Silver Prices Presenting a Great Buying Opportunity?

You may have heard of the old investing adage that goes something like this; when there’s a gold rush, sell shovels.

The idea behind this saying is very simple: you might make more money by selling shovels when everyone wants to look for gold. It’s something gold bugs will need to extract gold from the ground. As long as the gold rush remains, shovels will be high in demand.

With that said, pay attention to silver prices. The gray metal could be that trade.

Global Economy Roaring?

You see, these days, everyone one seems to be pitching the idea of global growth in the coming years.

For instance, the International Monetary Fund (IMF), in its World Economic Outlook, suggested that the global economy is witnessing an upswing in economic activity. It expects global output to increase 3.6% in 2017 and 3.7% in 2018. (Source: “World Economic Outlook, October 2017,” International Monetary Fund, last accessed December 12, 2017.)

The World Bank is optimistic about the global economy as well. It expects global growth to be 2.7% in 2017 and 2.9% in 2018.

In its report, Global Economic Prospects, World Bank said, “Global activity is firming broadly as expected. Manufacturing and trade are picking up, confidence is improving, and international financing conditions remain benign…” (Source: “Global Economic Prospects: A Fragile Recovery,” The World Bank, last accessed December 12, 2017.)

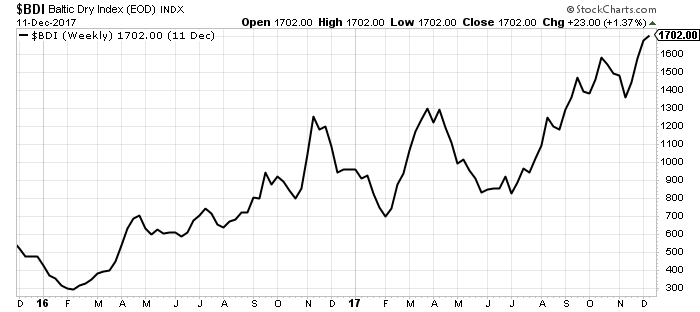

If you look at indicators of global growth, such as the Baltic Dry Index (BDI), it suggests global growth could be likely. Essentially, if the BDI is trending higher, it suggests that global trade is increasing and there’s economic growth. Look at the chart below:

Chart courtesy of StockCharts.com

Since early 2016, BDI has soared over 466%. In other words, it’s screaming growth in the world economy.

Copper Enjoys Global Growth, Silver Remains Ignored

With all this said, remember one thing: silver isn’t just a precious metal. It has more industrial demand than it has investment demand. So if global economy is improving, shouldn’t silver prices increase as well?

If you look at other industrial metals, they are seeing robust moves to the upside.

For example, look at copper prices. In the last two years, the red metal’s prices have soared over 45%. Silver prices, on the other hand, are up, but nothing compared to copper—just by 12%.

Silver Prices Outlook: Big Gains Could Be Ahead

Dear reader, understand this: silver is a critical metal for several industries. So if you are expecting global growth, you can’t ignore silver.

Currently, as I see it, the metal is very ignored. Investors are looking at it as a precious metal, ignoring it just like they are ignoring gold. I truly believe it shouldn’t be overlooked. In the coming year, we could really see silver prices soar. I will not be shocked if silver makes a solid run towards the $50.00-per-ounce level in 2018.