Economic Slowdown Indicator: Retailers Closing Shops

Mark my words, stock markets are not representing the real U.S. economy, whatsoever. There’s an economic slowdown looming. Once it starts showing up in the headline economic data, it could have dire consequences.

One possible economic slowdown indicator is the number of retail stores closing across the United States.

According to Fung Global Retail & Technology, a think tank that focuses on the retail sector, since January 1, 2017, retailers have announced 6,700 store closures. How significant is this? It is the highest number of stores closed down in the U.S. since the financial crisis of 2008. In that year, 6,163 stores were closed. (Source: “2017 just set the all-time record for store closings,” CNN Monday, October 25, 2017.)

Putting it in simple words, store closures this year are running at a similar pace to what they were when the U.S. economy was on the verge of collapse.

Mind you, it wasn’t just small retailers announcing closures. It included major ones like Michael Kors Holdings Ltd (NYSE:KORS), Gap Inc (NYSE:GPS), Walgreens Boots Alliance Inc (NASDAQ:WBA), and other well-known brands.

Sadly, the store closings are not the only signs of economic slowdown; we also see retailers filing bankruptcies.

According to BankruptcyData.com, over 300 retailers have filed for bankruptcy this year, which is 31% higher than in the same period a year ago. It was mainly smaller retailers, but it’s a sign of concern nonetheless. (Source: “Retail bloodbath: Bankruptcy filings pile up,” CNN Money, June 13, 2017.)

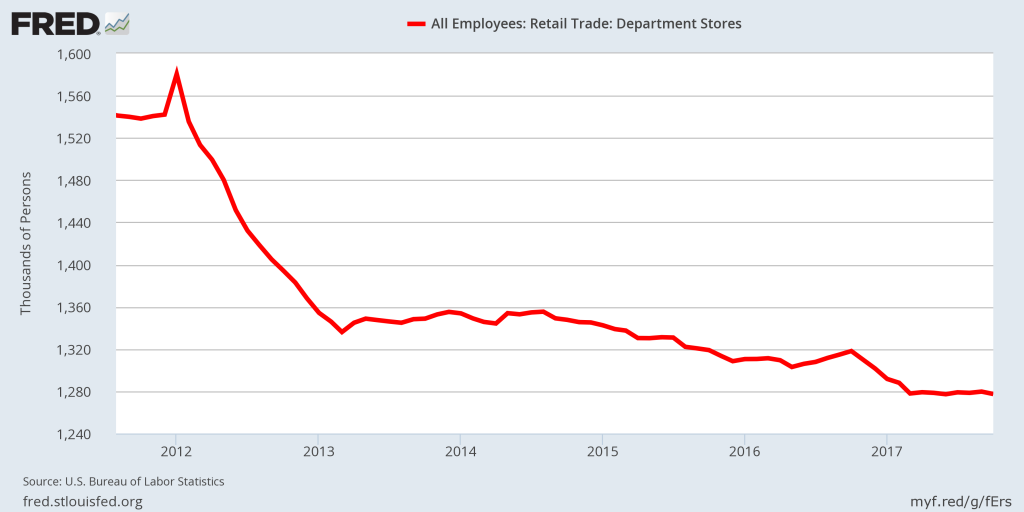

As a consequence of this, many Americans have been losing their jobs. Look at the chart below; it shows the change in the number of employees working at department stores in the U.S. economy.

The Counterargument: Online Sales Causing This?

It’s very understandable that one could be looking at this and saying, “It’s all happening because of the increase of online shopping, nothing to do with a U.S. economic slowdown.”

Certainly, the popularity of online shopping could be one factor, but it’s not the only one.

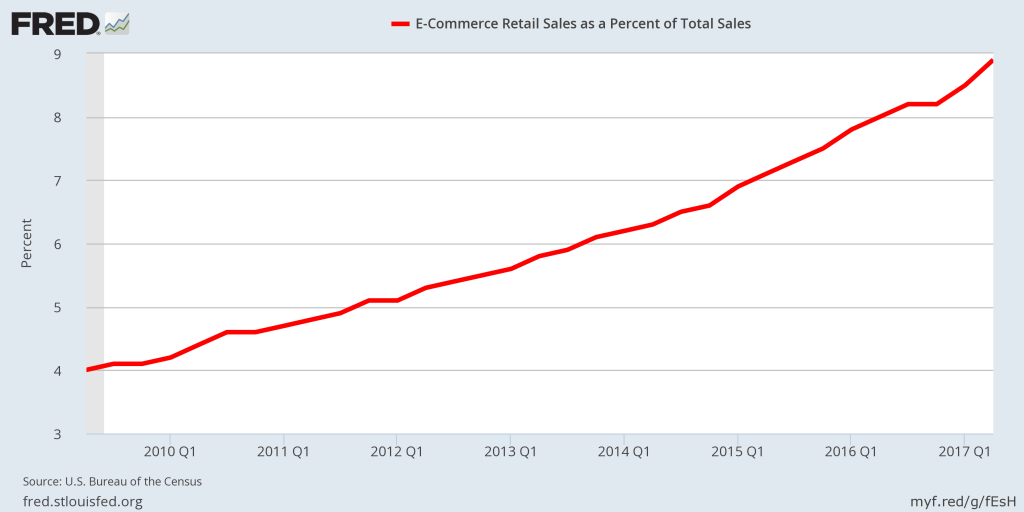

Just look at the chart below. It should pour a lot of cold water on the theory that online sales are behind retailers closing shops and going out of business.

Online sales, as a percentage of all retail sales, amount to less than nine percent. In other words, for every one dollar in retail sales, just $0.09 comes from online sales.

U.S. Economic Outlook: 2018 Could Be a Bad Year for U.S. Economy

Dear reader, at times, too much attention is paid to the noise, but not to the hard economic data. It’s screaming “Beware! Economic slowdown could be ahead.”

Don’t take the issue of stores closing across the U.S. lightly. It’s telling us that Americans are struggling financially, so they don’t have a lot of extra money to spend.

When I look at the data, I can’t help but be pessimistic about the U.S. economy.

I see 2018 as a bad year for the U.S., especially the first half. It will not be shocking to me if words like “economic slowdown” and “recession” start to appear in headlines in the mainstream media.

I also ask: How will investors take the next economic slowdown in the U.S. economy? Right now, investors seem certain that there will be growth, so they have been buying stocks. Will they run for the exit when they find that they were wrong all along? It’s possible.