The odds of a recession in the U.S. economy are rising as the list of recession indicators flashing red grows.

Recession Indicator #1: Housing Starts

On the housing front, we have the annual rate of new housing starts at almost 1.1 million in May 2017. This was down 5.5% from April 2017, and down 2.4% from May 2016. The date shows that housing starts have been dropping since October 2016. (Source: “Monthly New Residential Construction, May 2017,” U.S. Census Bureau, June 16, 2017.)

A drop in housing starts tells us that demand in the U.S. housing market is deteriorating, the result of which will eventually be a loss of construction jobs. The weakness in the new housing market could be directly related to weak consumer confidence.

Recession Indicator #2: Consumer Sentiment

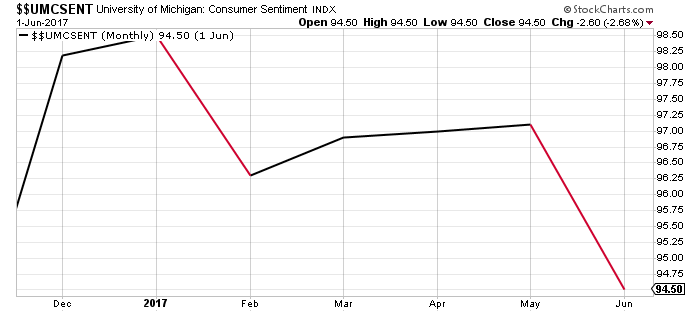

Below is the chart of the University of Michigan Consumer Sentiment Index, one of the most widely followed gauges of consumer confidence.

Chart Courtesy of StockCharts.com

As you can see, for the past six months, U.S. consumer confidence has been declining. This is not good. It suggests that consumer consumption could be on the line. This is worrisome, considering that consumption accounts for about two-thirds of U.S. gross domestic product (GDP).

Recession Indicator #3: Capacity Utilization

Finally, capacity utilization in the U.S. economy has been on a downtrend since late 2014, as shown in the chart below. This indicator shows how much of their total capacity to produce is being used by American industries. Think of it this way: of a factory’s resources that are available to be used, capacity utilization indicates the percentage that is actually being used.

(Source: “Capacity Utilization: Total Industry,” Federal Reserve Bank of St. Louis, last accessed June 16, 2017.)

American industries are currently only operating at 76.6% of their available capacity.

What Could Happen with this Coming Recession?

All of these negative recession indicators are happening at a time when the Federal Reserve is raising interest rates. This will not end well.

As we enter a recession, we could see the following three things:

- The stock market massively declining, since a recession leads to lower sales and earnings for companies on the key stock indices.

- The Federal Reserve re-thinking its monetary policy; with interest rates falling again. (For the record, I see two more interest rate increases first, because the Fed’s actions usually lag the market.)

- The U.S. dollar coming under fire as the U.S. economy softens. This would have an immediate negative impact on the stock market, as about half of the S&P 500 companies have sales outside the United States.

In other words, dear friend; this is not a great time to be invested in stocks.