U.S. Housing Market Looks Weak

The mainstream media will have you convinced that the U.S. housing market is hot once again, and that it’s only about to go higher. Don’t buy into this optimism, as data suggests that the U.S. housing market is setting up to disappoint once again.

The most important factors in the housing market are interest rates, affordability, and general economic conditions. These three factors essentially drive housing prices higher or lower. Currently, they suggest that a home price decline is likely.

1. Interest Rates

The U.S. Federal Reserve is set to raise interest rates. The Fed has been very adamant about this. The Federal Reserve has said it wants to raise rates two more times in 2017. Higher interest rates always put pressure on the housing market.

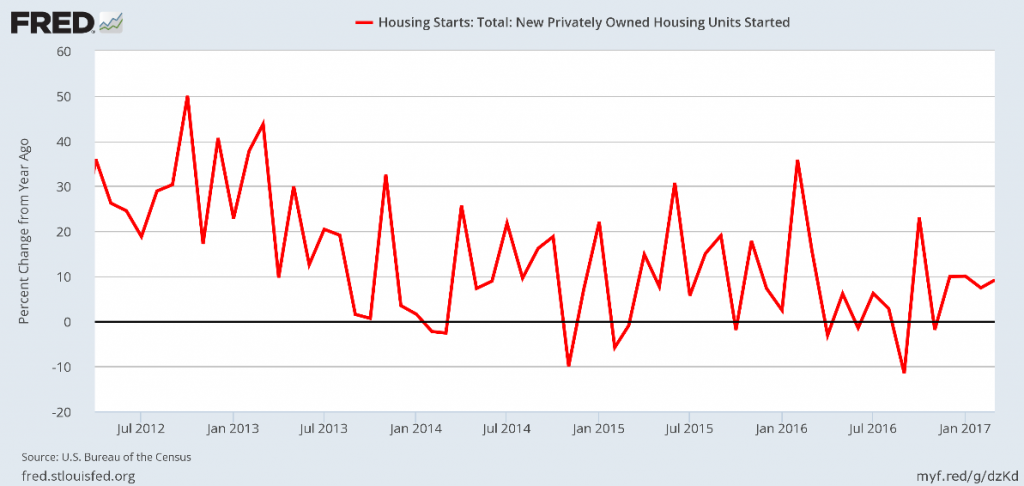

My feeling is that higher rates are already impacting the new housing market. The chart below shows U.S. housing starts since mid-2012. See how the number of new houses being built has been steadily declining. Housing starts decline when the demand for new houses declines; it’s that simple.

(Source: “Housing Starts: Total: New Privately Owned Housing Units Started,” Federal Reserve Bank of St. Louis, last accessed May 2, 2017.)

2. Affordability

With higher interest rates and Americans saving less of their money, home ownership affordability is an issue.

While banks have eased up on lending practices for potential homeowners, those rules continue to be stringent, compared to before the Great Recession. The required down payments for home mortgages are still relatively high, and the proof-of-income standards to justify the mortgage and taxes are still tight. But, how can potential homebuyers, especially first-time buyers, afford the homes of their dreams if they don’t have enough money saved for those down payments?

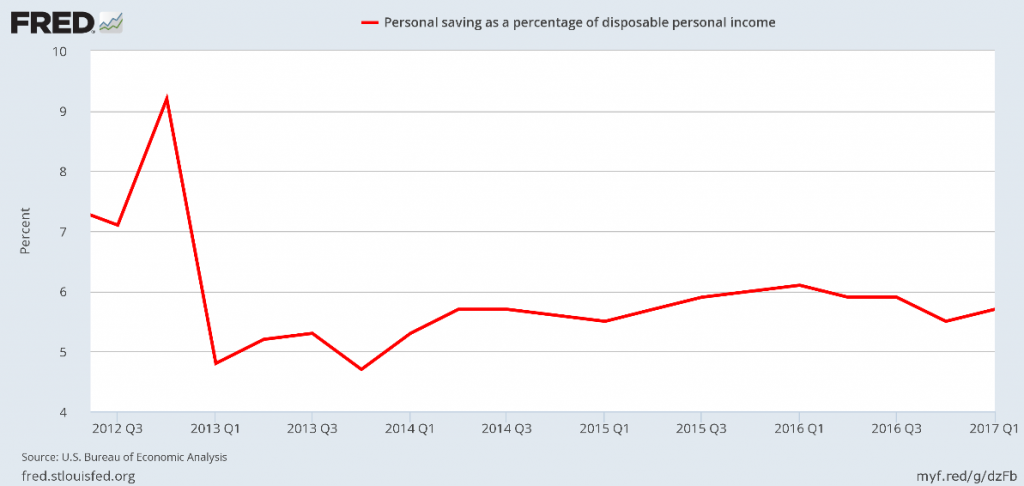

The chart below shows the percentage of disposable income that Americans are saving.

(Source: “Personal saving as a percentage of disposable personal income,” Federal Reserve Bank of St. Louis, last accessed May 2, 2017.)

This is not a good picture. Americans are saving just 5.7% of their disposable incomes. Back in the 1980s, the American personal savings rate was well over 10%.

3. General Economic Conditions

Economic conditions have a huge impact on the housing market. As I have said many times in these pages, American companies would rather stockpile their cash (or buy their own stock back) than invest in their own businesses. Capital expenditures at companies have collapsed. And no investment means poor economic growth.

All we have to do is look at the job numbers that come out month-after-month from the United States Department of Labor. The fastest-growing sector of the job market is the service industry, such as weak-paying restaurant jobs. You can’t grow an economy with a surge in jobs in the service industry. Quarter-after-quarter, U.S. gross domestic product (GDP) fails to rise by the old standard of three percent. In fact, Barack Obama was the first president in U.S. history that presided over eight years without a single three-percent GDP growth quarter!

The U.S. housing market faces headwinds each passing day. Interest rates are not coming down, people aren’t saving enough to accumulate their down payments, and the economy isn’t growing. It’s missing all the things needed for the housing market to move higher. Considering the current economic environment, I wouldn’t be surprised to see national housing prices fall in 2017.