Gold Price Rise Prediction

If you are one of those who bet on gold prices going higher with Donald Trump in the White House, you may have had a “meh” experience in 2017. Gold prices were OK, but it wasn’t until the last few months of the year that gold started to make a move. Nevertheless, your instincts were right.

Your gold price rise prediction is no doubt happening now, while everyone was staring at Bitcoin or the improbably high stock market. A gold price rise prediction of about $1,500 in 2018 seems more than reasonable. Gold should easily reach $1,500 per ounce. In fact, it seems to be preparing to break out.

Will the Gold Price Rise?

You, precious metal investor, are in the enviable position of not just asking “Will the gold price rise in 2018?” but “How much higher will the gold price rise in 2018?” The gold price per ounce already reached $1,366 on January 25. It closed at $1,348, a value it had not achieved since the middle of 2016. As it happens, that was when Trump started to scare the markets with the possibility that he would not only secure the Republican nomination but the White House itself.

Gold prices could defy the most optimistic expectations in 2018. Goldman Sachs Group Inc (NYSE:GS) and other major institutions expected gold prices to hit $1,350 per ounce by the end of the year. (Source: “Goldman: Gold Prices To Fall Into Mid-2018, Rally Into 2020,” Kitco, December 20, 2017.)

Goldman should pay closer attention to the first four letters of its name. Not only are prices not falling as it predicted, but they’ve already achieved a price just $10.00 shy of the peak it predicted for 2020—$1,375 per ounce.

Perhaps it’s not Goldman’s fault. Few were expecting gold to move much higher after Trump’s tax reform passed in the last days of 2017. It was all about the stock market; and the optimists have been proven right so far, given that the Dow is over 25,000 points.

Then there was Bitcoin and its sharp spike toward $20,000. Who would have guessed it would drop as spectacularly as it rose? Actually, many reasonable people expected nothing less. But the world has a shortage of those in the current outrageous Wall Street exuberance.

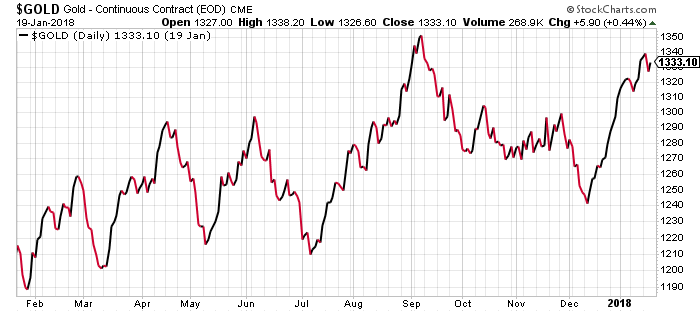

Note the trend and the ever-rising floor since 2017.

Chart courtesy of StockCharts.com

Why Does the Gold Price Rise When the Dollar Falls?

Gold is priced in dollars. But its value tends to run in an inverse proportion to that of the dollar. The higher the interest rates, the higher the dollar. The higher the dollar, the lower the incentive to buy gold and vice-versa. These are the main causes of a gold price rise. At present, there are low interest rates and a low dollar, clearing the path for a gold bull market in 2018.

The big news for gold is the sharp weakening of the U.S. dollar. Investors have realized that the Federal Reserve doesn’t have the technical components to raise rates. That’s the main tactic to boost the value of the dollar. Moreover, President Trump has made it rather clear that he favors a weak dollar. He is expected to deliver a speech that challenges free trade agreements at the World Economic Forum in Davos, Switzerland.

The euro (EUR), the British pound (GBP), the Canadian dollar (CAD), the Swiss franc (CHF), the Swedish krona (SEK), and the Japanese yen (JPY) make up the Dollar Index. They appear to have gotten the message. The Index signals a deliberate weakening of the greenback, which has pushed the euro much higher than at any time in the past few years. It was merely a year-and-a-half ago that the dollar was within a few cents of achieving parity with the euro. Now, the distance has increased by over 25%. The USDEUR exchange is over $1.25.

The Secretary of the Treasury, Steven Mnuchin, all but confirmed that the cheap dollar is no accident. Rather, it’s the centerpiece of the current administration’s strategy to drive the American econ0my and economic growth. But it’s a risky policy. For it to work, it’s not enough to lower the price of American goods abroad. Trump’s plan also includes re-establishing significant barriers and tariffs to imports.

The idea is to stimulate American manufacturing. Yet, tax cuts and all, there are no assurances that American industry will invest in rebuilding the abandoned factories in the United States. In addition, American exports need markets abroad. Foreign markets will be forced to reciprocate the erection of trade barriers when it comes to the United States. They will have no incentive to do otherwise. Thus, Trump’s plan could fall flat and wipe out any economic growth expectations resulting from the high stimulus package of low corporate taxes, a low dollar, and tariffs.

Effects of a Falling U.S. Dollar

The reasons why the dollar is falling in 2018 became clear when Mnuchin confirmed what everyone had suspected. The administration wants a low dollar. It’s part of the “Trump Doctrine,” as it were. Trump has chosen to replace Fed Chair Janet Yellen with Jerome Powell. No doubt, one of the criteria that must have influenced Trump’s pick was Powell’s well-known inclination not to stray too far away from the quantitative easing policies that have prevailed at the Federal Reserve since 2009.

The main effect of the low dollar is to scare off European and Chinese exporters, whose goods would be more expensive to Americans. But it could trigger a cut in consumption. The retail industry depends on imports now. American consumers will find most items more expensive.

How to Profit from a Falling U.S. Dollar

If you follow the Trump political calculus, the way to profit from cheap dollars is to buy some and hold them long term. Trump is thinking short term. He wants to make sure that by the time of the 2018 mid-term elections, his administration can show results—based on his campaign promises.

It’s anybody’s guess how long Trump will be able to sustain the low dollar. Indeed, he will likely reverse course after the 2018 elections—presuming the Republicans secure the votes—pushing the dollar and interest rates higher.

It’s a gamble. And nobody should be surprised, given Trump’s real estate mogul experience and casino ownership. This makes the other way to profit from the low dollar more obvious. In the midst of the “financial experiment” that Trump is conducting, investing in gold and precious metals seems like the most reasonable thing to do. Keep track of Federal Reserve developments, especially after the 2018 vote, which is when you should review your gold strategy. But, for the next few months, the future seems “golden” for gold.