Fed’s Beige Book Shows U.S. Economy Growing “Modestly”

When the Federal Reserve says the U.S. “economy is back to normal,” you would expect to see some data to back this up. But the best the 12 Federal Reserve banks can muster is to say is the pace of U.S. economic expansion is split between modest and moderate. The same thing the Federal Reserve said in March and January. Despite cheers that the U.S. economy is back to normal, the U.S. economy is anything but.

The Beige Book is a report the Federal Reserve publishes eight times per year. In it, each of the Federal Reserve banks provides anecdotal information on the economic conditions in each of the 12 districts. The most recent report was published on April 19. In it, the Fed said the U.S. economy expanded at a modest-to-moderate pace between mid-February and the end of March. (Source: “Beige Book,” Board of Governors of the Federal Reserve System, April 19, 2017.)

The 12 districts were evenly split between modest and moderate, with growth in freight shipments slowing and businesses expecting price growth to be mild to moderate over the coming months.

As far as the overall economic conditions, manufacturing expanded at a modest to moderate pace with freight shipments slowing. Residential construction increased slightly even though the growth in home sales has slowed. Nonresidential construction was strong, but was mixed in some regions.

Only five of the 12 districts mentioned consume spending; the Minneapolis Fed said consumer spending was down, Philadelphia and Chicago said consumer spending was flat, while the Kansas City and St. Louis Fed said consumer spending rose modestly.

Most Federal Reserve Districts said businesses were having difficulty filling low-skilled, low-paying positions while a number of larger businesses said they were having difficulty retaining workers. Inflation meanwhile, is, like the rest of the economy, modest, but still near five-year highs.

Goldilocks Economy Is More of a Nightmare

The Fed has raised its key interest rate twice since December, saying the U.S. economy is on solid ground and inflation is inching its way toward the central bank’s two-percent annual target rate. That said, there is still some debate as to how quickly the Fed should raise its key lending rate in this period of modest economic growth.

This is a bit surprising when you consider some in the Fed think the U.S. economy is doing fine. John Williams, the head of the Federal Reserve Bank of San Francisco said the U.S. economy is back to normal. Even better, he dubbed it the “Goldilocks economy.” (Source: “One Fed Official Says the U.S. Economy is Back to Normal,” Fortune, March 30, 2017.)

The Goldilocks economy is more like a nightmare.

Williams also said that it’s time for the Fed to move from obsessing about “How do we achieve a sustained recovery?” and focus instead on “How do we sustain the recovery we’ve achieved.” (Source: “Fed’s Williams: Don’t rule out more than 3 rate increases in 2017,” Financial Times, March 29, 2017.)

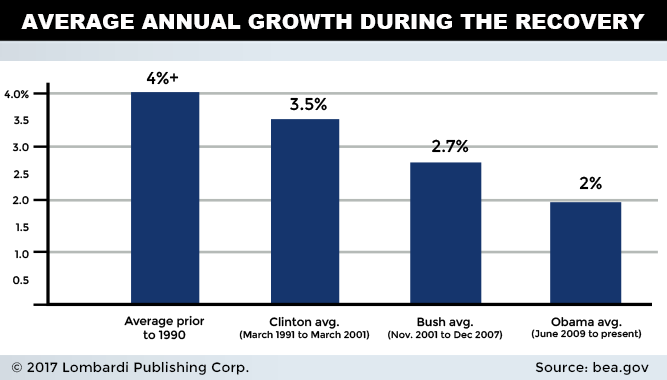

The recovery we’ve achieved? The U.S. economic recovery might be in its eighth year, but it’s the slowest economic recovery since World War II. Under President Barack Obama, annual gross domestic product (GDP) averaged two percent. In his last year in office, it was a princely 1.6%. Moreover, Obama is the only president to never have presided over a single year of three-percent GDP growth.

During the economic recovery under President George W. Bush, average GDP growth was 2.7%; under President Clinton, average annual GDP growth during the recovery was 3.5%. Prior to 1990, average annual GDP growth during an economic recovery was 4.0%.

In addition to household debt levels approaching pre-Great Recession levels, savings have been depleted, and nearly half of all Americans have no retirement savings. During the economic recovery that Williams wants to sustain, the poverty rate has soared. Six million more Americans are living in poverty than when President Obama entered the White House.

As the U.S. economy struggles, wage growth continues to stagnate and more Americans are living in poverty, it’s nice to see that Williams, who earns more than $430,000 a year, can relate to the average American.

Federal Reserve Chair Says Time to Let U.S. Economy Coast

Because the U.S. economy is doing so well, Federal Reserve chair Janet Yellen says the central bank no longer needs to juice the economy. In fact, Yellen says the U.S. economy is “healthy” and needs less help from the Fed. (Source: “Federal Reserve to let US economy ‘coast’ – Yellen,” BBC, April 11, 2017.)

“Before, we had our foot pressed down on the gas pedal trying to give the economy all the oomph we possibly could”.

Adding, “Now allowing the economy to kind of coast and remain on an even keel – to give it some gas but not so much that we are pressing down hard on the accelerator – that’s a better stance of monetary policy.”

Who wouldn’t want to let the world’s biggest economy coast on 1.6% annual GDP? Not everyone is convinced the U.S. economy is on solid ground and ready to run. According to the Atlanta Fed, the U.S. economy is on pace for the slowest growth in two years. It currently believes first-quarter real GDP growth will be just 0.5%. In early February, the Atlanta Fed predicted first-quarter GDP would come in at 2.7%. (Source: “GDPNow,” Federal Reserve Bank of Atlanta, April 18, 2017.)

The Federal Reserve of New York, on the other hand, expects first-quarter GDP to come in at 2.6% and second-quarter GDP of 2.1%. Even the ever optimistic New York Fed has had to temper its outlook though. Incoming economic data led it to reduce its GDP forecast for the first quarter by 0.2% and its second-quarter GDP forecast by a whopping 0.5%. (Source: Nowcasting Report, Federal Reserve Bank of New York, April 21, 2017.)

The Federal Reserve districts cannot really come together with an opinion on how strong the U.S. economy really is; evenly split between modest and moderate. The Atlanta and New York Feds might be miles apart with their GDP forecasts, but they both see the U.S. economy as getting worse.

If, after trillions in quantitative easing, this is what the Goldilocks economy looks like, then the average American has nothing to look forward to until the next economic recovery begins.