Signals are Pointing to a Stock Market Crash in the Near Future

Today, I present three new reasons to expect that a stock market crash is ahead.

First, earnings expectations are plummeting. In early 2017, Wall Street analysts made their predictions for the quarterly earnings growth of S&P 500 companies. At the beginning of 2017, those analysts predicted that S&P 500 companies would post earnings growth of 8.2% by the third quarter of this year. (Source: “Earnings Insight,” FactSet Research Systems Inc., March 24, 2017.)

Now those same Wall Street analysts expect only 4.5% earnings growth for S&P 500 companies in the third quarter. These analysts have slashed their earnings target by a staggering 45% in a matter of months! (Source: “Earnings Insight,” FactSet Research Systems Inc., September 15, 2017.)

How can stock prices rise on the backdrop of earnings expectations crashing?

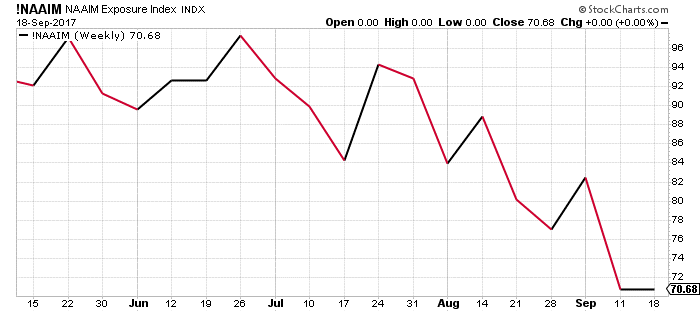

Second, I’d like to point out that sentiment among institutional investment managers is in a free fall.

The chart below is the National Association of Active Investment Managers (NAAIM) Exposure Index. Essentially, it shows the percentage of active managers’ portfolios that have stocks in them.

Chart courtesy of StockCharts.com

From the above chart, we can see that, in May of this year, active money managers’ portfolios primarily consisted of stocks. Now, only 70% of their portfolios are in stocks. When professional money managers are reducing their exposure to stocks, that means they are selling into the stock market (at the market’s recent highs). This is often an indication that they think stock prices are too high for the risk.

Third, there are problems in “stock buyback fairyland.” Over the past few years, corporate share buyback programs were keeping per-share earnings elevated and stock prices high. Not anymore, as companies are cutting back on their stock buybacks.

In the second quarter of 2017, S&P 500 companies purchased $120.1 billion worth of their own shares—a 9.8% decline from the first quarter of 2017 and a 5.8% decline from the second quarter of 2016. (Source: “Q2 2017 S&P 500 Buybacks Fall 9.8% from Q1, to $120.1 Billion,” PR Newswire, September 18, 2017.)

So, we have analysts aggressively cutting their earnings growth targets, institutional investors selling stocks, and public companies cutting back on their stock buyback programs. If this isn’t a recipe for lower stock prices, I don’t know what is.

The odds of a big, fat, stock market crash are increasing each passing day. I see the upside for stock prices as very limited, while the downside risk is substantial.