A Plaza Accord-Like Agreement Could Hurt the U.S. Dollar Severely

The U.S. dollar could lose a lot of value in the next few years. Don’t rule out a collapse-like scenario for the greenback just yet.

A lesson from history first.

Between 1980 and 1985, American companies were struggling to sell their goods to other countries, the U.S. economy was struggling, and the U.S. trade deficit had ballooned.

Why? Because the dollar had appreciated a lot. It almost had a vertical move to the upside; it increased by more than 50% in those years. Know this: a 50% move in a currency is considered immense. You don’t see this sort of move often.

So, five countries came together—the U.S., West Germany, France, the U.K., and Japan—and worked out a deal to devalue the dollar. This agreement was known as the Plaza Accord.

It was a coordinated intervention, and it worked.

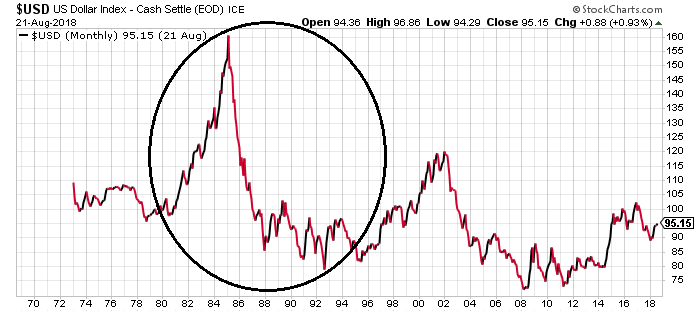

If you look at the U.S. dollar index, you’ll see that between 1985 and 1993, the greenback had declined 50% in value. Pay close attention to the circled area in the chart below. It highlights what happened to the dollar during that period.

Chart courtesy of StockCharts.com

Could We See a Repeat of the Plaza Accord?

This may sound like an out-of-this-world idea right now, but we could eventually see a repeat of the Plaza Accord.

Hear me out.

President Donald Trump has talked a lot about the U.S. having trade deficits with other countries. He has also spoken very blatantly about how U.S. companies are getting bad deals around the globe.

And, over the past few months, we have seen President Trump come out swinging at the Federal Reserve. He has said several times that he doesn’t like the Fed raising interest rates and that he doesn’t like a high U.S. dollar.

So, looking at this, one has to ask whether Trump would propose something like a repeat of the Plaza Accord.

Why in the World Would Countries Agree to Something Like This?

You see, over the past year, one issue has surfaced a lot: global trade.

The U.S. government has been imposing tariffs on goods coming in from other countries. This has been causing a lot of havoc in the global economy. Countries are asking how they are going to solve this. Understand that the U.S. is a major consumer of a lot of goods and services.

Believe it or not, the tariffs are putting a lot of industries and businesses around the world on the line.

With this, is it possible that countries would agree to a sort of dollar depreciation agreement? This way, President Trump would get what he wants: American companies would become competitive and the U.S. trade deficit would decline a bit. Major economies, on the other hand, wouldn’t have to deal with struggling industries and sectors.

U.S. Dollar Outlook: Greenback Could Go Much Lower

Dear reader, let’s get this straight: the U.S. government hasn’t talked about anything related to the Plaza Accord. This is just my thinking.

However, if something like that happens (a coordinated intervention in the U.S. dollar), you could expect the dollar to decline a lot. As I said earlier, don’t rule out a collapse-like scenario for the dollar just yet.

With all this said, gold looks so good. If President Trump is able to pull something like the Plaza Accord, gold could skyrocket. Gold is highly correlated with the dollar. We could see investors rushing to buy the precious metal to hedge themselves from the dollar devaluation.