A bill has been introduced at U.S. Congress that would allow student debt to be discharged in a bankruptcy. (Source: “H.R.2366 – Discharge Student Loans in Bankruptcy Act of 2017,” Congress.gov, last accessed May 23, 2017.)

As it stands now, a student cannot file for bankruptcy and have his or her student loans wiped out. This makes sense, since the great majority of recent graduates don’t have any assets, so the temptation to file for bankruptcy to erase student debts is huge.

That could all change now, with the proposed bill in Congress.

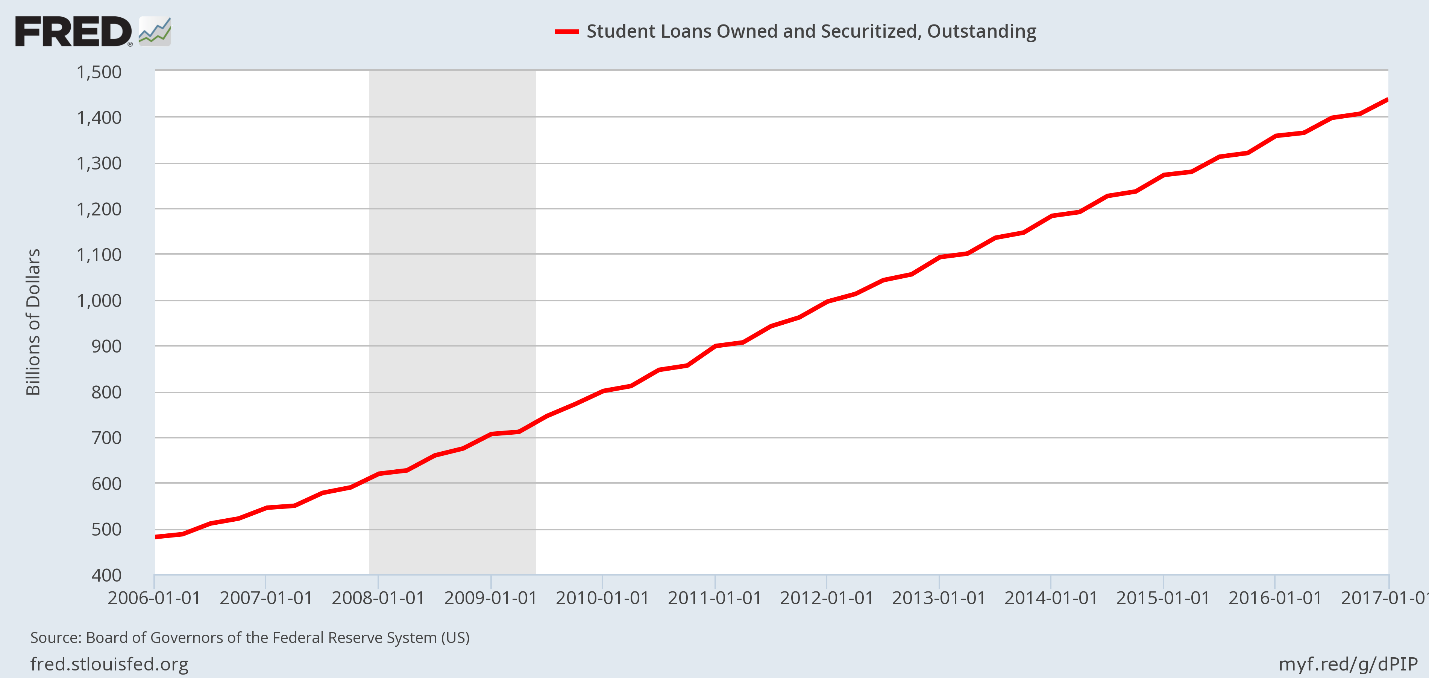

Student Loan Debt Skyrocketing

The chart below shows the astronomical growth in student loans since 2006. Student debt has skyrocketed from $500.0 billion in 2006 to $1.45 trillion today. The growth in student loans was fueled by the government’s involvement in the student loan market. The U.S. government guarantees most student loans.

(Source: “Student Loans Owned and Securitized, Outstanding,” Federal Reserve Bank of St. Louis, last accessed May 23, 2017.)

Considering that, in the first quarter of 2017, close to 11% of all student loans were 90+ days delinquent, the U.S. government could take a big hit if it makes student loans dischargeable under bankruptcy laws. (Source: “Household Debt And Credit Report (Q1 2017),” Federal Reserve Bank of New York, last accessed May 23, 2017).

$1.0 Trillion Added to Rising U.S. National Debt?

The government’s exposure to student loan bankruptcies could be in excess of $1.0 trillion. What student wouldn’t file for bankruptcy if it meant he or she didn’t have to pay for tens of thousands of dollars in student loans? And, since it’s the U.S. government that guarantees most of these loans, isn’t this really the same thing as government forgiving $1.0 trillion in student loans?

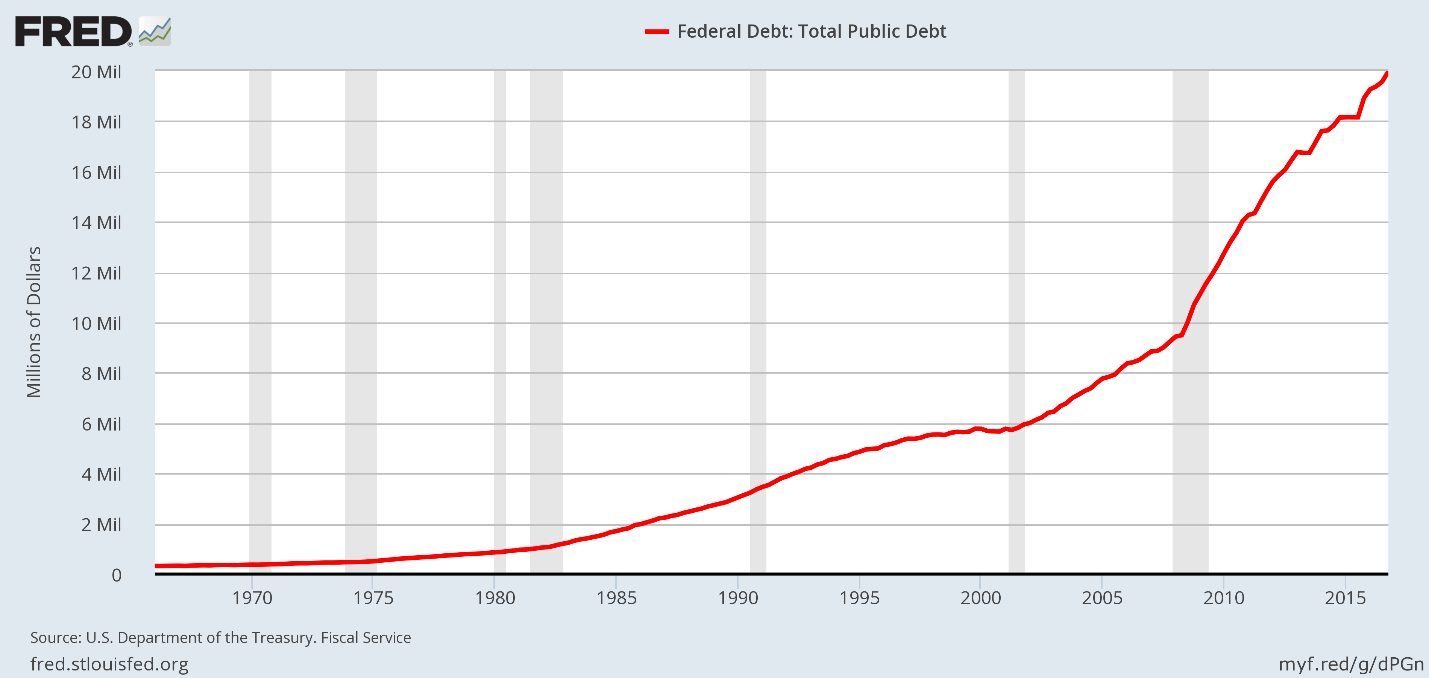

As of May 23, the U.S. national debt stood awfully close to $20.0 trillion. Assuming a U.S. population of 321 million, each man, woman, and child in this country owes $62,000!

The chart below shows the accelerated pace at which the U.S. national debt is rising.

(Source: “Federal Debt: Total Public Debt,” Federal Reserve Bank of St. Louis, last accessed May 23, 2017.)

Our national debt started skyrocketing in 2008 and 2009, and continues to soar. Within a decade, a U.S. debt equal to twice our gross domestic product (GDP) is not out of the question.

Another trillion dollars could quickly be added to our national debt if this crazy idea of making student loans subject to bankruptcy laws goes through.

Two things happen with higher debt: our currency gets weaker and interest rates rise. I’d prepare for both of these scenarios.