Ray Dalio Says Economic Picture Looks Scary

Ray Dalio, founder of the world’s largest hedge fund, says the “magnitude” of the next downturn in the stock market will be scary. The Chairman and Chief Investment Officer at Bridgewater Associates, with $102.0 billion under management, says the near-term outlook for the U.S. economy looks rosy, but the longer-term outlook for the U.S. economy is dire.

While American investors may ride the bull market for a little while longer, a recession or economic collapse is inevitable. The big questions are: when will the upcoming economic collapse happen, and what will it look like?

Dalio is preposterously rich, so when people say, “follow the smart money,” they mean getting behind Ray Dalio and trying to walk in his footsteps. In a recent blog post, Dalio said he fears that the coming downturn will have serious consequences, both socially and politically. (Source: “The Big Picture,” LinkedIn, May 12, 2017.)

In the near term, everything looks peachy. The U.S. economy is now at—or near—its best, and Dalio sees no major economic risks on the horizon for at least the next year or two. He doesn’t believe that the U.S. economy faces any significant long-term problems (high debt, non-debt obligations, limited abilities by central banks to stimulate growth, etc.) that will create a squeeze.

The major economies are in the middle of their short-term debt cycles, and their growth rates are above average. Or, as Dalio puts it, the U.S. and world economy are in the “Goldilocks” part of the business cycle. As a result, volatility is low right now.

Keep in mind, Dalio doesn’t make overt predictions about the stock market or use heavy-handed language to describe an upcoming stock market or economic collapse. He’s managing $102.0 billion, and sparking fear is not good for Wall Street. So, saying volatility is low is a bit of an understatement. Investors have almost never been this complacent.

Since the U.S. election, President Donald Trump’s pro-growth policies have helped fuel a 13% rally in the S&P 500. While the S&P 500 hasn’t really done much since the beginning of March, investors remain convinced that Trump’s tax cuts and spending will lead to three-percent gross domestic product (GDP) growth.

What Will the Next Economic Collapse Look Like?

Frankly, Trump hasn’t really revealed much about how he’s going to achieve this, but investors are giving him some time to prove himself. In the meantime, stocks continue to trade at record levels, and market volatility is near record lows. This is in spite of a raft of indicators suggesting that the current bull market is in jeopardy. Where has that left us? With stocks that are significantly overvalued and predictions of an economic and stock market collapse.

The S&P 500 topped 2,400 on May 15 as investors played down weak economic data and rising political tensions around the world. In fact, investors have not been this complacent since just before the 2008 Financial Crisis.

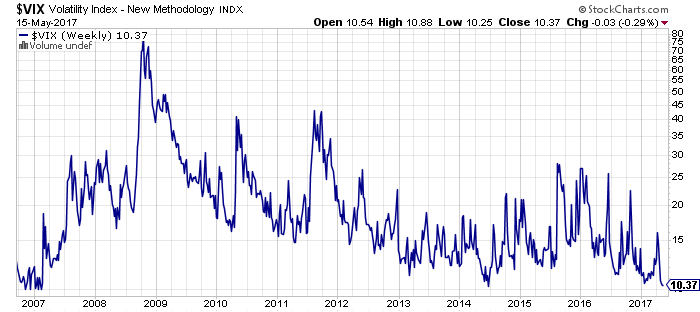

The Chicago Board Options Exchange (CBOE) Volatility Index (VIX) is at 10.37, which is a little above the recent low of 9.56 on May 9. The CBOE VIX, better known as the “Fear Index,” measures market volatility. The higher that investors expect the S&P 500 to fluctuate, the higher the VIX goes up.

Chart courtesy of StockCharts.com

The VIX is read as a percentage. At 10.37, investors expect the S&P 500 to fluctuate in a 10.37% range over the next 30 days. That may sound like a lot, but it’s not. In October 2008, the VIX hit a record high of 89.53, the same time that the S&P 500 was crashing.

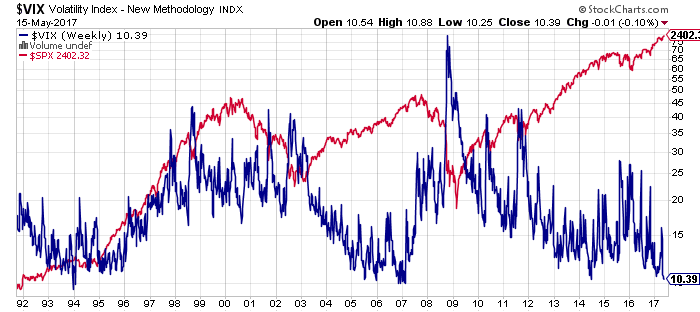

Chart courtesy of StockCharts.com

Right now, investors believe that the bull market (the second-longest in history) has lots of room to run. The chasm between investor complacency and the S&P 500 has never been this wide. The last time investor complacency was even close to this level was back in 2007, in the run-up to the stock market crash and the Great Recession.

Volatility is so low that investors have pushed stock valuations to levels last seen during Black Tuesday in 1929. Stocks are soaring despite a constitutional crisis in the U.S., weak U.S. economic data, the slowing Chinese economy, and ongoing tensions between the U.S. and North Korea, Syria, Iran, and Russia. Despite these headwinds, Dalio sees no major political or economic risks for the next year or two.

Except, there are major concerns here in the U.S. that Trump will not be able to get his pro-business, pro-growth campaign promises passed. This would put, not just the 13% gain on the S&P 500 since the election in jeopardy, but the entire bull market.

Stocks Soar as U.S. GDP Collapses

That’s the good news. Dalio’s outlook for the U.S. economy isn’t quite so upbeat: “We fear that whatever the magnitude of the downturn that eventually comes, whenever it eventually comes, it will likely produce much greater social and political conflict than currently exists.” (Source: Ibid.)

Again, Dalio doesn’t really commit to creating a picture of what an economic collapse or stock market collapse will look like, just that it will be worse than now. How bad can it be?

The NASDAQ and S&P 500 are reaching record levels at a time when U.S. GDP data is weak. The U.S. economy grew just 1.6% in 2016, its worst performance since 2011. It advanced 2.6% in 2015. During Barack Obama’s entire stay in the White House, U.S. GDP growth never topped three percent.

The current economic expansion has lasted for 95 months, making it the third-longest in U.S. history (and slowest since World War II). The economic expansion from March 1991 to March 2001 lasted 120 months, and the one from February 1961 to December 1969 lasted 106 months.

If the current expansion continues for another year or two, as Dalio suggests, the expansion would last between 107 and 109 months. But does the U.S. economy have the juice to keep the current economic expansion and bull market running?

It’s a tale of two continents. The difference between first-quarter earnings per share (EPS) growth and GDP expansion is at its widest since the third quarter of 2011. When it comes to S&P 500 companies and strong EPS, the less exposure to the U.S. economy the better.

S&P 500 companies that get more than half of their revenues from overseas are posting first-quarter EPS growth of, on average, 20.9%. For companies that get most of their revenues from the U.S., the number is less than half that. (Source: “Earnings Insight,” FactSet Research Systems Inc., May 12, 2017.)

The U.S. economy isn’t what’s propping up U.S. stock prices; it’s sales from overseas. This helps explain why S&P 500 companies can report solid earnings growth in the midst of abysmal U.S. GDP growth. It shows that the U.S. economy is not doing nearly as well as first-quarter earnings suggest.

To be fair, U.S. companies are also reporting what looks like decent EPS growth year-over-year because we were in an earnings recession a year ago. It’s not too difficult to report solid results when you’re stuck partway up a well and looking back down at the bottom, where you used to be. The real litmus test for the U.S. economy will be whether Wall Street can match or beat first-quarter EPS growth in the second and third quarters.

When Will the Next Economic Collapse Happen?

To repeat, President Trump vowed on the campaign trail to implement a number of economic policies that would juice the U.S. economy and get U.S. GDP to long-term growth of three to four percent. These promises will be in jeopardy if he can’t cut taxes, cut red tape, and increase spending.

While we may be in the second-longest bull market in history, Americans are living in the slowest economic recovery since World War II. It’s an economic recovery most Americans don’t even realize they’re basking in.

What is the U.S. economic outlook 2017 and U.S. GDP forecast 2017?? Not what Trump is hoping for. U.S. GDP growth in 2016 was 1.6%, and GDP for the first quarter of 2017 was 0.7%. According to the U.S. Federal Reserve, the long-term projected U.S. GDP growth rate is just 1.8%.

This is in sharp contrast to what U.S. Secretary of the Treasury Steven Mnuchin is hoping for. He believes that the Trump administration’s policies can deliver sustainable three-to-four-percent GDP growth. That’s the kind of growth that the U.S. experienced during the halcyon days of the 1980s and 1990s. It’s going to be tough to get there when the U.S. economy is, according to Dalio, already in the Goldilocks phase. (Source: “Steven Mnuchin Says U.S. Growth Can Be 3% to 4%. Here’s Why That’s Hard,” The Wall Street Journal, November 30, 2017.)

If anything, it appears as though the U.S. economy is going to continue to throw up weak GDP numbers. And the fact that the next economic collapse will be scary probably doesn’t come as much of a surprise.

How much worse can it get for Americans who rent, are saddled with debt, have no retirement savings, live paycheck-to-paycheck, and are locked in low-paying jobs that provide no security? There’s a new American nightmare awaiting the average person when the U.S. economy enters a recession.

When will the next financial crisis and stock market collapse happen? The stock market rally will continue until it is derailed by some sort of catalyst. With investors sending stocks to record levels in this environment, it’s anyone’s guess as to what will be the final trigger.

Will investors finally get fed up waiting for Trump’s economic policies to kick in? Will there be a financial crisis in 2017 because of reports of weak GDP growth? Or will rising national debt, simmering geopolitical tensions, or black swan events send investors to the exits and stocks careening?

If history is any indicator, the next economic collapse will probably look a lot like Black Tuesday or the 2000 tech bubble. On Thursday, October 25, 1929, the stock market crash began. By Tuesday, October 29, 1929, the market had lost 25% of its value. The Dow Jones Industrial Average (DJIA) didn’t recover from the crash until 1954.

On March 10, 2000, the tech bubble was stretched thin, as the NASDAQ hit an all-time high of 5132.52. On March 11, 2000, stocks started to sell off. Wall Street analysts called it profit taking, but it wasn’t.

No one knows why investors ran out of patience on March 11, 2000. They just did. And the negative sentiment expanded. Within 10 weeks, the NASDAQ had lost 37% of its value. By October 2002, the NASDAQ had plunged 78%. It took 15 years for the NASDAQ to reach its March 2000 peak.

Whether the next financial crisis and stock market crash happens over the course of a weekend or a number of months, it will leave people financially ruined.