Stock Market Correction of 3% Hasn’t Occurred in 10 Months—Most Since 1928

If the bears thought it was tough going 15 months without having a “small” five-percent stock market correction, there’s more. The S&P 500 hasn’t even corrected three percent in over 10 months, the longest streak since 1994. It’s truly astonishing when you think about it.

Why? Because three percent is a very small number in stock market parlance. That’s the size of a robust one-day sell-off in normal times. Not only has that not happened over the course of a single session, the bears can’t even string together a three percent loss over multiple days. The resilience of the S&P 500 is truly historic.

Could we keep grinding higher on low volatility? Of course, says Ryan Detrick, market strategist at LPL Financial Holdings Inc (NASDAQ:LPLA). But we’re so overdue for a correction, it could come anytime. “It’s been awfully long so that a normal correction this time of the year makes a lot of sense to us here,” says Detrick. (Source: “The S&P 500 is doing something it hasn’t since 1995, and that could mean a pullback ahead,” CNBC, September 10, 2017.)

Big Hedge Funds Throwing in the Towel

Bears have been pondering this question for five years running. Not even the threat of thermonuclear war, terrorism, so-so economic data, or the chorus of Wall Street pundits talking down the market could stifle it. And it’s taken a toll on even the most respected fund managers.

To wit, formerly successful hedge fund manager Hugh Hendry just announced he was closing his Eclectica Absolute Macro Fund. The reason? Poor returns led to massive redemptions by clients. So much so that only $30.0 million in assets remained, which is a far cry from the billions Hendry managed before. (Source: “Markets Are Wrong”: Hugh Hendry Shuts Down His Hedge Fund; Here Is His Farewell Letter,” Zero Hedge, September 14, 2017.)

But what makes this fund closure interesting is the backstory behind it. Hugh Hendry was a former bearish contrarian investor who made a killing back in the late 2000s. He maintained his bearish stance after the U.S. Housing Bubble, with lackluster results.

Finally, in November 2013, he capitulated on his contrarian investment thesis and turned bullish, infamously saying, “I cannot look at myself in the mirror; everything I have believed in I have had to reject. This environment only makes sense through the prism of trends.” (Source: Ibid.)

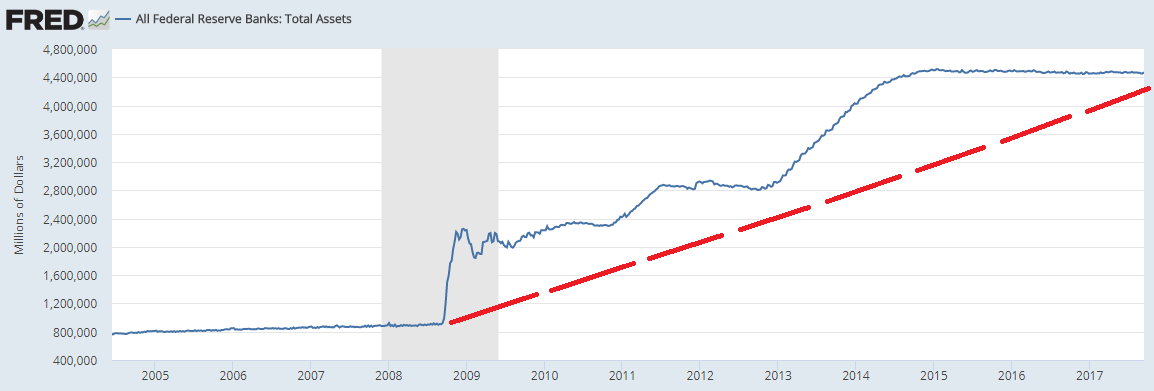

What Hendry was referring to was enduring central bank manipulation, which made it impossible for his bearish bets to profit. It wasn’t that Hendry was suddenly bullish on risk assets, rather, he grew weary of constantly fighting the Federal Reserve and European Central Bank. For every 100 salmon that swim upstream, one might make it to its final destination. Hendry didn’t want to be that salmon anymore.

So if Hendry became bullish, surely he’s done well in the past four years. The S&P 500 is up almost 40% during that time; the NASDAQ even more. That assumption would be incorrect.

Despite the “favorable” market conditions, his Eclectica Fund is down the past couple of years, and 9.8% so far this year (prompting the liquidation).

But the shocking part is that Hendry hasn’t been bearish on anything during this time. He wasn’t waiting around for a stock market correction. He blames the poor returns on a risk book overly correlated to the maelstrom, which is Donald Trump and the North Korean Peninsula. In his words, “It wasn’t supposed to be like this.”

Regardless of the reasons, it shows how difficult it is to make money in this historically bullish market. Staking large positions at these nosebleed levels is almost impossible. Everyone and their mother has joined the indexing craze (we all know what happens one everyone’s on one side of the boat). No one wants to play musical chairs with the Fed. What’s one to do?

If you’re Hugh Hendry (or several other Fund Managers who’ve packed it in over the years), maybe it’s time to take your ball and go home. Unless you’re passively investing over time, the Everything Bubble has made it exceedingly difficult to profit of the upside or downside.

A sad truth in today’s central managed matrix.