High-Flying Stocks Foretelling Stock Market Crash?

What happens when the euphoria and complacency ends? Investors panic, run for exit, and—in the midst of it all—we get a stock market crash. There’s an interesting phenomena happening these days, and the mainstream media is doing a very poor job at reporting it.

You see, over the past few years, investors have been complacent. The fundamentals didn’t matter to them; they only had one thing in their mind: buying stocks.

Now, if you look closely, all of a sudden, it seems like investors could be coming back to their senses and starting to pay attention to fundamentals. This is one sign of a stock market crash that shouldn’t be ignored.

What does it mean by paying attention to fundamentals?

It simply means, if a company is not performing well, it should get punished by investors.

Take a look at Snap Inc (NYSE:SNAP), for example. It recently reported its financial results for the third quarter of 2017. In the first three quarters of the year, the company lost over $3.0 billion, or $2.71 per diluted share. In the same period a year ago, the company had a net loss of $344.7 million, or $0.43 per diluted share. Furthermore, other metrics of the business were just outright gruesome. (Source: “Snap Inc. Reports Third Quarter 2017 Results,” Snap Inc, November 7, 2017.)

It wasn’t too long ago that SNAP stock was pitched as a great opportunity, and some were even saying that this company could be the next Facebook Inc (NASDAQ:FB) or Twitter Inc (NYSE:TWTR). After the recent bad earnings report, investors rushed out.

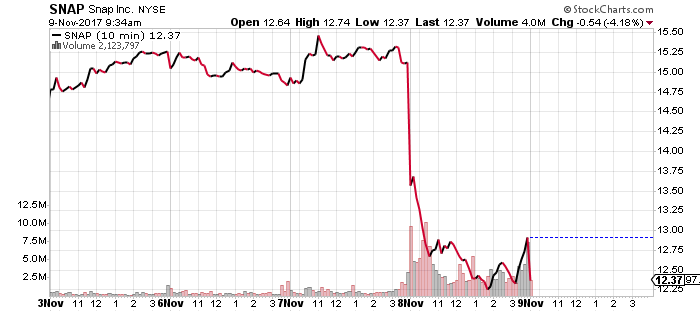

See the chart below, showing the price action of SNAP stock after the company’s recent earnings report.

Chart courtesy of StockCharts.com

After the dismal third-quarter earnings report, the share price plummeted 20%.

My goal is not to single out SNAP stock; look at other high-flying stocks as well. Investors seem to be paying attention to the facts. If a company is performing miserably, its shares are being sold, and we are seeing significant declines in stock prices.

Look at Tripadvisor Inc (NASDAQ:TRIP) too; its profitability tumbled and investors sold their shares.

What Does This All Have to Do With a Stock Market Crash?

Now, look from a broader prospective. Overall, stock market valuations are extremely expensive, relative to the long-term averages. This fact is very well documented in these pages.

With this, one has to wonder what happens when investors start to take the broad market valuations seriously. Do we see a rigorous stock market crash? Currently, U.S. stock market valuations are at their highest level since 2001. That is when we were witnessing a tech bubble. Prior to that, the valuations were about this high in 1929, before the huge stock market crash.

Dear reader, odds of another stock market crash are stacking up higher each day. It’s important to realize that stock markets have gone up without any major sell-offs in a while. If we see a sell-off, think about how those investors who are just entering the markets now after being away from them for years will feel. What would happen if, all of a sudden, there’s a correction of 10% in the markets?

As I see it, it wouldn’t be shocking to see selling escalate in no time and losses mounting higher. I see capital preservation as the best investment strategy for now.