Creation of “Space Force” Military Branch Could Prevent Another Financial Crisis

Donald Trump recently announced plans to create a sixth branch of the U.S. Armed Forces. Many analysts have, understandably, balked as President Trump discussed his vision of a “Space Force.” But, if you allow greed to guide your analysis, it becomes clear that this could be an effort to prevent another financial crisis.

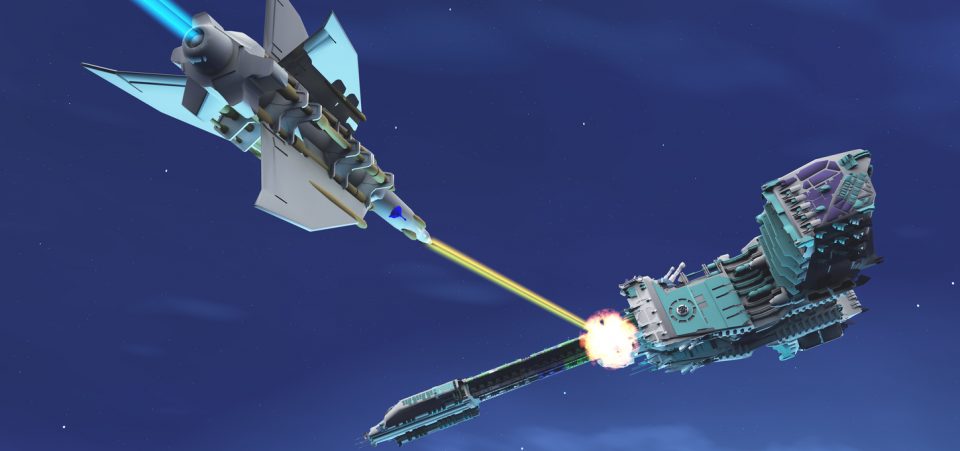

Trump has already signed a Space Policy Directive to lead a renewed U.S. effort in the global space race and to prepare, literally, for space wars. The Space Force would be separate from the Air Force, he said. (Source: “Trump: Space Force and Air Force will be ‘separate but equal’,” CNN, June 18, 2018.)

The idea isn’t new.

President Ronald Reagan ordered a similar initiative (“Star Wars”) in the 1980s. But, while Reagan wanted to ensure that the U.S. would win the Cold War with the Soviet Union, Trump’s ultimate goal might be to prevent the kind of stock slide on Wall Street that triggers a financial crisis.

Is Trump Using Space Force to Avert a Defense Stock Crash?

The timing of President Trump’s Space Force announcement, on the back of a recent summit with North Korea’s leader, Kim Jong-un, could have been aimed at reassuring the military-industrial complex.

Some defense stocks, among the top market performers in the past few years, have lost considerable value after the summit.

Lockheed Martin Corporation (NYSE:LMT), for example, has dropped by more than 10% since its record high in February. Note that Lockheed Martin’s revenue overwhelmingly comes from military products.

Boeing Co (NYSE:BA), on the other hand, has a more diversified product range. It’s almost equally balanced between military and civilian product lines. The result? Boeing stock has retained its gains.

Peace Is Bad for the Markets

Peace (or the higher potential of peace) has sent negative shocks throughout the defense sector. And, given the sector’s excellent performance and market-cap weight in the Dow Jones Industrial Average over the past few years, a bearish turn could trigger a financial crisis.

Of course, the best way to ensure that bullish sentiment for defense stocks continues is to keep the door open to military conflict. If enemies don’t exist, they should be encouraged. Minor threats, thousands of miles away (the Iraq War, anyone?) must be presented as sources of clear and immediate danger.

Trump’s talk about space wars is clearly an effort in that direction.

Given that Congress recently approved a defense budget for 2019 that literally reaches for the stars—at $716.0 billion—the timing of Trump’s Space Force announcement could not have come at a better moment.

North Korea has all but earned the right to have its name removed from the “Axis of Evil” club. New enemies must be found (or created).

Short of intensifying the new Cold War with Russia, re-arming (and resuming funding for) Syrian “rebels” and related characters (such as the White Helmets), outer space offers an elegant and clean solution.

Space Force Will Drive Fresh Investment in Defense Sector

The space program will drive more direct government investment in rocket design and advancements in related technologies. The key is growth and keeping defense contractors relevant.

It’s not that you should think that Trump and Kim Jong-un did their best impression of Luciano Pavarotti and José Carreras singing “Kumbaya” at full blast. There remain many reasons for skepticism over peace prospects.

Surely, the idea that Trump, whom some Norwegian politicians have nominated for a Nobel Peace Prize, has converted to pacifism as Saint Paul did to Christianity on the road to Damascus (Acts of the Apostles, Chapter 9) warrants laughter.

“I Have a Bigger Gun” Syndrome?

Trump is an opportunist and a gambler (or risk-taker, if you prefer). The president has merely found a new way for the U.S. to send an “I’ve got a bigger gun than you” message.

Previously, Trump used Twitter posts alluding to Kim Jong-un’s intelligence—or lack thereof—to insult. President Trump also made sure to threaten the total obliteration of North Korea. (Source: “All the insults Trump and Kim Jong Un have thrown at each other this month,” The Loop, September 22, 2017.)

That was great for the performance of defense companies on Wall Street. The stock market fears international rapprochement, lest it triggers a collapse of defense stocks.

In reality, not much has changed on the ground. Even though the situation might be easing in North Korea, the Middle East remains a powder keg.

The evidence, therefore, still points to the defense sector as one of the safest ones for investments.

While many have marveled at the price-to-earnings-ratio-defying performance of many stocks in the past two years, the defense sector has far and away led the performance charts.

On June 11, Lockheed Martin won a $736.0-million contract with the Pentagon. This amount will buy “F-35” jet fighter components and materials.

Therefore, if the company’s stock price has fallen, not because of a slowdown in business activity or of any major technical or fiscal problems, peace breakouts must be the reason.

Technical Shakeup in the Defense Sector

Indeed, the aerospace and defense sector remains confident that the next few months will bring more growth in business activity.

Nevertheless, the sector will experience a technical shakeup. The outsourcing and digital revolutions will determine how efficient the major industry players will be in the next decade.

Playing this card correctly could promote a veritable redefinition of the word “power.” In other words, those who achieve the optimal delegation of design and assembly will achieve the most savings. Presumably, the next generation of designs will move from the computer screen to the runway with fewer delays.

The peace or thaw that Trump has pursued with Kim Jong-un may have a temporary impact on the risk perception.

But there are other threats that, frankly, have always been more significant in the Middle East. Meanwhile, as Trump pursues peace in the East Pacific, he’s encouraging the opposite in the Middle East.

A perspective to consider is that scrapping the Iran nuclear deal was a way to avert a financial crisis. And if maintaining tense relations with Iran is good for business, encouraging the weaponization of space is downright bullish—at least for the defense sector.

Now There’s Space: Literally the Final Frontier

Space wars will be all the rage soon. That’s what Trump wants Americans to believe. And far from being “far out,” the strategy is a gift to the aerospace and defense sector.

Many equity investors should thank the president. He’s preventing (or delaying) a financial crisis that, from all other perspectives, has already started to knock at the door.

Trump wants to create a military Space Force as a partner to the other five traditional branches of the U.S. defense establishment: the Air Force, Navy, Army, Marine Corps, and Coast Guard.

And Trump is playing for keeps. He doesn’t expect a mere U.S. military presence in outer space. He wants domination, having noted that Russia and China have made progress in the space sector.

President Trump needs Congress to create and approve the new Space Force. Considering he’s about to hand the Republicans a massive win in the mid-term elections in November, Congress approving Trump’s space plans seems the least they can do to show their gratitude.

Technical Difficulties for a Space Force? Good

Will there be technical difficulties in developing a Space Force? Of course there will. And that’s what makes the sector so exciting, from a shareholders’ point of view.

Military contractors get billions of dollars from the government for research and development. A military space race will prompt a flood of requests and related dollars from the Pentagon.

Ronald Reagan wanted something much further along the path of reality in the 1980s. And he got the funding for his space shield.

For investors, the best part was that the space shield program accelerated the arms race to the point where the Soviet Union was struggling to keep up, perhaps forcing Soviet leader Mikhail Gorbachev to capitulate.

In this case, China is the target. Beijing correctly fears that space wars will force it to divert precious resources away from its goal of achieving global economic primacy by 2050.

The space war also involves Russia, and Vladimir Putin is probably the sharpest political leader in the world right now. He governs with keen analysis and a strong understanding of history. He knows why the Soviet Union collapsed. Russia will respond, only more strategically.

It’s unclear whether President Trump was deliberately trying to avert or delay a financial crisis with his Space Force announcement, but his instincts and timing are uncanny.