U.S. Dollar Could Dictate Gold Prices Ahead

If you are looking for direction on gold prices, it’s important you look at the U.S. dollar. If the dollar declines continue, gold prices could rally significantly.

Gold bugs, be happy; the U.S. dollar is declining. Mind you, don’t pay attention to the daily fluctuations. A lot of it has to do with noise more than anything else.

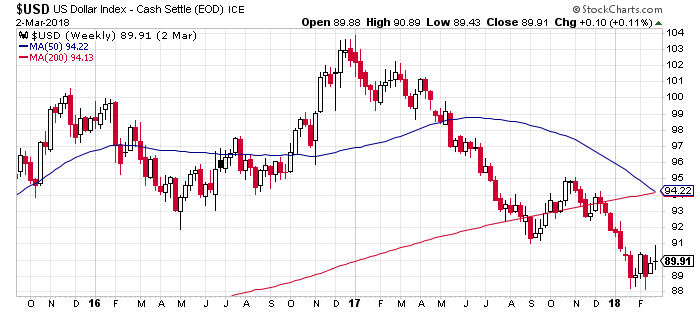

Look at the chart below, which plots the U.S. Dollar Index; this essentially tracks the performance of the U.S. dollar relative to major currencies. Also, pay close attention to the blue and red lines drawn on the chart.

Right off the bat, the U.S. dollar continues to make higher highs and lower lows.

Chart Courtesy of StockCharts.com

The red line represents the 200-day week moving average of the U.S. Dollar Index, while the blue line represents the 50-week moving average. These are basically trend indicators. If the price is below them, it suggests the long-term and intermediate-term trends are pointing downwards.

The U.S. dollar index is currently trading below these moving averages. Remember that the trend is your friend.

But that’s not all. Notice how the blue line and the red line are about to cross over? Technical analysts call this a “death cross.” When this happens, technical analysts expect bearish sentiments prevailing and prices going much lower, much faster. This is bad for the U.S. dollar, but could be great for gold prices.

Fundamentals Call for Lower Greenback

From a fundamental perspective, the U.S. dollar could drop further. So one could expect gold prices to increase a lot.

The U.S. government is still spending without remorse. It wasn’t just a problem during the Obama administration; the Trump administration is really no different when it comes to spending. Its incurring budget deficits and budget deficits are bad for the U.S. dollar.

To give you some perspective, in the first four months of the fiscal year for the U.S. government that began in October 2017, the budget deficit had already soared to over $175.0 billion. (Source: “Monthly Treasury Statement,” U.S. Bureau of the Fiscal Service, last accessed March 5, 2018.)

Beyond this, President Donald Trump recently came out swinging at steel and aluminum imports into the U.S. He even talked about imposing tariffs. This is not good for the dollar either. Some are calling for the beginning of trade wars, despite knowing that trade wars may not be very good for the greenback.

Gold Prices Outlook: Watching This One Key Level on the Dollar Index

Dear reader, the U.S. dollar looks weak, and it could get much weaker, given what’s happening these days. Charts and fundamentals are making a strong case for a lower dollar.

Now, one could be wondering: what do gold prices have to do with the U.S. dollar?

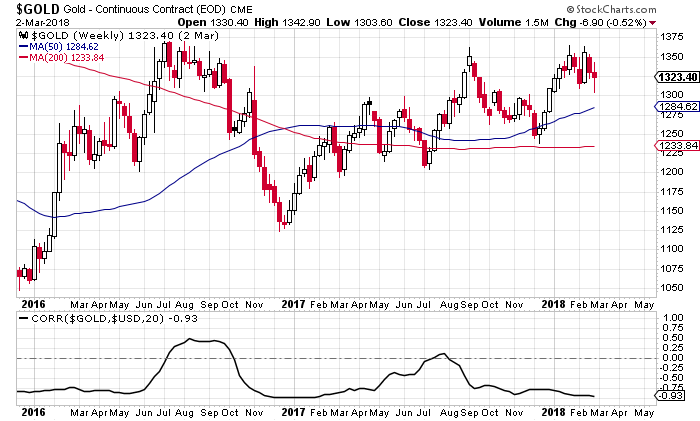

To put this question to rest, please look at the chart below. It shows the weekly gold prices. At the bottom, a correlation between the U.S. dollar and gold prices is plotted:

Chart courtesy of StockCharts.com

Currently, the correlation between gold prices and the U.S. dollar is -0.93. This is awfully close to having an almost negative inverse relationship. That means that if the dollar falls, gold prices go up.

I am currently watching the U.S. dollar index at around 90.0. If it breaks this level, the next support isn’t until around 80.0. If it drops to that low, gold prices could show stellar returns in the meantime.