There’s a Retirement Crisis Brewing, Don’t Ignore It

There’s a retirement crisis in the making…

You see, to retire comfortably, one needs savings. Sadly, however, Americans have not been saving.

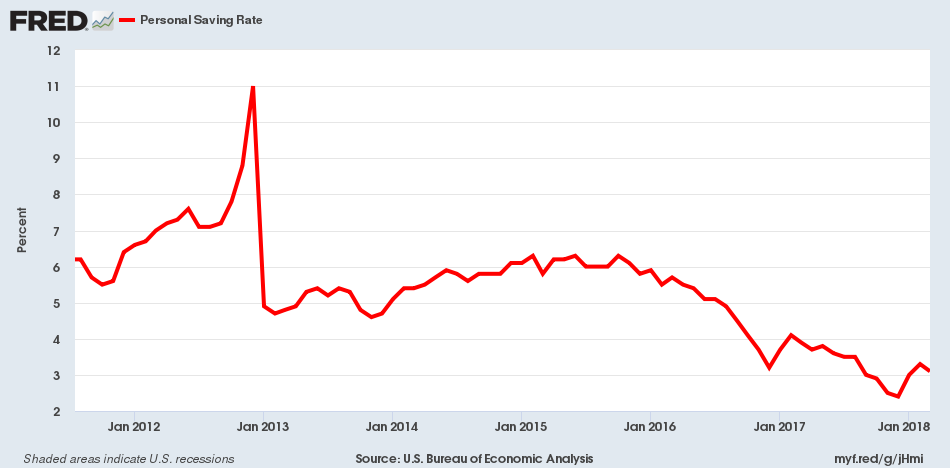

Look at the chart below to get some idea. It plots the personal saving rate—the percentage of disposable income that Americans save.

In March, it stood at 3.1%. This means that, if a person had $100.00 in disposable income, they saved just $3.10. Mind you, disposable income is income after taxes and other mandatory charges.

Here’s the thing: the personal saving rate has collapsed over the past few years. In 2015, the rate was 6.1%. At the end of 2012, it was as high as 11%.

(Source: “Personal Saving Rate,” Federal Reserve Bank of St. Louis, last accessed May 4, 2018.)

Going back further, the monthly average personal saving rate since 1959 is around 8.2%. So, the current saving rate of 3.1% is 62% below the historical average. This is not good.

Survey Says, Americans Don’t Have Money Saved Up

But this isn’t the only thing that suggests there’s a retirement crisis in the making.

On a regular basis, there are retirement surveys from leading institutions suggesting that Americans aren’t saving enough.

Consider a recent survey by GoBankingRates. It shows that 42% of Americans only have $10,000 or less stashed away for retirement. (Source: “Retiring broke? More than half of Americans are at risk of it happening,” USA Today, April 24, 2018.)

Will Pensions and Social Security Help?

Here’s the worst part: many Americans could be banking on their pensions for retirement. Sadly, pensions may not provide much help. We currently have a pension crisis; pension funds run by cities and states in the U.S. are severely underfunded. To get some more perspective, read my earlier article “Retirement in Trouble: Underfunded Pension Liabilities Amount to $18,676 for Every Resident of the U.S.”

Social Security may not be as helpful either during retirement. Americans already realize this.

According to the Annual Nationwide Retirement Institute survey, 78% of future retirees fear that Social Security funding will run out in their lifetimes. Of those surveyed, 52% expect cuts to Social Security benefits under the current administration. (Source: “Many Americans Appear to Have a Discouraged Outlook on Retirement, But There’s Hope,” Nationwide, September 19, 2017.)

Some Food for Thought

Dear reader, I don’t want to be the bearer of bad news. From the looks of it though, retirement for a lot of Americans could be on the line.

Going forward, it’s important to look out for what’s happening regarding savings, pensions, and Social Security.

During the financial crisis, major U.S. banks were bailed out. Their bad assets were taken away by the Federal Reserve and they were given freshly printed money. They got a lifeline from the government, or else some of them would not be around now.

With a retirement crisis looming, it has to be questioned whether the U.S. government will bail out Americans. Could it afford to do it? The U.S. national debt currently stands at more than $21.1 trillion, and it is only expected to go higher. What would happen to the debt the in case that retirees need to be bailed out?