Billionaire Investor Warren Buffett Explains the Real Problem with the U.S. Economy

Is the best already behind us? While the stock market indices continue their ninth year of almost uninterrupted growth, the future of the stock market is questionable. And for good reason. The arrival of summer inevitably reminds investors of the maxim “Sell in May and go on holiday.” But how many can afford to go on vacation? That’s the essence of Warren Buffett’s prediction for the U.S. economy.

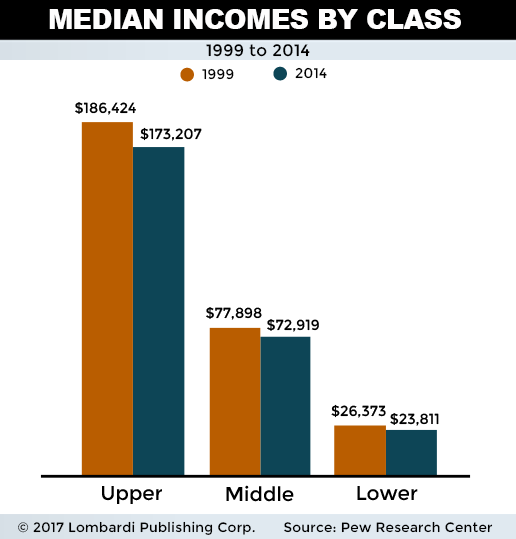

Indeed, Warren Buffett thinks that the people who are already rich or well-off have benefited far more than any other group from the country’s economic growth and stock market performance. (Source: “This is what Warren Buffett thinks is the real problem with U.S. economy,” MarketWatch, June 28, 2017.)

You would think that the famous 86-year-old billionaire CEO/founder of Berkshire Hathaway Inc. (NYSE:BRK.B) had just discovered the benefits of hot water. Buffett’s predictions are not complicated; they tend to cut through the noise and get to the obvious points. Surely Buffett has the peace of mind to sleep well at night. But his observation that the U.S. economy disproportionately rewards a small number Americans might be rather revolutionary.

Also Read:

Warren Buffett Indicator Predicts Stock Market Crash in 2017

U.S. Economic Outlook 2017: Trigger Event Could Rock U.S. Economy

How many billionaires have you heard making such candid observations lately? Many of today’s high-tech billionaires speak of improving the world, fighting climate change, saving ecosystems, and other causes.

Ultimately, most Americans know little—and couldn’t care less—about these causes and the millions of dollars that billionaires throw at them (perhaps to deal with feelings of guilt and/or to secure tax write-offs). It’s not because Americans want to be ignorant, though. They might care about these issues too if they did not have to worry about how to pay for the electricity bill, daycare, student loans, credit cards, rent or mortgage, and a myriad of other little and big things that add up. For most Americans, even those in the ever shrinking middle class, life has become more of a struggle than a journey.

Buffett’s a Billionaire, So Why Should He Care About This Aspect of the U.S. Economy?

Buffett is the world’s second-richest man, give or take a few hundred million dollars, according to the Forbes list of billionaires. He boasts a net worth of about $76.2 billion.

Nevertheless, Buffett has had the courage to admit that the average American worker has seen no economic benefits since the financial crisis of 2008. He has admitted what everybody can feel at a gut level: only the very rich have improved their fortunes.

One wonders what is the point of the U.S. economy doing well if average people are not? The Dow Jones Industrial Average has risen by an average of well over 100% from January 2009 to January 2017. When President Barack Obama took office in January 2009, the Dow Jones was just over 7,900 points. In January 2017, it was just under 20,000. The Dow more than doubled, but has the average American benefited in any way from this?

The latest Forbes ranking of the richest people in the world has confirmed that the high-tech industry remains one of the most profitable sectors (when it is successful). The Forbes study has revealed that a mere 52 people in various U.S. states have amassed wealth of $747.0 billion. That’s almost $100.0 billion more than they made last year. What more do you need to realize that the rich are getting richer? (Source: “Meet The Richest Person In Every State 2017,” Forbes, June 21, 2017.)

Some can see the “glass half full” analogy, but it has become ever harder to maintain that optimism. The American dream will never go away; it’s a dream. But reality offers few ways out. There will always be those who strike it rich. But, in an economic system like the one in the U.S., distribution of wealth favors the individual. Thus, the rich have amassed far more than they ever dreamt of desiring. Having talent, dedication, and diligence is no guarantee of financial success.

There are plenty of people who have chosen to direct their considerable talents into activities that don’t gain them much wealth. That doesn’t make them inferior to Mark Zuckerberg, Bill Gates, or Warren Buffett. Luck or chance plays an enormous role in wealth distribution; much more than Americans, in particular, are willing to concede.

So why is Buffett worried now? As the practical person he is, Buffett has realized that the kind of wealth accumulation that is happening in the U.S. could produce a social catastrophe. If the majority of Americans start to get angry about the immense concentration of wealth in a few hands, the risk of social unrest grows. No doubt, if Buffett is worried, it’s because the U.S. economic outlook has become more precarious.

As it happens, one of the key factors that has favored this huge concentration of wealth and income in the hands of a microscopic minority is the growing gap between capital remuneration and labor income. In almost all rich countries and developing countries, salaried workers have been getting ever smaller paychecks. Therefore, they have not benefited at all from the alleged economic growth. Capital owners, on the contrary, have benefited from an increase in their earnings—with interest, dividends, accumulated profits, etc.—experiencing much faster growth than the overall economy.

Meanwhile, when the next market crash does occur, the salaried employees are the ones who are going to suffer the most. They will lose their jobs, income, and homes. The rich will still be there, perhaps less excessively rich than before, but still in a position to not know what to do with all their money.