Why Aren’t Americans Buying Houses Anymore?

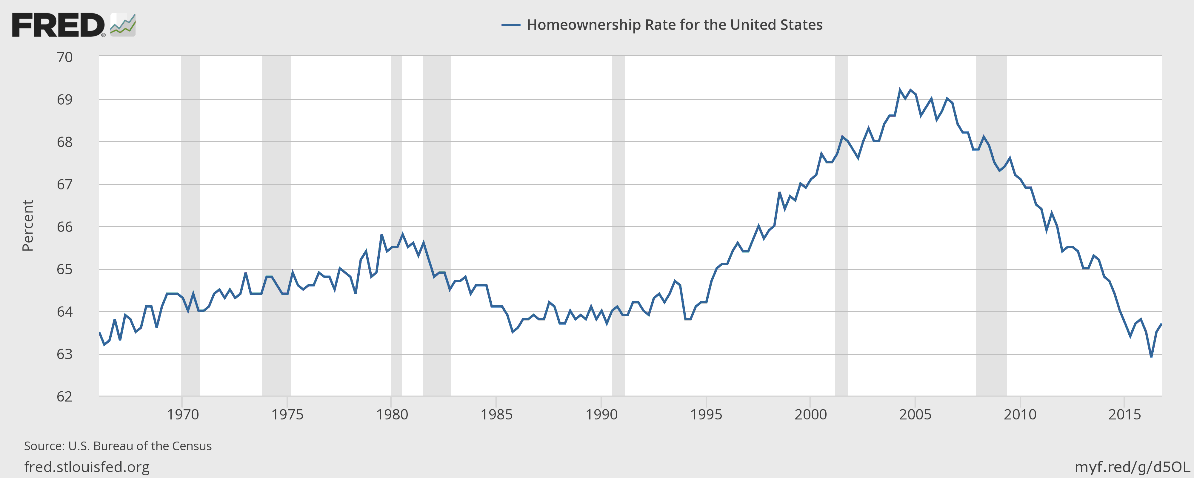

The home ownership rate in the United States economy currently stands at one of the lowest levels since the late 1960s. It will continue to decline, pushing us closer to an economic collapse, as I explain below.

With interest rates that are still historically low and a U.S. housing market that is relatively cheap compared to other major industrialized countries, why are Americans moving away from buying homes?

Dear reader, the answer is that Americans are not buying homes simply because they can’t afford to. And the situation is going to get worse.

The chart below is of the home ownership rate in the U.S., going all the way back to the 1960s. It includes periods over the past 50 years when we have experienced economic collapse. It’s outright scary to see the dream of owning a home plummet in this country.

Sure, the stock market has been rising for years and painting a picture of prosperity. But that “boom times” picture is only for those who own stocks, a small portion of the U.S. population.

According to a survey published by the Employee Benefit Research Institute, six in 10 Americans feel they won’t have enough money for long-term health care. (Source: “The 2017 Retirement Confidence Survey: Many Workers Lack Retirement Confidence and Feel Stressed About Retirement Preparations,” Employee Benefit Research Institute, March 21, 2017.)

And food stamp usage in the U.S. economy continues near a record high. As of December 2016, there were 42.96 million Americans who used food stamps. The number of people on food stamps in the U.S. is similar to the size of Argentina’s population! (Source: “Supplemental Nutrition Assistance Program,” United States Department of Agriculture, March 10, 2017.)

For millions of Americans, we are already living in an economic collapse today.

The housing boom of the mid-2000s that ultimately burst in 2006 was fueled by easy money being made available to consumers who couldn’t really afford the homes they were buying. No-income-verification mortgages coupled with zero-dollar down payments fueled a housing market that had no choice but to eventually bust.

Today, financial institutions put U.S. consumers “through the ringer” when it comes to qualifying for a mortgage. You better have a good down payment, a great credit score, and verifiable income that can easily support the mortgage you are qualifying for. This automatically excludes the great majority of Americans.

Add to this two more scheduled interest rate hikes this year, courtesy of the Federal Reserve, and home ownership has gone from the “American Dream” to an impossibility in this country.

Historically, the housing market, which is a big part of the U.S. economy, usually leads the economy and the stock market. With the negative picture we are seeing in housing today, my fear is that an economic collapse, which often happens when least expected, could be a lot closer than we think.