What Is Insider Trading, and How Does Insider Trading Work?

You may have wondered, “exactly what is insider trading?” The term “insider trading” can be confusing. It does not refer to finance professionals doing trades inside their Wall Street offices. Indeed, insider trading can even occur outdoors, in a park. Insider trading begins with the exchange of information and ends with the use of that information to gain advantage in a securities trade.

How does insider trading work? An individual must buy a stock, bond, option or other investment instrument based on confidential information for insider trading to take place. Often it occurs when persons who, because of their geographic or professional relationships, have come to possess details about a company that are not in the public domain.

Such information, by its nature, allows individuals who exploit their privileged insider contacts to gain a tremendous advantage over other investors in the same market. In a sense, insider trading is a case of asymmetric information. Both the disclosure and the use of insider news before it spreads to the public domain are criminal offenses, which are punishable by law.

In some ways, insider trading is related to industrial espionage. The latter occurs, for example, when a company goes to unusual and desperate measures to acquire a special secret (information) about a new project. Likewise, a financial company might go to such lengths to get details to make better informed trades on stocks or shares.

In situations of industrial espionage, the insiders sell the privileged information secretly. It’s a business version of what Soviet and American assets did during the Cold War. In both the U.S. and the Soviet Union, those caught selling state secrets would face severe punishment, including the death penalty.

In the industrial or business example, insider espionage can sabotage the profits and survival of an entire company. It puts employees’ jobs on the line, and thus has the potential to inflict social and economic damage that goes far beyond the fate of a single company.

Why Is Insider Trading Illegal?

In the past two decades, there has been a substantial increase in cases of industrial espionage involving insider information. The advent of the Internet has facilitated and expanded the development of insider information networks worldwide. Moreover, believe it or not, insider trading was not always illegal.

In both cases, whether the point is to keep abreast of the competition or gain an investment advantage, the actions constitute espionage. Espionage is a criminal offense. Nevertheless, when the espionage—or actionable intelligence—is facilitated by one or more internal people from the company itself, it becomes insider trading.

By way of illustration, inside information must also meet certain criteria. Not all information is insider information. For starters, the information must be accurate. Investors who try to secure and use insiders must find out the exact amounts of, for example, losses or gains that will be announced on a given date and occasion.

Insiders will want to know about specific deals or contracts that a certain company will—as opposed to could—sign. Insiders also benefit from getting advance knowledge about a restructuring, a merger, a divestment, and any similar details about a stock/company obtained through the concealed disclosure of a secret.

The details and accuracy of the information are what make it privileged. The privilege comes from the inequality of access to information. The privileged investors simply have far more information than anyone else in planning to sell or buy a given financial instrument. Thus, if you know that company X, struggling with earnings and other problems, is negotiating a merger with the much healthier company Y, before this information hits the news, you can exploit it.

You can buy shares of X at a very cheap price in the confidence that, within a few days or weeks, its price will rise. If the insiders made that information public, X’s stock would rise too quickly for you to enjoy the kind of margins possible, when big details remain undisclosed.

So, why is insider training illegal? It’s a combination of ethical and practical business factors. The ethical problem is obvious. Insider trading relies on subjects who work for a given company or entity. As such, they are aware of inside information. That is information that has not been disclosed to the public. They have what can be called “privileged information.”

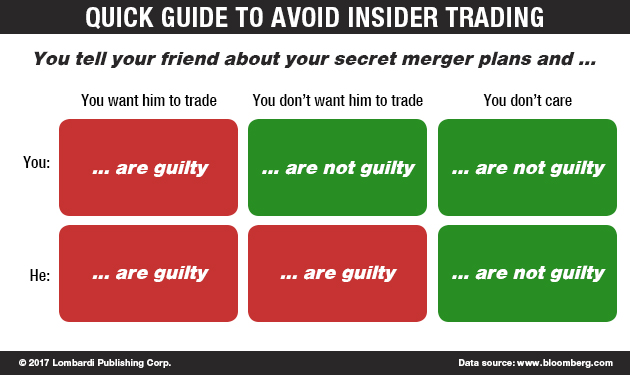

The following chart shows a quick way of knowing whether insider trading is happening, and how to avoid it.

Types of Insider Trading

In general, insider trading involves someone in possession of undisclosed and important details, due to their functions as a member of a company’s administration or management. As a result of these responsibilities and the exercise of their employment functions, the practice of insider trading can involve one or all of the following forms of conduct.

Buying, selling or performing transactions on behalf of third parties of financial instruments using such information as:

- Communicating insider information to others outside the boundaries of the company/business.

- Recommending the taking of action with, i.e. taking advantage of, the insider information as obtained above.

Evidently, the common denominator is the use of privileged information for speculative purposes. By way of example, consider a hypothetical case involving the CEO of a publicly traded company. Along with other members of the board, he is presented with a takeover bid from an investor who wants to buy a certain percentage of the company’s shares at a price that might be, let’s say, 30% higher than the current one.

This is clearly highly sensitive information. If, or rather when, it becomes disclosed to the media and the markets, it could instantly influence the share price. But, let us now assume that, before the information enters the public domain, a board member or the CEO buys a nice stake of shares at the current price in order to take advantage of the next—and guaranteed—upturn in share prices.

That board member could proceed to sell the shares after a few hours, at a considerably higher price, pocketing a huge gain. That is perhaps the most classic, almost textbook, insider trading case. That’s the sort of thing that the U.S. Securities Exchange Commission (SEC) monitors. It does so by tracing suspicious trades and stock price movements.

If, for example, shortly before the publication of important information about a stock, there was an abnormally large number of “buy” or “sell” transactions, the SEC might investigate. The commission will try to find out if there are people who share a connection with that information and the person who had it first.

Insider trading, in a narrow sense, has been a criminal offense in the United States. But, this only started in 1932 after the formation of the SEC to curb the excesses that enabled the stock market crash of 1929.

As far as insider trading laws go, there is no general federal law that prohibits the practice of insider trading directly. The legal mechanisms that make it possible for prosecutors to charge and pursue insider trading in the U.S. derive from the Supreme Court. It has interpreted section 16(b) of the Securities Exchange Act of 1934. Specifically, the Supreme Court has referred to rule 10b-5 of the act. It discusses insider trading regulations in the context of fraud, as related to the sale of securities.

That said, in practice, insider trading was considered more unethical than illegal in the U.S. until the 1960s. (Source: “Regulation Of Insider Trading,” Law Teacher, last accessed April 3, 2017.)

The provider and the beneficiary of the insider information are the perpetrators of the crime, and the victims are all investors in general. By taking the risk out of investing, those benefiting from insider information corrupt the ideal market mechanisms of supply and demand. Insider trading is a kind of virus that raises suspicion of manipulation.

The Markets Must Be Above Suspicion

Like Julius Caesar’s wife, the markets—in order to function properly—must be above suspicion. Investors lose and win on their market trades. Generally, those who lose accept the fact. Suspicion of manipulation in the form of insider trading, adds unfairness, however. Left unchecked, it could break the entire stock market system.

The number of insider trading complaints are numerous. Therefore, they are tough to prosecute. Faced with these challenges, the SEC and the supervisory bodies of other countries with developed stock markets are demanding more universal rules to prevent this sort of crime.

Insider trading was first identified and criminalized in the United States which, in matters of market regulations, has led the way for the rest of the world. In Europe, for example, market authorities did not pursue insider trading with adequate legal tools until the early 1990s.

This should not be a surprise. Insider trading remains the object of much uncertainty when it comes to its criminal nature and how to combat it. Some countries still disputed the very criminalization of insider trading conduct. In others, there are legal mechanisms, but the penalties are mild, such that the balance of penalty vs. benefit from the crime works in favor of the latter.

Therefore, to fight insider trading, and ensure that markets operate in fairness, there are still limited tools at the international level. Hollywood has shown the appeal of insider trading, its addictive nature, and the difficulty of legally pursuing it, in such movies as Wall Street by Oliver Stone.

Certainly, the methods of preventing insider trading can be intrusive. Moreover, the intrusive measures, just like airport security—no matter how strict—cannot guarantee all of the time that no crime is committed. Yet, the more one practices insider trading in the U.S., the greater the chances are of being caught.

The insider trading penalties involve jail, in most cases. Famously, TV personality Martha Stewart spent a month in a special white-collar-crime jail after being found guilty of insider trading. She sold a biotech stock (ImClone Systems LLC) on the advice of an insider, a friend, who warned of an imminent U.S. Food and Drug Administration (FDA) trial failure.

Others have faced much longer jail sentences. Raj Rajaratnam was slapped with 11 years in prison after profiting $80.0 million from transactions involving Goldman Sachs. (Source: “Insider Trading: Civil Or Criminal Crime?,” Forbes, October 24, 2013.)

Others can get away with a large fine. In other words, there’s a fine line dividing criminal from civil in insider trading. But, suffice it to say, when the gains are in the millions of dollars, jail is a good bet.