Fear Factor Making a Comeback as Gold “Fear Hedge” Qualities Make a Comeback

Could gold’s reputation as the ultimate “fear hedge” be making a comeback? After several years of laissez-faire attitudes towards increasing world political risk—including North Korea, the Middle East, the South China Sea, and of course, Trump’s political embattlement at home—investors could flock to gold once again. In fact, the much under-the-radar U.S. debt ceiling negotiations could become a bigger issue than many realize. The gold price today stands to benefit more than any other time since 2008.

Other smart people are thinking along similar lines.

Also Read: Gold Price Forecast 2017

Bridgewater Associates, LP CIO Ray Dalio is encouraging investors to purchase gold to hedge geopolitical risks. Dalio opined two specific scenarios that posed an imminent and significant risk: 1) the heightened threat of war with North Korea; 2) the real threat of Congress failing to raise the debt ceiling. “[If] things go badly, it would seem that gold would benefit, so if you don’t have 5%-10% of your assets in gold as a hedge, we’d suggest that you relook at this.” (Source: “Dalio urges investors to buy gold to hedge against possible war with North Korea,” MarketWatch, August 10, 2017.)

Dalio’s first concern is self-explanatory. Brinkmanship leading to war (thermonuclear or otherwise) on the Korean Peninsula would be devastating. The repercussions would extend well beyond the millions of lives at risk. A military confrontation could be the start of a proxy war with China—something nobody wants. A war could easily pull in different actors in the region, and sully trade between the world’s two biggest trade partners. Besides bringing bonanza profits to the military industrial complex, the overall economy would suffer (especially exporters).

We’ve already seen this movie before in the 1950s during the original Korean war. The death count back then was impressive: approximately 2.7 million Koreans died, along with 800,000 Chinese people and 33,000 Americans. The U.S. could pre-empt a larger war by overwhelming North Korea’s defenses in order to head off a longer conflict. But North Korea has intercontinental missiles it can fire under the cover of sea. There’s no reliable defense against that. Ultimately, there’s no guarantee a conflict would be limited strictly to the North Korean peninsula. Obviously, any attack on continental America would be cataclysmic to the economy.

Dalio’s second concern probably has the highest odds of occurring. The threat that Congress stonewalls debt ceiling negotiations is real. It’s plainly clear the “establishment” (democrats, globalists, leftists, “Never Trumpers”—whatever you’d like to call them) are doing everything they can to oust Trump. What better way to bring the country to a standstill than using a debt ceiling crisis? Creating a domestic crisis could be the last straw for an already-teetering administration.

It’s quite conceivable gold’s protective qualities could be critical should the United States technically default. As interest rates would spike and the dollar would fall, gold would be the perfect inflation and credit hedge.

Ray Dalio recognizes this fact. So should ordinary investors.

Also Read: Precious Metal Analysis: Keep Gold and Silver on Your Radar in 2017

Gold Prices to Jump to a Four-Year High by the End of 2017?

Looking at current gold prices, you wouldn’t think much fear is in the air, but it’s building. With Congress on summer vacations until September, the U.S. debt ceiling has taken a back burner. But it’s about to re-emerge in the news cycle with a vengeance. That’s when “fear hedge” demand could pick up pace again, especially if combined with a sell-off in equities.

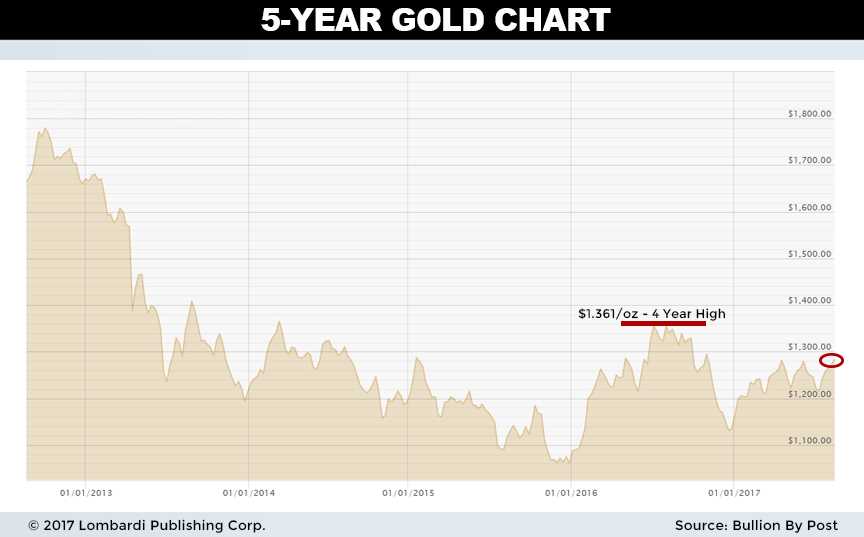

Looking at the gold price chart, the four-year high is approximately $1,361/oz. That was reached in June 2016, soon after the “Yes” Brexit vote. It was also the last time gold was bid up due to investor angst. We believe the potential debt ceiling crisis provides a deeper and longer catalyst, considering the possible direct effects on U.S. credit rating and a weakening dollar.

As such, we expect gold to rise into September and October in anticipation of tough debt ceiling negotiations expected in Congress. Our gold price forecast has the yellow metal testing or exceeding four-year highs of $1,361/oz by mid-October. Should chatter materialize that debt ceiling negotiations are falling flat, gold could easily break those highs. As this would probably combine with a stock market tumble, market angst will be high. Investors will seek the protection of gold.

In the end, making gold price predictions based on “black swan” type events is a fool’s game. However, I believe a potential U.S. debt ceiling impasse is the real deal. Donald Trump is getting eaten alive by the very swamp he tried to drain. Now, the swamp will try to deliver the knockout blow while their “enemy” is reeling. A U.S. debt ceiling crisis—leading to rising bond yields and weakening dollar purchase power—would serve to eliminate Trump’s last remaining significant pillar of support—his base. There’s nothing like rising living costs to turn support into rejection.

This is just my theory, but one I’m quite fearful of. Got gold?