IMF Says Volatility Could Cause Stock Market Crash

I can’t stress this enough: Don’t get too complacent as key stock indices continue to soar. A major stock market crash could be ahead.

It’s important for investors to assess risks often. As it stands, risks of a stock market crash are increasing, and they are being ignored. Remember, complacency never ends well. Even major institutions are now warning investors to be careful and to tread lightly.

One of the most recent warnings about a sell-off in the stock market came from the International Monetary Fund (IMF). Tobias Adrian, the IMF’s director of the “Monetary and Capital Markets Department,” mentioned that, due to low volatility and low yields, investors are taking on leverage to boost their returns. (Source: “IMF warns volatility products loom as next big market shock,” Financial Times, October 30, 2017.)

This is dangerous.

Adrian explained that pension funds and insurance companies are getting into riskier investments, and they are betting against a stock market crash. Mind you, pension funds and insurance companies are usually deemed as risk-averse because they tend to plan for the long term instead of speculating on short-term bets.

What to watch out for going forward? According to Adrian, “A sustained increase in volatility could then trigger a sell-off in the assets underlying these products, amplifying the shock to markets.” (Source: Ibid.)

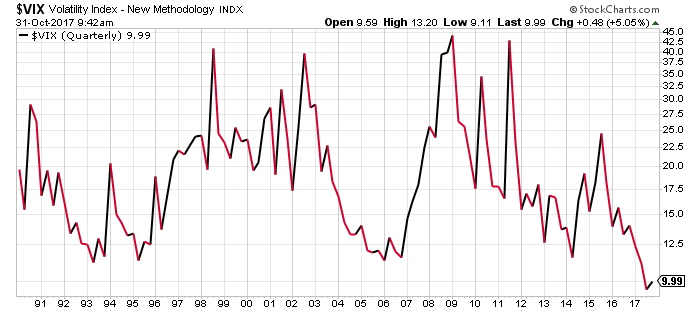

To provide some perspective, take a look at the Chicago Board Options Exchange Volatility Index (VIX). It is essentially an indicator of volatility on the stock markets.

Chart courtesy of StockCharts.com

The stock market volatility index currently sits at the lowest level on record.

Valuations Getting Extremely Overvalued

Beyond this, it’s important that investors pay attention to valuations. If there’s one thing we have learned over the years, valuations tend to fall back to their historical averages, or close to that average.

One way to look at valuations is the cyclically adjusted price-to-earnings ratio (CAPE ratio). The long-term average of this ratio since 1881 is around 16.8. Currently, the CAPE ratio stands at 31.21. (Source: “Online Data Robert Shiller,” Yale University, last accessed October 31, 2017.)

See a problem here? Even if we assume that the market corrects back just halfway to the long-term average, it would have to go down significantly. Currently, markets are trading at 86% above their historical average.

When Will the Stock Market Crash Happen?

Dear reader, understand that I am not trying to predict tops, nor declare when investors should start accumulating short positions. My goal here is to be a voice of reason, more than anything else.

Currently, the momentum in the markets is extremely strong in favor of bulls, so short-term, we could see price escalation. But it’s important to question how long this go could on.

Here’s what I know: the higher the indices go on the back of poor fundamentals, the bigger the next stock market crash is going to be.

Keeping all this in mind, it’s great to see markets soaring, but it wouldn’t be a bad idea for investors to focus on capital preservation. That could be as simple as moving stops higher on positions at hand. So, in case there’s a sell-off, investors get out before giving away too much profit.