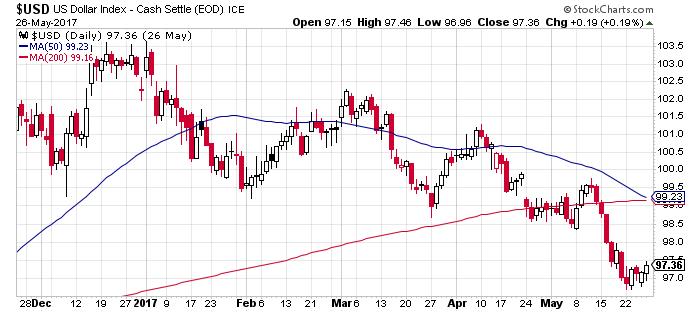

Since the beginning of 2017, the U.S. dollar has been collapsing in value against other world currencies. The chart below depicts the price action of the U.S. dollar index—essentially the value of the U.S. dollar relative to other major world currencies.

Chart courtesy of StockCharts.com

Interest Rates Impacting the U.S. Dollar

Forecasted interest rates have a huge impact on the direction of currencies. And I believe that the reason the U.S. dollar is falling in value is that investors do not believe that the U.S. Federal Reserve will increase interest rates this year as it has been warning it will. The Fed has announced that it expects to raise rates two more times in 2017.

U.S. Treasury Notes?

My theory is based on the falling yields of U.S. Treasury Notes.

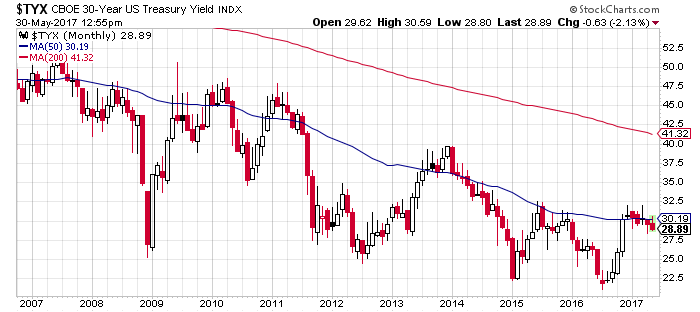

Please look at the chart below of the 30-year U.S. Treasury yield.

Chart courtesy of StockCharts.com

See how, from mid-to-late 2016, the chart started to move up? An increase in the yield of the long-term U.S. Treasury signifies that interest rates will rise.

Something fascinating started happening at the beginning of 2017: the yield on the 30-year U.S. Treasury started to decline, which means that investors now see lower interest rates ahead.

And maybe that’s why the stock market has been rising this year; it too doesn’t expect interest rates to rise this year. I believe this is wrong. I fully expect the Federal Reserve to increase its rates in 2017. I won’t be surprised to see the Fed increase those rates two more times this year, just like it’s been telling us it will.

Unemployment Rates Are Key

On June 2, the United States Department of Labor reported that the U.S. unemployment rate dropped to 4.3% in May—the lowest level in 16 years, and the 21st consecutive month that the unemployment rate has been at or below five percent. (Source: “U.S. job growth slows; unemployment rate drops to 4.3 percent,” Reuters, June 2, 2017.)

With the unemployment rate so low, I believe that the Fed has no alternative but to raise interest rates. Hence, the decline in the value of the U.S. dollar, which in turn pushes up the profits of U.S. multinational companies and the stock market, will be a short-lived event.