Wall Street Oscillates as Trump Remains Indecisive

President-elect Donald Trump’s first news conference since the U.S. election underwhelmed the market, with stocks, the U.S. dollar, and other assets falling while gold climbed. Investors were hoping that Trump would provide detailed insight on his plans to cut taxes, reduce regulations, and boost fiscal stimulus. This mostly didn’t happen, and Wall Street responded in kind.

Since winning the election in November 2016, Trump has mainly used Twitter to communicate with the country. In doing so, he has waited longer than any recent President-elect to hold his first press conference. The long silence set the stage for what many presumed would be an eye-opening news conference on Trump’s economic action plan for the country.

Instead of providing concrete plans on how he was going to further stimulate the U.S. economy, Trump addressed concerns about the suspected Russian interference in the U.S. election, salacious alleged details about his private life, health care, immigration policy, and his business holdings. (Source: “WATCH FULL: President-Elect Donald Trump Holds Press Conference at Trump Tower (1/11/2017),” YouTube video, 1:07:57, posted January 11, 2017.)

The lack of any real substance has left Wall Street in a state of suspended animation, waiting for some incentive to send the markets higher. Again, that didn’t happen on Wednesday.

Those same investors who drove the U.S. dollar to 14-year highs since the November election sent the U.S. dollar lower as details on Trump’s policies failed to materialize.

That uncertainty also sent gold prices higher. Gold prices popped 1.5%, from $1,178.00 per ounce at the opening to an intra-day high of $1,196.00 during Trump’s news conference.

Stocks took a breather, vacillating between small gains and losses during his speech, with a couple of notable exceptions.

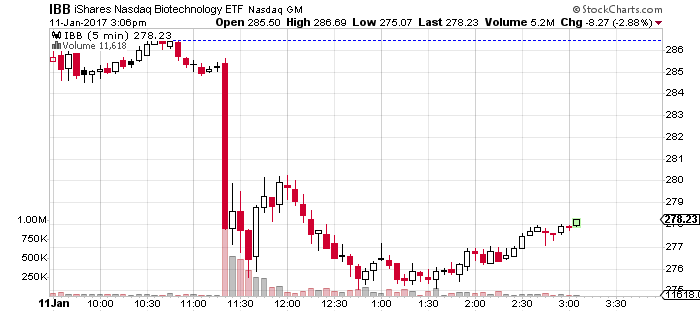

Healthcare and biotech stocks fell sharply after Trump attacked the industry, saying that drugmakers are “getting away with murder” when it comes to pricing. The widely-followed iShares NASDAQ Biotechnology Index (NASDAQ:IBB) fell roughly 3.5% during Trump’s news conference, rebounded, then declined again. That said, IBB is still up more than 12% since the presidential election.

Chart courtesy of StockCharts.com

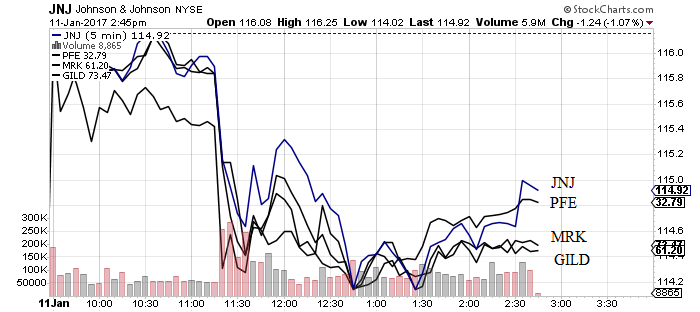

More specifically, the nine biggest pharmaceutical companies on the S&P 500 lost $24.6 billion in market cap in just 20 minutes. This includes Johnson & Johnson (NYSE:JNJ), Pfizer Inc. (NYSE:PFE), Merck & Co., Inc. (NYSE:MRK), and Gilead Sciences, Inc. (NASDAQ:GILD).

Chart courtesy of StockCharts.com

The Lockheed Martin Corporation (NYSE:LMT) share prices faced a similar retreat after President-elect Donald Trump criticized the cost of the company’s “F-35” jet program, saying in the news conference: “It’s way, way behind schedule and many, many billions of dollars over budget. I don’t like that. We’re going to get those costs way down.”

Lockheed Martin shares fell more than one percent after his comments, but then they were in the process of rebounding.

Chart courtesy of StockCharts.com

This is the second time that Trump has taken aim at Lockheed Martin. LMT shares fell by two percent on December 12, 2016 after Trump’s negative Twitter comments about the F-35 costs. (Source: “Twitter post,” Donald J. Trump Twitter account, December 12, 2016, 9:26 a.m.)

As a businessman, Trump’s opinions didn’t hold much—if any—sway on the markets. But as Commander in Chief, his words can have critical impacts. After Wednesday, many investors may be hoping that once he swings open the doors to the Oval Office, he’ll choose his words more carefully.

Or not.

Stock Market Waiting for Decisive Signs

What Thursday’s news conference showed investors is that they need decisive signs on where Trump is going with his economic policies to move the markets higher.

The broader U.S. markets have experienced a major melt-up since the U.S. election, hitting record after record, but the move to the upside might have been too fast, with the rally losing steam.

Until Wall Street gets insight into Trump’s governance and policies, the markets will be unable to build on the current rally, or even create momentum in the event of a correction. With the post-election honeymoon seemingly over, investors will need to use their investing acumen and play both sides of the coin.