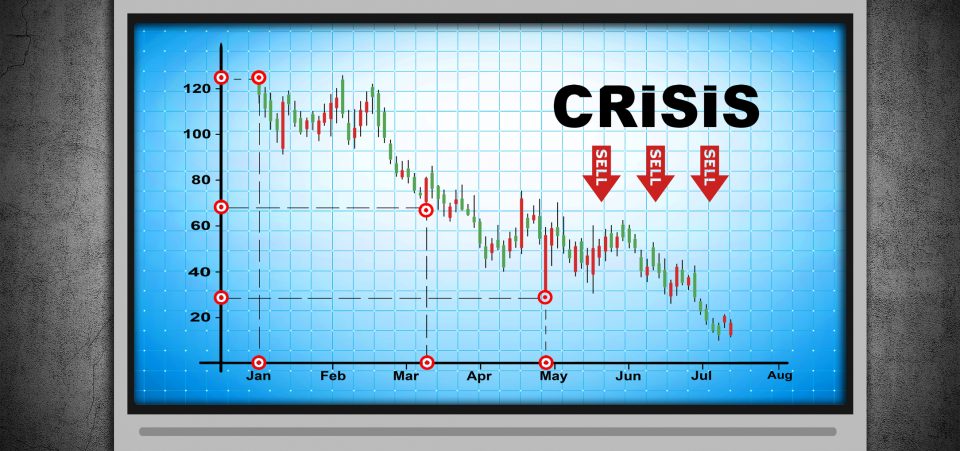

Stock Market Divergence Would Make Way for The Next Financial Crisis

In 2008, Wall Street burned itself. The financial masters of the universe decided to become “generous.” They wanted to make homeowners out of everyone. In fact, they set a trap that ended up catching them as well as the hapless property “buyers.” They used unscrupulous methods based on high-risk mortgage “products” that fueled a market bubble. But, the next financial crisis will not make you wait much longer to strike. A stock market divergence is appearing on the horizon.

In 2008, that divergence involved exploiting people who would never have passed a basic credit check. At the very first shock, be it a job loss or major car repair, or any other sudden situation, could become insolvent. The bankers knew they were accumulating enormous risks. But, they slept comfortably. They had passed on the risks to the larger market.

Also Read: “Economic Crash 2017” and How Next Financial Crisis Could Be Worse than 2008

They were hidden away in special “products,” derivatives, too complex for most people—even financial experts—to detect. Meanwhile, in the mid-2000s, there was the start of a hyperinflation of resources. In fact, the next financial crisis prediction is always around the corner. That’s because there are always those who abuse the system from positions of power.

We don’t know the source yet. But we do know that the next financial crisis will be even worse. It’s always worse because the risks get bigger. But generally, crises stem from too much debt. An event happens, it could be any number of triggers that expose the weakness of the debt-based economy. That’s what happened in 2008 with the subprime crisis and the Lehman Brothers Holdings Inc. collapse.

Yet, that crisis started a year earlier in August of 2007. The French bank, BNP Paribas SA (EPA:BNP), told its customers they could not withdraw from three of its funds. And that’s how the worst financial crisis of the last 100 years began. (Source: “How one bank avoided the meltdown,” Fortune, August 27, 2008.)

Many people still have no clue. This suggests that nobody really has a clue about what will trigger the next financial crisis. BNP identified a toxic presence in some of its assets and took action. But it still could not have imagined the extent of the problem and the millions of people who would be affected.

Between 2007 and 2009, the stock market dropped to half of its value. It would take three years for the Dow to recover its pre-financial crisis level in the United States. Now, the economic landscape appears unrecognizable. The economy has been growing, slowly but steadily, for the past eight years. Even employment is rising.

Yet, a billionaire promising to bring back blue-collar jobs won over the electorate on November 8, 2016. A good many people who would have once demanded union support and voted Democrat voted for the Republican rich guy. Now, Trump, working with his Goldman Sachs bankers, who have filled many roles in his White House, is working to raise market risk again.

Yes, the markets are flying. But how long will they stay up for and how hard will they crash? Trump has been dismantling controls on banking speculation like the Dodd–Frank Wall Street Reform and Consumer Protection Act. The “banksters”—as in predatory bankers—are back.

Actually, they never left. President Obama himself admitted that “no banker has ended up in jail” for the 2008-2009 financial disaster and its causes. Well, one actually did do time, but he’s the exception that proves the rule. (Source: “Why Only One Top Banker Went to Jail for the Financial Crisis,” The New York Times Magazine, April 30, 2014.)

Obama himself has retired and adapted well to Hillary Clinton’s example of getting paid hundreds of thousands of dollars for speeches to Wall Street executives. They talk the talk of social progress, environmentalism, and all manners of causes. But in the end, nobody is immune to the charm of the dollar. The “left” and the “right” never really fought the interests of the big banks. After all, taxpayers footed the bill to fix the banks’ “errors” to the tune of $800.0 billion.

While the banks were getting back the money they recklessly gambled through risky transactions, thousands of small businesses, jobs, and savings vanished. The government was far less generous with them than it was with the banks. The recipe for growth, however, had a nice and democratic ring to it: quantitative easing, or QE. The end of QE, as it happens, could well serve as the spark for the next financial crisis.

QE is the strategy that started as the Federal Reserve primed the economy by buying up bonds. The Europeans borrowed the idea a few years later. It worked somewhat. But while stocks on Wall Street have been flying, the real economy has lagged behind compared to the golden age between the 1950s and the 1980s. Finance continues to exert too much weight in the economy and sucks up resources from the real economy, the kind that produces value rather than playing around with it.

The world floats on liquidity created by central banks. Even the big masters of Silicon Valley, Facebook Inc (NASDAQ:FB), Apple Inc. (NASDAQ:AAPL), Amazon.com, Inc. (NASDAQ:AMZN), Netflix, Inc. (NASDAQ:NFLX), and Alphabet Inc (NASDAQ:GOOGL) have privileged finance. They have monetized their products to generate profits rather than innovate technology. But what will happen now that central banks are looking for the best ways to cut off the QE faucet? That’s the stock market diversion to watch.

QE has masked the fact that the historical engines of capitalist development—industry, making things—have collapsed. Trump wants to give free rein to bankers to move fast forward with financial deregulation. Thus, a new financial accident cannot be ruled out. Indeed, you should expect one.