What Would Ray Dalio’s Ominous Warning Mean for Investors?

Free-market proponents like Donald Trump—before he entered the political arena—have advocated for a strict separation of economics and politics. As president, Trump has been getting a harsh lesson. Politics, especially in its convoluted variety, does affect the economy, and not in a good way. Hedge fund manager Ray Dalio’s warning for investors clearly demonstrates this.

The founder of Bridgewater Associates, LP started the new year feeling optimistic about the economy. He expected it to perform better under Trump’s leadership. Instead, Ray Dalio’s economic predictions for 2017 have turned rather sour, rather fast.

Dalio and similarly-minded finance experts had high hopes for President Trump. They expected he would truly shift the White House’s attention away from political crises abroad toward economic problems at home. That’s what Dalio understood Trump’s “Make America Great Again” slogan to mean.

Dalio is not alone; millions of Americans voted for Trump for that same reason, regardless of their income or wealth. The last U.S. election was unusually democratic. It showed that, given the right circumstances and ideas on the table, Americans from diametrically opposed living circumstances could agree on politics. The richest, most successful hedge fund manager on Wall Street and the poorest unemployed coal worker in Pennsylvania both agreed that Trump offered the best solution for America.

Such instances of agreement between classes of people, who would have felt more comfortable at odds with one another in different eras, are exceedingly rare. It would be like if the poorest peasants in France in 1789 had backed King Louis XV against the middle class and intellectual leaders of the French Revolution.

Dalio Worries That the U.S. Is Stumbling into a Catastrophe

Dalio has changed his mind rather quickly on Trump. Now Ray Dalio’s warning for investors amounts to a prediction of an economic crisis in 2017.

From the “America First” promises of Trump’s inauguration speech on January 20 to the so-called immigration ban about 10 days later, Dalio had to reset his expectations. What’s fascinating is that the turnaround had nothing to do with Dalio’s net worth of almost $17.0 billion or even with Dalio’s investment portfolio. Dalio made it abundantly clear that he’s happy with both.

Rather, Dalio wants assurances that the economy will improve such that a bigger number of Americans can benefit from it. After all, that’s the most obvious hope for a billionaire. In situations where only a handful of people are thriving, there’s widespread resentment and instability. Dalio doesn’t want the United States to become as socially and economically divided as Brazil or Mexico.

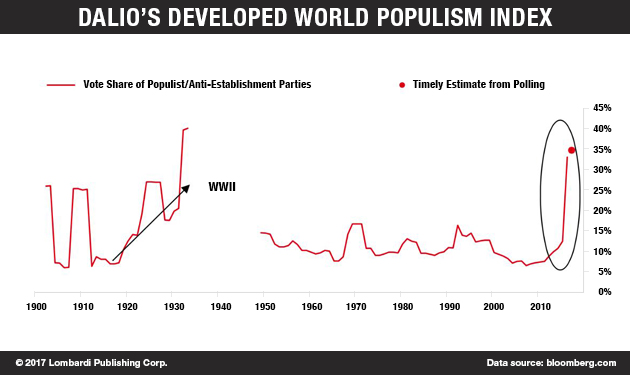

The leaders who come out with promises to fix the problems created by excessive wealth discrepancies tend to be populists. Dalio fears populists, who have managed to build more political momentum now than at any other time since the 1930s. (Source: “Ray Dalio Says Populism May Be a Bigger Deal Than Monetary and Fiscal Policy,” Bloomberg, March 22, 2017.)

Dalio has even devised a “Populism Index” (see chart below). If he’s right, America (and the rest of the world, for that matter) has plenty to fear. Dalio shows that peak populism occurred in 1938, at the height of Adolf Hitler’s popularity in Germany! Dalio’s index, however, has not reached such levels—for now. But it could.

Dalio worries that the current political course could lead the U.S. and the rest of the world stumbling into another major war. Or it could produce an economic catastrophe like the stock market crash of 1929 (the Great Depression) or the one in 2008 (the Great Recession). Both downturns resulted in devastating socioeconomic effects. The crashes exacerbated disparities and ruined millions of lives.

Thus, Dalio sees a deep link between the quality of politics and its effects on the economy. He has a clear understanding of how the decisions that leaders take in Washington can affect the daily lives of everybody, whether they be poor or rich. Clearly, given such concerns, Dalio has a dire stock market outlook for 2017.

Dalio’s opinion on the U.S. economic outlook in 2017 in general has grown more pessimistic. In December 2016, Dalio published an article that became viral, in which he argued that Trump’s presidency would be a government of pragmatic men with business experience who would end the economic inaction of the past two decades.

Dalio has since found it necessary to reverse his position. He now argues that President Trump has fostered conflict instead of pursuing cooperation. This has weakened the president’s ability to get his reforms and growth policies through Congress. (Source: “DALIO: Trump is putting a small part of America ahead of the entire world,” Business Insider, June 5, 2017.)

Dalio sees the economy as falling behind in Trump’s list of priorities. Politics, in the sense of political games, are now driving Trump’s agenda. The fact that the stock market’s main indices on Wall Street—the Dow Jones and the NASDAQ—have been riding their biggest waves ever has not helped. This may have only increased a sense of arrogance in the administration.

Any president would love to be able to exploit stocks’ good performance for political leverage. Trump may feel that the recent successive records that the U.S. stock market has reached are a reflection of how his administration has encouraged investors and businesses. But are they?

The S&P 500 index has gained over 13% since election day on November 8, 2016. But, on closer inspection, we can see that the market has become highly skewed. Tech stocks have risen to rather unusual levels, without any special reason. The valuations of such technology stocks as Facebook Inc (NASDAQ:FB), Apple Inc. (NASDAQ:AAPL), and Alphabet Inc (NASDAQ:GOOG) (also known as Google) have hit ludicrous mode. The markets have entered a phase that former Federal Reserve Chair Alan Greenspan defined as “irrational exuberance.”

It’s All About the FAAMG, But Be Afraid!

The so-called FAAMG stocks—Facebook, Amazon.com, Inc. (NASDAQ:AMZN), Apple, Microsoft Corporation (NASDAQ:MSFT), and Google—have gained more than $600.0 billion of market capitalization. That figure is comparable to the combined gross domestic product (GDP) of Hong Kong and South Africa. (Source: “Apple, Facebook and other big tech stocks tank, weigh on Wall Street,” CNBC, June 9, 2017.)

Such stock market success clearly shows that investors believed Trump’s promises. The president has stated from the outset that he would implement an economic agenda that was biased toward growth. On the surface, the promise seems to have worked, but has Trump actually implemented such a growth agenda at all? The Fed’s recent increase in interest rates, even if merely by 0.25%, also relies on Trump’s growth promises.

But the markets and growth are founded on a house of cards that could collapse at any given moment. The increasing political polarization and weak public approval numbers have started to cast doubt on the Trump administration’s ability to launch—let alone sustain—an ambitious agenda including expansive fiscal reform, massive infrastructure spending, and an impressive repatriation of corporate capital.

It’s not just the usual suspects, liberals, who don’t trust Trump. Former supporters like Dalio represent a clear example of how even the wealthiest business elites have started to lose faith in Trump. Don’t be fooled by the market indices moving on up. Expectations of the president’s ability to push through his economic agenda are in full decline, although this sentiment has not yet transferred to the markets, whose dynamics are still in euphoria mode. But ask yourself, how long can this continue?

The fact is, the aforementioned FAAMG stocks have been driving up the markets. They’ve inflated a massive tech bubble. These technology firms account for some 13% of the S&P 500, but they account for almost 40% of its growth, according to a report from Goldman Sachs Group Inc (NYSE:GS). (Source: Ibid.)

It’s almost as if the Facebooks, Apples, and Amazons of the world have replaced assets such as gold or Treasury Bonds as the go-to asset in times of financial stress. But many investors will likely soon wish they had resolved to buy the real thing instead of its risky imitation.

The common argument is that the FAAMG business model is oblivious to the political uncertainty surrounding the Trump administration. These stocks represent high-tech industries, leading the field in disruptive technologies such as artificial intelligence (AI). But, without political and economic stability, there will be few chances for the tech icons to achieve the kind of corporate performance necessary to match their market valuations. Any gains may have already been priced in.

As Dalio has noted, American business leaders no longer trust the Trump administration’s ability to carry out the president’s promised agenda for growth. The fact that Dalio—who promoted the Republican presidential candidate during the election campaign—has been among the first to get off the Trump train should worry you.