Here’s Why Gold Prices Are Worth a Look

It can’t be stressed enough: Don’t ignore gold prices. They are setting up to reward big-time. Another bull run, like the one after 2009, could be in the making. As cliché as it may sound, if investors are snoozing on the precious metal, they could be losing out on massive gains.

Since 2016, we have see an extraordinary gold rush. No one seems to be talking about it though. There’s solid demand, and buyers remain—regardless of where the price of gold stands. And I have written all about it before in these pages.

The supply side is crushed; miners are struggling to produce. As per basic economics, this is a perfect recipe for much higher precious metal prices.

Charts Say Gold Prices Are Setting Up to Soar

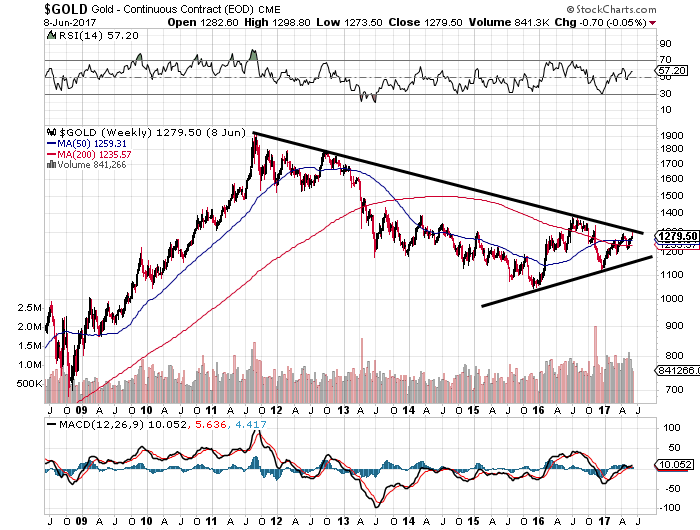

The price action on the below gold chart is suggesting that the yellow precious metal is worth a look.

There are five things that investors need to keep in mind.

- Notice the black trend lines drawn on the below chart? You see the downtrend that began in 2011? Its existence is in jeopardy. In late 2015, we saw a bottom form in gold prices, and we see the emergence of an uptrend, since there are higher highs and higher lows. If the price of gold could break above the $1,300.00 level, it would be very bullish, to say the least. It will mean that the downtrend in the price of the precious metal is over.

Chart courtesy of StockCharts.com

- Also on the above chart, the 200-week and 50-week moving averages are shown below the gold price line. At its core, these moving averages are confirming that the long-term and intermediate-term trends are turning in favor of those who are bullish on gold. Bears beware.

- Notice the volume at the bottom of the chart. Since the end of 2015, we see it gradually increasing. This is a very encouraging sign. At its most basic level, this suggests that buyers are coming in as prices are going higher. It would be worrisome if trading volume was declining as gold prices were going higher. It would mean that buyers aren’t as excited.

- Pay attention to moving average convergence/divergence (MACD), a momentum indicator at the bottom of the chart. Since mid-2013, the MACD has been trending higher, even when the price of gold was trending lower. This is an extremely bullish sign. This sort of divergence suggests that a solid move to the upside could be ahead.

- Finally, look at the relative strength index (RSI) at the top of the chart. In 2013, the RSI indicator hit below 30. This means that gold was severely oversold. Move forward to 2015, when the price of the yellow precious metal was much lower. The RSI never broke below 2013 levels. Now we see it trending higher. This tells us that buyers are coming in, and they see the price as attractive.

Gold Prices Outlook 2017: As Gold Soars, This Could Be an Even Bigger Winner

Dear reader, the mainstream media will have you convinced that gold isn’t even worth looking at, let alone investing in. They will call it a “pet rock” or other similar names. Ignore the noise.

Out of all the asset classes, the yellow precious metal seems to be the most ignored, undervalued, and most set up to soar. I repeat: Big gains could be ahead.

Here’s the thing: If the price of the precious metal makes a move higher, it might be wise for investors to pay attention to mining company stocks. They provide leveraged returns to gold prices. So, if we assume that the price of gold hits $2,000 (about 57% from where it currently trades.), we could see some mining stocks increase 10 times in value.