Stock investors should be careful; there’s a stock market crash ahead, and it could wipe out a lot of wealth.

While the stock market is severely overvalued when measured by several historically proven market indicators, another indicator just flashed a warning sign: the CAPE ratio of the S&P 500 index.

What the CAPE Ratio’s Telling Us About the Stock Market

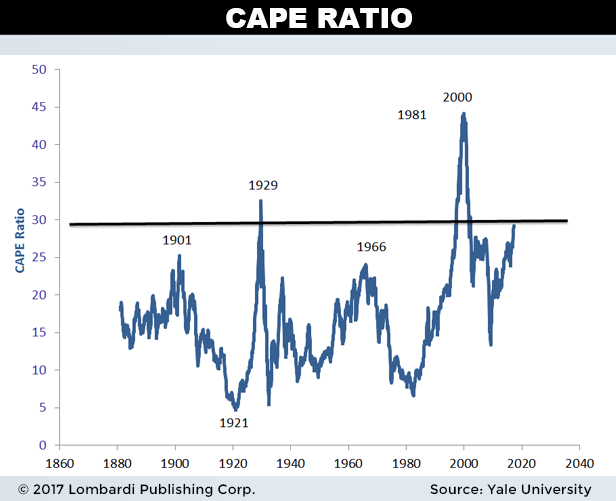

The CAPE ratio is basically the price-to-earnings (P/E) ratio of U.S. stocks adjusted for inflation and cyclicality. At the beginning of June, the CAPE ratio reached 30.06. (Source: “U.S. Stock Markets 1871-Present and CAPE Ratio,” Yale University, last accessed June 6, 2017.)

The last time the CAPE ratio was higher was back in 1998–2000, when the tech bubble was blowing apart. Before that, the ratio was higher way back in 1929 (just before the stock market crash). (Source: Ibid.)

See for yourself in the chart of the CAPE ratio below. This should scare those who own stocks.

The historical average of the CAPE ratio since 1881 is around 16. According to this measure, today’s CAPE ratio is around 80% above the historical ratio.

Regression to the Mean

Dear reader; asset prices always come back to their average historical valuations. This is known as “regression to the mean.” And U.S. stocks, which are in a bubble now as measured by so many stock market valuation tools, will not escape the regression to the mean.

When the stock market crashes this time, the damage to the economy could be worse than we’ve ever experienced, since world economies are so weak already.

At the very best, the U.S. Federal Reserve, which usually has an optimistic outlook, expects the U.S. economy to grow just 2.1% in 2017—well below the historical average. (Source: “FOMC Projections,” Board of Governors of the Federal Reserve System, March 15, 2017.)

And we are starting to hear a lot about a new banking crisis brewing in the eurozone again, especially in Italy.

Britain’s exit from the European Union (EU) could have a negative impact on Britain and on the EU. The Middle East’s economy is in trouble as oil prices are crashing again. And China’s economy is growing at its slowest pace in years.

Stock Market Crash: How Bad Could It Get?

How far down could the stock market crash?

The higher that stock prices have gone beyond the fundamentals, the bigger their decline has always been. While I hear people talk about a stock market correction in the area of 10%, I believe the stock market could crash 20–30% in a very short time frame…and that’s just for starters!

Hence, I continue to preach capital preservation.