Why a Recession Could Become a Reality for the U.S. Economy

Know this: the risk of a recession in the U.S. economy is increasing day by day. Don’t get too distracted by the soaring key stock indices; the economic data is screaming that trouble could be ahead for the U.S. in early 2018.

It must be made very clear that consumption constitutes roughly 70% of U.S. gross domestic product (GDP) calculations. So, if consumption takes a hit, the U.S. economy enters a recession. Look back at any previous U.S. recession and you will notice one of the leading causes of economic slowdown was a reduction of consumption.

As it stands, we are seeing consumption data taking a turn in the wrong direction. It’s signaling that a recession could be ahead.

Consumer Spending Dropping Quickly

The first data set that investors must look out for is consumer spending. The rate of growth in consumer spending is decelerating very quickly.

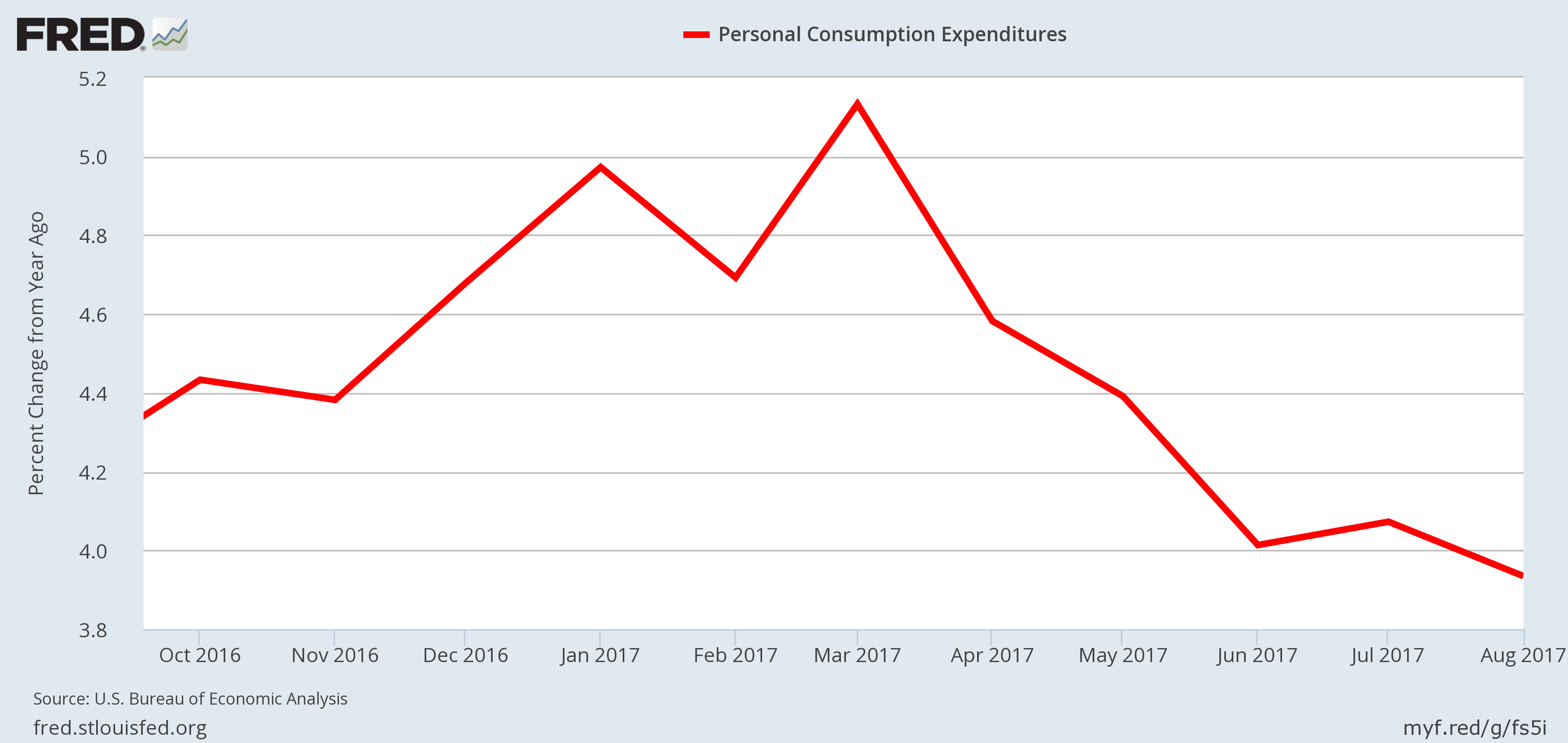

Look at the chart below, which shows the year-over-year changes in monthly personal consumption expenditures.

In March, the personal consumption expenditure grew by over five percent. In a matter of five months, until August, the growth dropped to below four percent. In percentage terms, this represents a deceleration of over 23% in the growth rate (from 5.13% in March to 3.93% in August).

Looking at the above chart, it appears that U.S. consumers are watching their spending and pulling back. This is not good, and it foretells a recession sooner rather than later.

Business Confidence Tumbling

The second thing that investors need to pay attention to is business confidence. If businesses are optimistic, they go out and spend. This gives a boost to overall U.S. GDP. If businesses are turning pessimistic, it’s time to be worried.

With this said, look at The Conference Board’s Measure of CEO Confidence, an index tracking the confidence levels of CEOs. This index has been declining for two consecutive quarters. In the third quarter of 2017, it dropped to 59 from 61 in the second quarter. Mind you, a reading above 50 means that CEOs are generally optimistic, rather than pessimistic. However, a drop in their confidence shouldn’t be taken lightly. (Source: “The Conference Board Measure of CEO Confidence,” The Conference Board, October 5, 2017.)

You must remember that CEOs are the ultimate decision-makers for companies. If their optimism is diminishing, they could be planning on pulling back on business spending. This could have dire consequences on the overall U.S. economy.

U.S. Economic Outlook: Why 2018 Could Be Bad for the U.S. Economy

Dear reader, given the solid performance of the stock market, economic data is disregarded by many people these days. It shouldn’t be.

As I see it, the odds of a recession are stacking higher day by day. Know that it takes time for economic data to turn. I wouldn’t be shocked if in early 2018, the U.S. economy is in a full-on recession.

Here’s what I am worried about: investors currently have very rosy expectations for the U.S. economy. What will they do once they start paying attention to the data? Or worse, if the headline figures say the U.S. economy is in a recession? Will they panic and run for the exit? It’s possible.