Be very careful! This Federal Reserve-induced stock market bubble could pop at any time, delivering us one nice, big stock market crash.

Why am I blaming the Fed for the stock market bubble we have today?

The Federal Reserve lowered interest rates to record lows in the midst of the credit crisis of 2008 and 2009. To further jump-start the economy, the Fed printed $4.0 trillion in new money, which it used to purchase bonds.

These actions caused the yields on bonds to collapse, thus sending the price of bonds much higher. So, if you were a fixed income investor, you really had no other option than to go and park your money in the stock market, because it was the only place that was providing decent returns. The returns on traditionally safe and stable dividend stocks looked a whole lot better than the yields on U.S. Treasuries, so investors flocked to stocks.

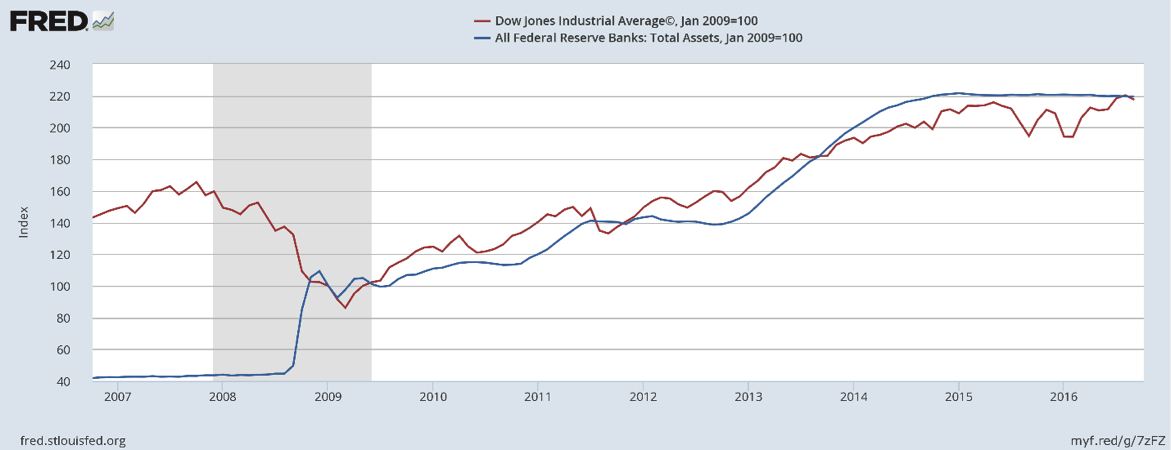

The chart below compares the assets at the Federal Reserve (blue line) with the performance of the stock market, as represented by the Dow Jones Industrial Average (red line).

(Source: Federal Reserve Bank of St. Louis, last accessed October 6, 2016.)

As the chart so easily illustrates, there is a direct correlation between the growth in the Federal Reserve’s balance sheet and the stock market. In fact, the relationship is phenomenal.

Now, why could there be a stock market crash?

Soon or later, the Federal Reserve needs to raise interest rates to fend off rising inflation. We saw a one-quarter-point increase in rates by the Fed in December of 2015, and it looks like the next hike will be now be this December.

Lower interest rates enabled companies to borrow billions of dollars to buy back their own stock. As interest rates now rise, the cost of borrowing will rise, and the support stock that buyback programs have given the stock market will start to give way.

And despite the easy monetary policy, the U.S. economy hasn’t really improved that much. U.S. gross domestic product (GDP) is stagnating, the labor market remains fundamentally tormented and a large number of Americans are still struggling (as evidenced by the 40-million people using some form of food stamps and the fact we now have more people on government assistance than those working).

Stock Market Outlook for 2017: Could Get Gruesome

If we have learned anything from previous stock market bubbles, it’s that they can continue for some time because irrationality can run for a long time. But when the panic strikes, losses run deep. Stock market crashes always follow stock market bubbles. And as we have seen in recent history, key stock indices could plunge 50%+ or more in a very short period during a stock market crash.

After the tech bubble of the late 1990s, the NASDAQ collapsed 70%. After the housing boom of the mid-2000s, the Dow Jones Industrial Average crashed 55%. I know it sounds inconceivable today that the markets could crash that much again. But it’s exactly at the point when the majority of investors are least likely expecting a crash that it happens.

Stocks are extremely overpriced today. The S&P 500 has a CAPE ratio, or simply the price-to-earnings multiple adjusted for cycles, of 26.56. The historical average since 1818 is only 16.70. (Source: “Online Data Robert Shiller,” Yale University, last accessed October 6, 2016.)

In other words, the S&P 500 is overvalued by 59.04% when comparing it to its historical average. I reiterate; be very careful if you own stocks.