Bitcoin Price Could Stabilize Soon

The ongoing Bitcoin price collapse is a case of déjà-vu, mimicking price action seen just over three years ago. The year may be different, but the storyline is much the same: general profit-taking and fears of Chinese regulatory interference (this time to control capital outflows) are the main catalysts. We touched on these developments in a story titled “The Last Time This Happened, Bitcoin Crashed 78%,” on January 9.

While reasons to expect enhanced price stability were briefly outlined, greater focus was required. We don’t have a crystal ball here at Lombardi Letter, but we see key differences indicating that Bitcoin price discovery may be on a more solid footing this time around, ultimately leading to record prices.

Reason #1: Growing Bitcoin (and Blockchain) Acceptance

In its infancy, most people didn’t know what to make of Bitcoin. Many still don’t. Volatility was astronomical (negating worth as a holding currency) and there were scant benefits for owning it outside of buying illegal wares on fringe websites like Silk Road. Ledger technology was simply too fresh for the average consumer, merchant, or investment bank to wrap their heads around. The requisite systems to handle transactions had not been created en masse. Bitcoin was predominantly just an interesting concept to most, not a serious vehicle for transacting, saving, or investing.

Times are changing.

Since the Bitcoin price reached an all-time high in November 2013, total transaction volume has increased around 340%, to just under 300,000 transactions for the first week on January 2017. This growth is leading to a virtuous cycle, in which more vendors are accepting Bitcoin and more consumers transacting with it.

There have also been several high-profile cryptocurrency projects further legitimizing the belief that ledger technology can instill real utility in real-world financial applications. The most recent involves a consortium-backed project to replace back-office processing of a major derivatives clearing house. The Depository Trust & Clearing Corporation (DTCC) announced that International Business Machines Corp. (NYSE:IBM) and select partners will re-platform DTCC’s Trade Information Warehouse (TIW) using blockchain technology.

This isn’t some small-time operation: the DTCC is the world’s largest credit derivatives clearinghouse, servicing approximately 98% of all transactions in the global marketplace. The decision will move $11.0 trillion worth of credit derivatives to a custom distributed ledger.

As blockchain systems displace entrenched systems and obtain critical mass acceptance, it stands to reason that Bitcoin—cryptocurrency’s undisputed patriarch—will benefit by association. Although various cryptocurrencies employ variations of Bitcoin’s distributed ledger prototype, it’s nonetheless an validation of Bitcoin’s core decentralized model.

Viewed another way, would Bitcoin carry any intrinsic value if cryptocurrency utility went the way of “Betamax” or “Blu Ray?” Would a single Honus Wagner baseball card sell for $3.12 million if baseball interest fizzled out and had not become America’s pastime? We don’t think so either.

Chart courtesy of CoinDesk.com

Reason #2: Higher Trading Volumes, Strong Technicals

While everyone focused on whether Bitcoin would break its nominal November 2013 high, it actually smashed through it in market capitalization terms. This is a more complete way to gauge relative strength. Owing to greater amounts of Bitcoin in circulation, market cap peaked at $18.0 billion in January 2017 from just under $12.0 billion on November 2013. Put another way, would you be more wealthy if you owned 1,000 Apple Inc. (NASDAQ:AAPL) shares at $100.00, or 2,000 shares of AAPL post-split at $65.00? A similar analogy applies.

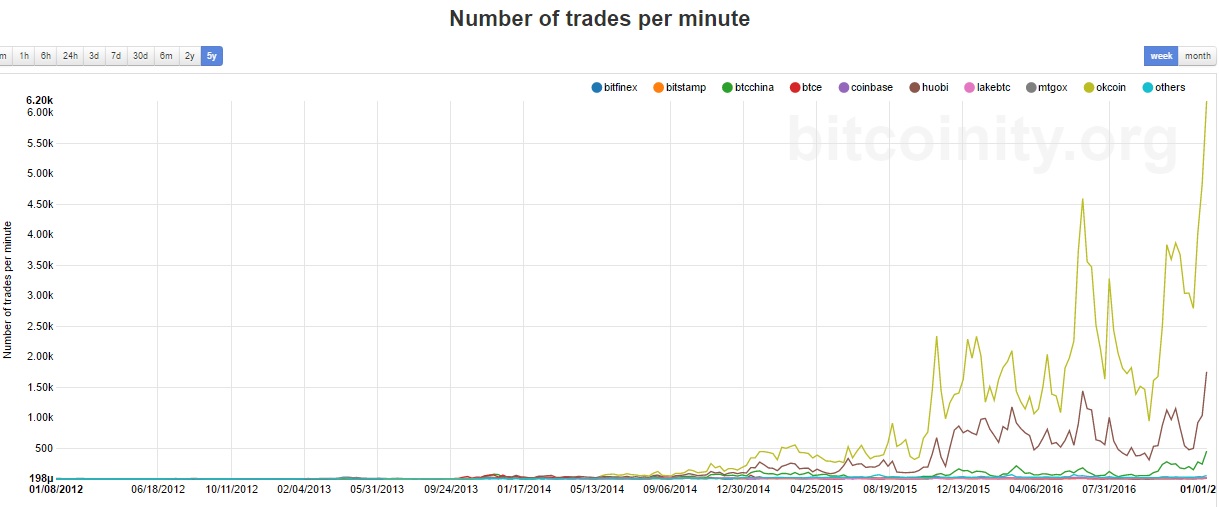

Furthermore, the data indicates an exponential increase in the number of trades per minute (see chart below), suggesting greater investor interest and (presumably) higher liquidity on aggregate exchanges. This should theoretically help cushion selling on the downside, although we haven’t seen evidence of this effect yet.

Chart courtesy of Bitcoinity.org

Reason #3: Bitcoin Is Not a Bubble

There are two types of market bubbles, irrespective of asset class: ones where prices recover, and ones where prices never do. While short-term exuberance can overextend any market, given the right mix of conditions, which ones bounce back—it can be argued—is inherently a function of utility.

For example, why didn’t tulip prices or Pets.com stock recover while U.S. housing prices and NASDAQ recovered in full? All were bubbles, yet only the latter markets had intrinsic value owing to widespread acceptance as a public utility. We do not argue that tulips look great in the garden but, in the end, tulips are simply bulbs; they are not scarce, they do not provide shelter, nor do they pay dividends. It was the same with Pets.com; pie-in-the-sky valuations based on fantasy and Wall Street pimping, nothing more.

During the 2001 dotcom bubble, NASDAQ consisted of many Pets.com-like companies, decimating the exchange when fantasy turned into nightmare. But it also consisted of Intel Corporation (NASDAQ:INTC), Apple, Microsoft Corporation (NASDAQ:MSFT), and Amazon.com, Inc. (NASDAQ:AMZN).

Among the riffraff were emergent technology companies forming the bedrock and foundation necessary for NASDAQ to recover once the dotcom mess got swept away. In this case, the parts were greater than the sum because select individual companies maintained intrinsic value and quantifiable future growth prospects. Hindsight has proven this to be correct.

Housing, too, has obvious intrinsic value. All humans require adequate shelter to live normal lives. Although valuations broke free from all historical norms due to securitization and sub-prime lending, nobody thought that housing would go to zero once excesses were removed from the system. Nobody.

And herein lies the question: Do you believe that Bitcoin more closely resembles the utility of tulips or Pets.com stock, or NASDAQ and U.S. housing during its comparable bubble phase? Take another look at a Bitcoin price chart and you will find your answer.