The next stock market crash will be much worse than what we saw back in 2008 and 2009. And it could happen sooner than most anticipate, as the fact of the matter is: the higher that key stock indices go on the back of dismal fundamentals, the harder they will fall.

So Why’s the Stock Market Hitting Record Highs?

Why is the stock market continually at record highs anyway? Investors are hoping there will be huge corporate tax cuts in the United States, which would push per-share earnings higher. But the reality is that tax reform is just an idea right now, and nothing more.

Take away the euphoria surrounding the possible tax cuts, and there isn’t much for corporate America to celebrate.

S&P 500 Earnings: A Warning Sign

So far, 76 of the S&P 500 companies have warned about their earnings for the second quarter of 2017, while only 37 have issued positive guidance.

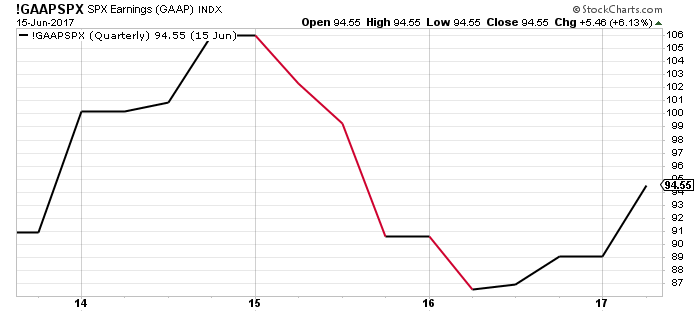

And the chart below of S&P 500 earnings is dismal. Earnings for the S&P 500 companies are well below their 2015 level.

Chart courtesy of StockCharts.com

Stock Market Crash: Why It Will Be Worse Than 2008-2009

At the outset of this article, I said that the stock market crash that is coming will be more severe than what happened in 2008 and 2009.

Here’s why…

Right now, the S&P 500 is trading at a record-high price-to-earnings (P/E) ratio of 25.79. That means investors are willing to pay $25.79 for a stock with earnings of $1.00 in its last fiscal year. And the dividend yield on the S&P 500 is at a near-record low of two percent. This means that, if investors put $50.00 into an S&P 500 company stock, on average they will get a dividend of $2.00 (which, by the way, they need to pay tax on).

By the Federal Reserve’s own projections, before the end of next year, government-guaranteed 10-year Treasuries will pay three percent; that’s 150% more than S&P 500 stocks, and something I’ve never seen in my life. Why would anyone buy risky stocks that yield only two percent when 10-year U.S. Treasuries will yield three percent sometime in 2018?

In all the previous stock market crashes, key stock indices fell back to their major support levels. Look at the long-term chart below of the S&P 500, and pay close attention to the thick, straight black lines drawn on the chart.

Chart courtesy of StockCharts.com

For the S&P 500, major support isn’t until around 1,550 (the upper black line). If we assume that’s where the stock market will crash to, then it would result in a decline of 36%.

If that support level breaks, and I believe it will, the next support isn’t until below 800. So, that would mean a decline of close to 70%!