The U.S. economy is highly reliant on consumer spending. Historically, as consumer spending has declined, a recession has followed. And sadly, all the stars are lining up for dismal consumer spending ahead.

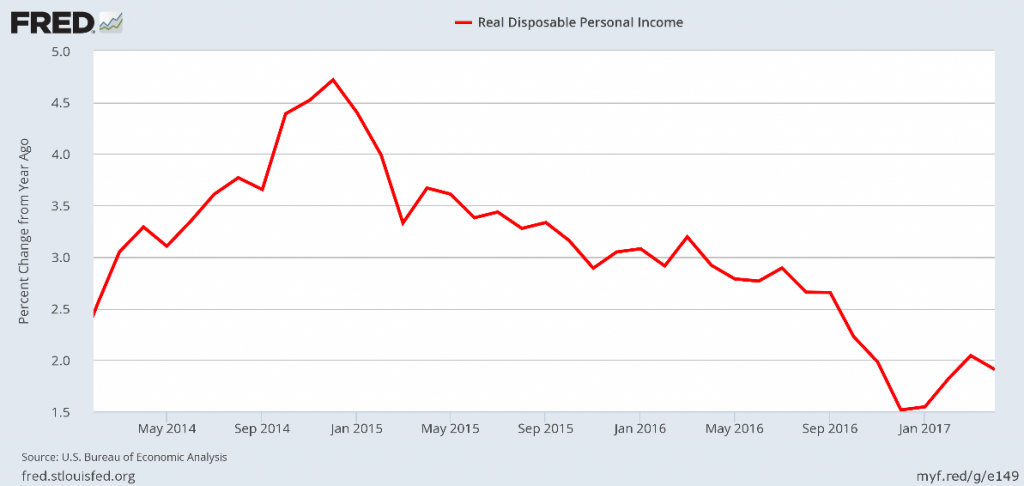

Indicator #1: Real Disposable Personal Income

Let’s start with the chart below, which shows the year-over-year percentage change in real disposable personal income in the U.S. economy. It should alarm investors.

(Source: “Real Disposable Personal Income,” Federal Reserve Bank of St. Louis, last accessed June 8, 2017.)

Personal disposable income has been on the decline since late 2014. Obviously, when consumers have less money, they will spend less of it. And since consumer spending makes up about two-thirds of U.S. gross domestic product (GDP), that’s a big problem.

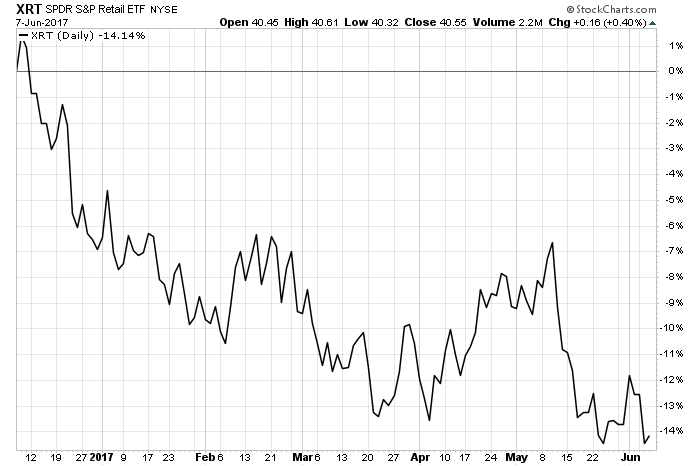

Indicator #2: Impact on Retailers in the U.S.

We can see the pullback on consumer spending directly affecting American retailers. The price chart below is of SPDR S&P Retail (ETF) (NYSEARCA:XRT), a well-known exchange-traded fund that tracks major retailers in the United States.

Chart courtesy StockCharts.com

In the last six months, SPDR S&P Retail (ETF) has been devastated, declining 14%. While some might argue that people are buying more online as opposed to at stores, the increase in online sales is minor compared to the collapse in U.S. retail sales.

Dear reader, the collapse of retail stocks is an important recession indicator that’s being overlooked.

Indicator #3: Jobs Numbers

While the job numbers pumped out by the U.S. Department of Labor show a declining unemployment rate, a closer look at the numbers paints a different picture.

In May 2017, 138,000 jobs were added to the U.S. economy. This is much lower than what we saw over the previous 12 months, with an average monthly gain of 181,000 jobs. (Source: “Employment Situation Summary,” Bureau of Labor Statistics, June 2, 2017.)

Furthermore, over the past few months, the job figures have been revised lower. For example, March’s job numbers were revised lower to 50,000, from the 79,000 originally reported, and April’s job numbers were revised lower to 174,000, from the 211,000 originally reported. That means there were 66,000 fewer jobs created in the U.S. in March and April than previously reported. These are big (and bad) numbers. (Source: Ibid.)

Recession Coming? A Perfect Storm

Thinking that the U.S. economy is progressing smoothly could be a big mistake, as the reality is the complete opposite.

We have consumer income, consumer spending, and sales at U.S. retailers all falling at the same time. And we have three terrible months of job numbers. This all points to a recession starting in late 2017 or early 2018.