without health insurance by 2027. Trump’s tax plan repeals the estate tax, which only benefits those inheriting more than $11.0 million.

It eliminates deductions for state and local taxes and repeals the Alternative Minimum Tax. The tax plan also lowers the number of owners of non-corporate businesses from 39.9% to 25%. This means wealthy Americans will pay lower tax rates than many middle-class Americans.

Americans can no longer deduct large medical expenses. It taxes waived tuition for college students, ends deductions for student loan payments, and disallows teachers from deducting what they personally spend on school supplies.

The Congressional Budget Office found that Americans making less than $100,000 a year (roughly 80% of the U.S.) will actually be hit with increased taxes. The same cannot be said for those who make more money than that.

Again, Americans are not being fooled; 37% say the tax bill will leave their family worse off than they are right now, with only 21% saying it will improve the current status of their family. Some 63% think the tax plan will benefit the Trump family while a paltry five percent say the president’s family will be worse off.

Trump may have said the tax bill is “going to cost me a fortune,” but this just isn’t true.

It’s not an entirely new tax plan. We’ve seen one like this before. In 1926, Andrew Mellon, secretary treasurer under Republican President Calvin Coolidge, pushed through a massive tax cut that helped usher in the Great Depression.

During the “Roaring Twenties,” Coolidge said, “the business of America is business.” He also said, “the man who finds a factory builds a temple,” and, “the man who works there worships there.”

Shortly after Reagan became president in 1981, he noted that Coolidge cut taxes four times, adding that, “we had probably the greatest growth in prosperity that we’ve ever known.”

Maybe. Except that prosperity vanished just a few months after Coolidge left office.

Interestingly, when President Bill Clinton proposed a small increase in the top marginal tax rate in his 1993 budget, Republicans voted against it, with trickle-down economists saying it would lead to an economic disaster. But the tax increase was followed by a period of great prosperity in America, and led to a budget surplus.

When George W. Bush and the Republicans took back the White House in 2001, they followed the familiar Republican economic positions, which inevitably led to the 2008 financial crisis.

Correlation is not necessarily causation, but few believe that Trump’s economic action plan will actually benefit the vanishing middle class, the “economic backbone of America.” Historically, trickle-down economics hasn’t panned out.

Rising Interest Rates and Household Debt

The U.S. economy might be in its “Goldilocks” phase, with growth and inflation not too hot and not too cold, but Americans are worse off.

- Mortgage delinquencies have increased.

- Student loan transitions into serious delinquencies have remained high.

- Auto loan balances and serious delinquencies have continued their steady rise.

- Credit card delinquencies have increased.

In 2018, it’s an absolute certainty that Americans will take on even more debt, with credit card balances rising for the fifth consecutive year. This will lead to an increase in credit card delinquencies.

While some might blame this on unnecessary purchases, the fact is that food and housing expenses have soared— significantly faster than the barely-there wage growth. The end result? Less money for essential and emergency funds.

Speaking of which, 78% of full-time workers in America have said they live paycheck to paycheck, up from 75% in 2016. On top of that, 71% of U.S. workers have said they are in debt, up from 68% in the previous year. Even those making over $100,000 have said they were struggling, with nearly 10% of those making at least that much money usually (or always) living paycheck to paycheck—with 59% admitting they are in the red.

Until recently, many Americans have only been able to handle their debt loads because interest rates and inflation have been low. That’s changing, though, with the Fed having raised interest rates three times in 2017 and being expected to raise rates another three more times in 2018. When that happens, the cost of living will rise, making it more difficult for Americans to just get by. That’s bad news for an economy that relies on consumers to drive 70% of its growth.

Real Estate Unaffordable

Real estate has become increasingly unaffordable for first-time homebuyers, which could also put a huge dent in the U.S. economy.

Right now, roughly 39 million U.S. households cannot afford their housing. Experts advise budgeting 30% of monthly income for rent or mortgage costs, but millions of Americans are blowing past that barrier.

One-third of U.S. households spend more than 30% of their income on housing costs. Of that number, 19 million pay more than 50% of their income on housing. Paying more for shelter means making sacrifices in other areas, including food and healthcare. According to the latest statistics, almost 25 million children live in homes that spend more than 30% to cover costs.

It’s getting harder and harder for first-time buyers to get onto the property ladder. Home prices tanked after the 2007 housing crash but have been climbing ever since. In 2016, they surpassed their pre-recession peak.

First-time home buyers, a benchmark for how well the U.S. economy is doing, accounted for just 32% of all home purchases in late 2017. First-time home buyers also accounted for 32% of all existing home sales in 2016. The 30-year average (and a number that economists consider healthy) is 40%. This is an unwelcome trend.

First-time home buyers are an important part of the U.S. economy. When people buy their first home, they spend money on furniture, appliances, furnishings, renovations, etc. The housing sector’s combined contribution to U.S. GDP averages 15% to 18%.

The high cost of housing then could have serious implications on the U.S. economy.

Those who cannot afford to buy their first home either end up living with their parents or end up renting. Demand for rental units has increased and, as a result, lifted rental prices. This too can lead to serious economic problems. More than 11 million rental households pay more than half their income on housing, a 3.7 million (33.3%) increase from 2001.

Trump’s tax reforms could make housing affordability even worse. Lawmakers are looking to claw back tax benefits designed to encourage developers to build affordable housing and public facilities (schools and hospitals) in poor neighborhoods. If those tax benefits are axed, more than 780,000 fewer affordable rental homes will be built or preserved over the next decade.

Black Swan Events

iStock.com/alexali111

“Black swan” events could also send the U.S. and/or global economies careening into a financial crisis in 2018. But, of course, you can’t predict a black swan event; they’re random and unexpected.

The U.S. economy has not taken off like some predicted it would after Trump won the election. The Republican tax bill is not expected to help out the middle class or poor Americans, and healthcare reform and massive infrastructure spending have failed to materialize. Consumer spending is weak, wage growth is anemic, and debt levels are up.

These are not the economic conditions under which the Federal Reserve should be hiking interest rates. Tightening its monetary policy too much, too soon, could have devastating results and stall the economy. If that happens and the U.S. enters a recession, you can look for President Trump to implement massive quantitative easing, and maybe even negative interest rates.

Internationally, simmering tensions in the Middle East could threaten the region’s stability. And tensions between the U.S. and North Korea could threaten the entire world, as would an event similar to the September 11, 2001 attacks in the U.S.

In mid-December, Trump said that Russia and China are power rivals. Our relationships with Russia and China are already strained. A hard and fast implementation of “America First” policies against China could have massive negative implications for the U.S. economy.

There has never been a year when the U.S. has not been whacked by black swan events, and 2018 will be no different. The big question is, how big will the black swan event be, and how will it impact the U.S. economy?