Here’s Why CAD to USD Exchange Rate Could Fall To 0.62

The CAD to USD exchange rate could tumble to 0.62, its 2002 lows. Pay attention to the fundamentals of the Canadian dollar; they paint a gruesome image for the CAD/USD currency pair.

There are essentially five things that investors should be paying close attention to when looking at the CAD to USD exchange rate.

- The Canadian economy is vulnerable, to say the very least. The booming housing market in the country and consumer debt are two of the of the biggest concerns. As per the most recent figures, Canadians’ ratio of debt to disposable income is very close to 170%. This means that, for every one dollar of disposable income, they have debt of $1.70. If consumer spending stalls in Canada due to high debt, a severe recession could follow, which could pressure the CAD to USD exchange rate further.

- In its most recent Financial System Review, the Bank of Canada talked about “fragile liquidity in the fixed-income market,” among other things. I question how the central bank will mitigate this risk. Will it step into the bond market? It’s possible and, if it does, the CAD to USD exchange rate could see wild swings. (Source: “Financial System Review December 2016,” Bank of Canada, December 15, 2016.)

- Interest rates play a major role when it comes to currencies. As it stands, the U.S. Federal Reserve is raising rates while Canadian interest rates are the same. Usually when this happens, investors prefer a currency with a higher interest rate. This alone could cause investors to run toward the U.S. dollar and ditch the Canadian dollar.

- Prior to the U.S. elections, Donald Trump, now the president-elect, threatened scrap the North America Free Trade Agreement (NAFTA). This trade deal has provided advantages to Canada. If NAFTA is scrapped, it could have dire consequences on Canadian trade; the country exports significant amount to the United States. This wouldn’t be seen as positive for the CAD to USD exchange rate, whatsoever.

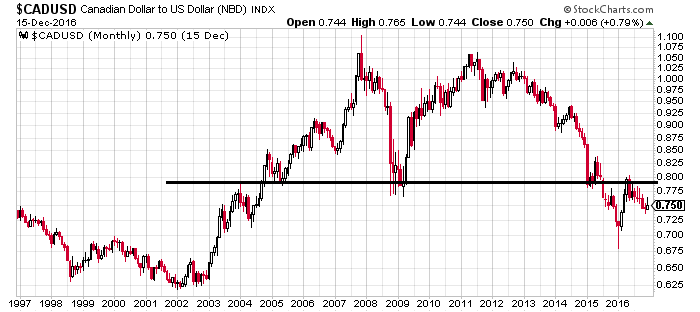

- Look at the long-term chart below. It suggests that there is significant bearish sentiment toward the CAD/USD exchange rate.

Chart Courtesy of StockCharts.com

Before going into any details, know one rule of technical analysis: when a support level breaks, it becomes resistance.

Now, with the chart above; the CAD to USD exchange rate was finding support at 0.78. It was tested during the financial crisis as well. In early 2015, CAD/USD broke below this level. In early 2016, the currency pair tested the 0.78 level, but failed to break above it. This is very significant. It pretty much confirms that we have resistance in play at 0.78.

With this, understand that the next support level for CAD to USD isn’t until the 0.62 area, the lows made in 2002. It could drop that low.

What Will Change the Outlook on the CAD to USD Exchange Rate?

For my outlook to change on the Canadian dollar, there are several factors that need to turn. By this, I mean: the Canadian economy has to get out of the rut is has been in for several years now, consumer debt has to decline, resource prices (especially oil) have to pick up a little more, and the Bank of Canada’s rhetoric has to change a bit.