Earnings, Sentiment, and Valuation Predicting Stock Market Crash

At a time when key stock indices are ripping through their all-time highs, it may sound irrational to talk about a stock market crash. But investors beware, for there are a few factors suggesting that significant losses could be ahead.

Look back at any previous stock market crash. There are usually a few things that are common just before a sell-off kicks in: earnings estimates start to tumble all of a sudden, investor sentiment turns bearish, and valuations become extreme.

Earnings Estimates Tumbling

As it stands, we are seeing all three things happening as stocks soar.

Consider this: we are about to enter the third-quarter earnings season. Sadly, analysts have pulled backed severely on their estimates.

At the start of the third quarter of 2017, analysts were expecting S&P 500 companies to report earnings growth of 7.5%. Now, they estimate the growth rate to be just 2.8%. (Source: “Earnings Insight,” FactSet, October 6, 2017.)

It’s simple math; over the quarter, their estimates have tumbled 62%. This shouldn’t be taken lightly whatsoever.

It must be understood that analysts are closely followed by the institutional investors. Wouldn’t this solid decline in estimates worry those who have the power to move the markets?

Wall Street Sentiment Changing

As this is happening, we are starting to see Wall Street’s sentiment turn as well.

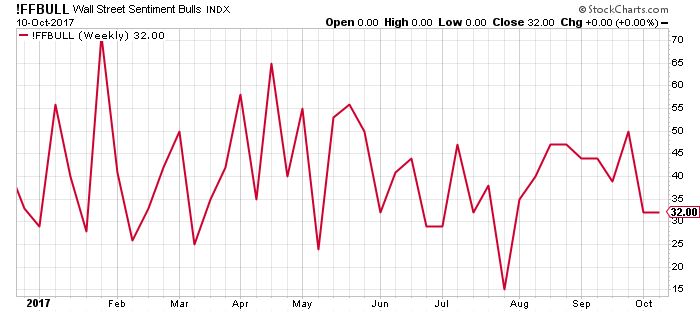

Look at the chart below. It shows result of a weekly survey that asks traders and analysts about their outlook on the stock market. The number of bullish traders and analysts seems to be declining, which is worrisome.

Chart Courtesy of StockCharts.com

In early 2017, 70% of the respondents were bullish. Now, this figure has dropped to just 32%.

Valuations Are Stretched

Lastly, know that the valuations continue to stretch.

Look at the CAPE ratio. Its price-to-earnings ratio of the U.S. stock market is adjusted for inflation and cyclicality. It has been talked about several times in these pages. Currently, the ratio stands above 31.0. (Source: “Online Data Robert Shiller,” Yale University Department of Economics, last accessed October 10, 2017.)

The historical average of the CAPE ratio since 1881 is around 16.8. By this measure, the U.S. stock markets are trading 85% above their historical average. If the stock markets come back to their historical average, we could see severe losses.

Stock Market Outlook: How Long Could This Rally Go?

Dear reader, it must be understood: even though stock market crash indicators are flashing red, it doesn’t mean we have reached the top of the markets. Predicting tops is dangerous and could hurt the portfolio big time.

Irrationality could remain in play for a while, but it doesn’t last forever.

To me, it wouldn’t be shocking to see this market continue for a while. The momentum is too strong.

But, I worry about what happens when the reality hits investors. Based on my own experiences, when investors are faced with reality, they tend to panic and run for the exit. They sell everything and anything in sight.

Here’s what I am looking for: if we get sustained selling, it could make a lot of investors very nervous. Since late 2016, we haven’t seen indices like the S&P 500 witness a five-percent down move. Sustained selling could really wake investors up, and only then we will know where we go next.