Is This the Slowest Economic Recovery?

Drivers like falling oil prices. Even the few drivers of electric cars like cheap oil. The cheaper oil gets, the lower the transport costs for many goods. Thus, consumers benefit from low food prices at the supermarket or at any other store. Yet, despite the clearly favorable effects, falling crude oil prices can trigger unpredictable events on the markets and on the economy. A recent geopolitical episode has just forced oil prices down. This could harm the global economic recovery in 2017.

It’s been almost nine years since July 11, 2008, when petroleum hit its highest historic price of $147.25 a barrel. Since then, between the highs and lows, the price has fallen. This drop, welcomed at first, has become dangerous to the global economy. And it’s about to get worse.

Indeed, you would have been right to wonder if this is the slowest economic recovery. The markets may be flying, but for how long? The real economy has not recovered, and the dark clouds that provoked the 2008 financial crisis have returned, looking as menacing as ever. They approach as the global situation has embroiled itself in more risk.

The Global Situation Is More Confusing

Before we examine the returning debt crisis (the one that many promised would never return), it’s vital to understand the nature of the global mess we are facing. We have all heard about the political disagreements over the Paris Agreement. President Donald Trump might be right on that one, but the rest of the world sees opportunities in it. This disagreement about climate change and carbon is bound to have major global consequences. But it’s only a minor one in a context loaded with political, economic, and financial pitfalls.

There’s the escalation of the crisis in the Middle East. This time it hits closer to Wall Street because it affects Qatar, which has a sovereign fund worth an estimated $335.0 billion. The rift between Qatar and the other Sunni-leader countries (particularly Saudi Arabia and Egypt) falls after the recent U.S. President’s visit to the Middle East, which has consolidated Trump’s relationship with the Saudis. But Qatar is also a Washington ally, one which hosts a large U.S. military base within its borders.

It seems that no month has gone by in 2017 without an ISIS-related bombing or attack, like the ones in London, Paris, and Stockholm; not to mention Kabul or Cairo. Then there is the world’s psychosis over North Korean ballistic missile tests. Finally, if the Middle East were not already a source of instability, most of the oil-rich Gulf Arabs have directed their diplomatic fury against Qatar (for now).

The Markets Are Vulnerable

All this by itself should have a negative impact on the financial markets. Even as the Americans and their allies have closed in on the capital of the Islamic State (Raqqa, Syria), the Arab world has found a new problem. Qatar is different than previous Middle East crises. It’s the richest country per capita in the world.

Qatar’s leaders are also some of the biggest investors in the world. When they sneeze, the financial markets catch a cold. There’s little left to advise investors other than to tell them to fasten their seat belts. The world is heading for a rough ride.

Then there are the British elections, taking place in the most insecure political climate in recent memory. The British are heading to the most heavily guarded elections in their history, after two terror attacks have rocked the country in as many weeks. Prime Minister Theresa May, who called the election early in order to accelerate Brexit, the process of leaving the European Union (EU), has found an unexpectedly strong rival candidate in Jeremy Corbyn. The latter could interfere with Brexit, fueling the kind of uncertainty that favors bearish investors.

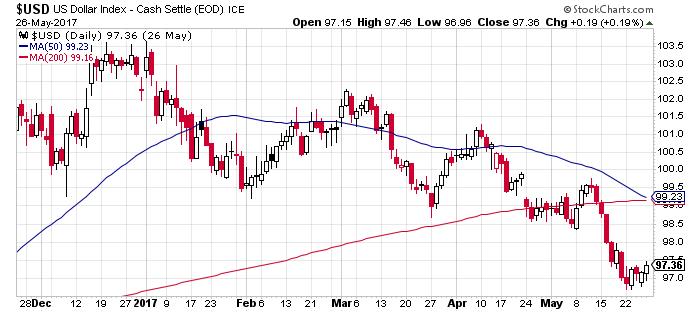

Lest we forget, James Comey, former FBI chief, will testify before Congress. What he says has the power to shake Trump’s presidency to the core. The U.S. dollar has shown what could happen if, as expected, the Trump political crisis continues. Awaiting Comey’s testimony, the dollar has dropped to a seven-month low compared to the Japanese yen and the euro (1.127). That’s good for Trump, in a way, but it also contradicts his policies.

Chart courtesy of StockCharts.com

Trump wanted a weaker dollar such that U.S. exports would become more competitive. Yet, Trump has also continued to champion protectionist measures in talks with G7 counterparts and China. Even Trump, accustomed to getting his way, understands that you can’t have it both ways. This contradiction will confuse the world and delay the economic recovery that was starting to emerge this year.

The Symptoms of Disease Are Getting Stronger

In fact, while the Dow Jones and the NASDAQ continue to perform at their record levels, the typical symptoms of concern have appeared. Wall Street may seem as if everything is alright. But the fact that gold has been rising for weeks now, reaching over $1,280 an ounce, all but proves that uncertainty has returned as the dominant market force now.

There is also an eerie sensation of stagnation in the markets. The Dow has not moved with determination in any one direction. It hasn’t continued to sustain the bullish spurt and it has not fallen by much…yet. Investors need to come to terms with a dense package of risks, which keeps building. No sooner is a solution found to address one risk that another emerges.

Of these, rather suddenly, oil has returned to the fore. It used to be that high oil prices would bring down the markets and the economy. Indeed, a sudden spike in oil prices would kill the economic recovery. But, the economy is equally unequipped to handle a sudden drop in oil prices—particularly in North America.

The United States and Canada have become major oil producers and exporters in their own right. Their economies benefit from higher oil prices, because it creates jobs, stimulates housing investments, and boosts retail sectors in a virtuous circle. If the price of oil is reasonable enough, it allows the rest of the economy to thrive as well. Consumers may spend a little more for gas, but there is a greater sense of shared prosperity.

In contrast, low oil prices have killed real estate values in some areas and rendered millions of dollars in oil and shale extraction infrastructure useless. The same goes for the OPEC oil-producing states of the—mostly—Middle East. When prices are high, the dollars they rake in help pay for massive infrastructure projects while filling state coffers with the money needed to fund the generous income redistribution mechanisms.

Beware the Qatar Crisis and Its Devastating Effects on Economic Recovery

But, the Qataris’ profits do one more thing that many overlook. They feed some of the world’s largest investment funds and hedge funds, which feed the money back into the world’s main financial markets, real estate, and other speculation. Much of this goes to the United States, of course. Thus, when oil profits are low, the OPEC countries’ funds tend to pull that money out of Wall Street and the American economy.

To some extent, this is what contributed greatly to the stock market’s bearish performance in 2015 and early 2016. Chinese market “inexperience” also contributed, but that’s a subject for another day. Therefore, Qatar’s isolation will cause problems for the markets and for the economic recovery in 2017.

President Trump has praised the Saudis’ isolation of Qatar. He seems to have forgotten that there is a U.S. military base there with at least 10,000 troops. Qatar is not a major oil producer. It extracts and sells more gas than crude oil. But, Qatar is a member of OPEC. Investors fear that the “breakup” with other Gulf countries, especially Saudi Arabia, could undermine the oil cartel’s efforts to support prices by cutting production until March 2018.

Fears of falling oil prices should also help raise the price of gold as a safe haven. Geopolitical tensions around Qatar could send oil back to the $40.00/barrel level, which proved to be the threshold of tolerance for OPEC. Still, given the tension, the Qatar situation could escalate to something altogether different and much bigger in risk.

Qatar has been totally and suddenly isolated by its neighbors. It could even face a food crisis, given that it imports much food through its borders with Saudi Arabia. Qatar also has a capable armed force, which would enable it to retaliate. Additionally, Qatar has seen coups before. The Qatari emir triggered the crisis with the Saudis and their Gulf allies, by offering sympathetic words (tweets) for Iran—now, Saudi Arabia’s archenemy.

The cousins of the Emir of Qatar, Tamim bin Hamad al-Thani, have already gone behind their relative’s back to offer apologies to Saudi King Salman. That’s almost an invitation for the Saudis to “sponsor” or provoke a coup in Doha. The risk level is masked only by the fact that a major military action has gotten underway in Syria, as NATO-backed forces are targeting the ISIS capital.

That risk could spark a military escalation and conflict in the heart of the world’s oil-producing and exporting region. In other words, it could trigger an unexpected oil price hike and a real disruption in oil shipping, which would cause major damage to China and Japan in particular. It could spark a mini oil crisis and a Wall Street collapse.

As noted earlier, while a lower crude oil price has obvious positive consequences, the processes that this can trigger are unpredictable and potentially damaging. But a sudden upward spike in oil prices is even more damaging. It is a potential black swan that could block the economic recovery this year and into 2018 as well.