Despite what record stock markets here in America are doing, there’s a global economic crisis looming, and investors need to prepare for it.

Global Company Sales Falling

First, sales of truly global companies like Caterpillar Inc. (NYSE:CAT) have been tumbling for years. This suggests that demand in the global economy, especially industrial demand, is deteriorating.

The table below shows the year-over-year change in revenue at Caterpillar.

| Year | Year-over-Year% Change |

| 2009 | -36.88% |

| 2010 | 31.46% |

| 2011 | 41.21% |

| 2012 | 9.54% |

| 2013 | -15.51% |

| 2014 | -0.85% |

| 2015 | -14.81% |

| 2016 | -18.03% |

(Source: “Caterpillar, Inc. Revenue & Earnings Per Share (EPS),” NASDAQ, last accessed April 25, 2017.)

The 2016 sales at Caterpillar were the lowest since 2009! And, for 2017, the company expects to generate the same sales as 2016. Collapsing revenue at Caterpillar is a leading indicator of a global economic crisis.

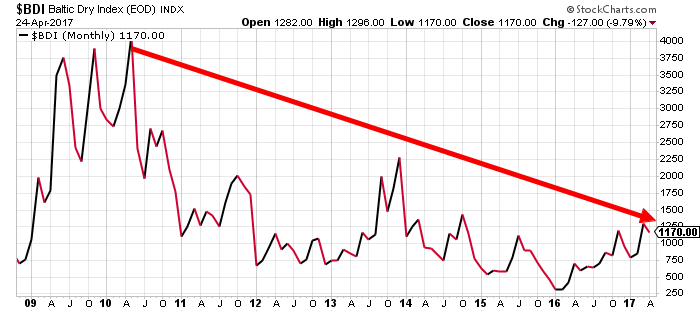

Baltic Dry Index Trending Lower

Next, investors need to pay attention to the Baltic Dry Index (BDI). This indicator tracks shipping rates—another indicator of demand in the global economy.

As the chart below illustrates, after the global economic crisis of 2008–2009, the BDI bounced higher. But, since 2010, it has been trending lower, suggesting trouble ahead for the global economy.

Chart courtesy of StockCharts.com

Global Economy Hubs Stagnating

Finally, let’s look at growth rates at major economic hubs in the global economy.

The table below shows the expected economic growth rate of major countries in the global economy, as estimated by the International Monetary Fund (IMF). Historically, the IMF lowers growth expectations by the end of each year.

| Country | 2016 | 2017 | 2018 |

| U.S. | 1.60% | 2.30% | 2.50% |

| Germany | 1.70% | 1.50% | 1.50% |

| France | 1.30% | 1.30% | 1.60% |

| Italy | 0.90% | 0.70% | 0.80% |

| Japan | 0.90% | 0.80% | 0.50% |

| Canada | 1.30% | 1.90% | 2.00% |

| U.K. | 2.00% | 1.50% | 1.40% |

| China | 6.70% | 6.50% | 6.00% |

(Source: “World Economic Outlook Update January 2017,” International Monetary Fund, last accessed April 25, 2017.)

Looking at the table above, growth rates of major industrialized countries are well below their historical averages. Take out China (which usually grows at 10% per year), and no country is growing at the historical growth rate of three percent per annum.

And some of these countries are still exercising extreme monetary stimulus measures. The Bank of Japan has continued to print money while keeping interest rates below zero. But the Japanese economy remains stagnant, at the very best.

Global Economic Crisis & the U.S.

From my experience, when stock markets are soaring, investors don’t really want to pay attention to facts.

But one important fact is that 50% of all the revenue that S&P 500 companies generate comes from outside the United States. So, if there’s a global economic crisis, American companies will report lower revenue and earnings, which will drive down their share prices.

With time, we will know more. As key stock indices hit their all-time highs, I preach capital preservation. Be careful when everyone is severely optimistic, like they are today.