Trump’s Obstruction of Justice Allegations Represent a Major Economic Threat

Could Donald Trump really be impeached? The President of the United States will have to endure a few political hurdles before it happens. Legally speaking, nothing could stop that from happening. One of the problems of an impeachment, or even rumors of its possibility, is not the actual procedure itself, it’s the uncertainty. This hurts the U.S. economy.

Markets don’t like uncertainty. That’s why a Trump impeachment represents a major economic threat. But, this is rowdy news that casts a shadow on President Trump’s political fate. It is also likely to fuel uncertainty in the markets, terminating the upswing that has been attributed to the “Trump Effect” for the past eight months or so. All of a sudden, the impeachment prospect would bring Trump’s economic policies of protectionism, tax cuts, and happy-go-lucky infrastructure spending to a close.

The chances of an impeachment are unclear. But what is clear and certain is that they are higher now than they were last April, when the so-called “Russiagate” investigation began. Special prosecutor Robert Mueller has formally launched an investigation against Donald Trump for obstruction of justice. That’s the same charge that triggered the impeachments of Presidents Andrew Johnson and Bill Clinton.

The fact that Mueller chose to deliver news on the day of President Trump’s 71st birthday may not have been accidental. The fact that Mueller dropped the bombshell on June 14, at 6:00 p.m., two hours after Wall Street closed for the day, was no doubt an attempt to avoid causing undue shock in the markets. The tension between former FBI director James Comey and Trump can be cut with the proverbial knife.

The Washington Post, the daily newspaper that Amazon.com, Inc. (NASDAQ:AMZN) CEO Jeff Bezos owns, made the announcement. (Source: “Special counsel is investigating Trump for possible obstruction of justice, officials say,” The Washington Post, June 14, 2017.)

Trump avoided commenting, perhaps with an eye on Wall Street, but the sense is clear. This step confirms the White House’s worst fears. The offense of obstruction of justice could construe a crime. Suffice it to note that the same indictment eventually led to President Richard Nixon resigning to avoid certain impeachment.

Trump later reacted by tweeting that the investigation was nothing short of the biggest “witch hunt” in U.S. history. But whether Trump is truly innocent or not, Mueller’s investigation could poke a big hole in the Trump rally. A stock market crash is all but inevitable if the investigation results in Trump resigning or facing impeachment.

You are witnessing the single greatest WITCH HUNT in American political history – led by some very bad and conflicted people! #MAGA

— Donald J. Trump (@realDonaldTrump) June 15, 2017

Trump’s Potential Impeachment Comes at Weak Moment for the U.S. Economy

The fundamentals of the U.S. economy have only changed for the worse. Therefore, a market crash in the current context would be devastating. The Federal Reserve chair, Janet Yellen, thought it wise to raise the nominal interest rate. The fact that it was only by a quarter percentage point suggests that even the Fed is not all that confident about economic growth.

Trump expected gross domestic product (GDP) to reach three percent by the end of his first year in office. But all of that becomes meaningless now. Impeachment means that all of the fiscal stimuli that have pushed the markets higher while prompting companies to—reportedly—hire more people lose any meaning. Trump’s charisma was essential in getting corporate taxes moving from 35% to 15%.

The impeachment process will probably be delayed, because it helps the Democrats. Protracting impeachment means effectively blocking out a Republican presidency from consequential decisions. By the time the next congressional elections come around in 2018, the sour political experience with Trump might push many to vote Democrat. At that point, Trump’s likely successor, Mike Pence, in case of Trump’s impeachment or related resignation, would be a sitting duck.

Politicians Don’t Care About Your Financial Security

Politicians are a special breed (regardless of which government they represent). They naturally care more about perpetuating their terms in office than doing the things that could actually improve their voters’ lives. That’s become one of the problems of democracy. Politicians tend to forget who sent them to Washington and why.

The first question that many Americans ask, whether they own a house, a stock, or a mutual fund is this: “What are the chances that Trump gets impeached and what would be the impact on the markets?” Impeachment rumors are likely to be a turning point for the markets, but also for the fate of the U.S. economy—perhaps even the world economy.

The Derivative Time Bomb

Somewhat ignored by all the political infighting is the fact that the U.S. banking system is sitting on a gigantic mountain of derivatives. Estimates suggest these could be valued at some $222.0 trillion. (Source: “Financial Weapons Of Mass Destruction: Top 25 US Banks Have 222 Trillion Dollars Derivatives Exposure,” Zero Hedge, May 17, 2017.)

Derivatives are best described as bets on bets. They are complicated financial instruments that didn’t even exist before the October 1929 market crash. Derivatives are relatively new, and a figment of mathematical alchemy that has turned the financial markets ever more into a casino.

Derivatives certainly played a major role in the 2008 financial crash and the great recession that followed. Many banks were, as was said at the time, “too big to fail” when the chickens stumbled their way home to roost in September 2008. Lehman Brothers Holdings, Inc. was the sacrificial lamb that succumbed, overloaded with derivatives based on toxic mortgage debt.

American banks appear not to have learned anything from the subprime mortgage crisis. Derivatives played a major role in deflagrating that financial bomb. Thus, less than 10 years after that epochal disaster—comparable to the Great Depression of the 1930s itself, if not worse—they never stopped playing with fire. Especially the top five banks, including Morgan Stanley (NYSE:MS), Citigroup Inc (NYSE:C) and JPMorgan Chase & Co. (NYSE:JPM) and Wells Fargo & Co (NYSE:WFC).

As the situation stands now, the Trump indictment is the equivalent of walking into a hornet’s nest. The markets were already facing high risk before Comey and Mueller did their thing. Now, the prospect of Donald Trump’s impeachment raises market risk to potentially devastating. The result would be nothing short of economic collapse.

Should Trump be evicted from the White House, the effect on the markets could be catastrophic. The market crash might even be in the order of a 40% fall on Wall Street. This could make the crash of 2008 look like a success story by comparison. It would be nothing short of a tsunami that will flood the whole world into a systemic crisis. (Source: Ibid.)

Even if the 40% figure is exaggerated, a 20% or even a 10% crash would still be ruinous. Derivatives are always great until they are not. They work well in a bull market and as long as the economy grows. No wonder the big banks have become so exposed to their charms. But if the risk wind changes direction, the troubles begin fast and before anyone can manage them.

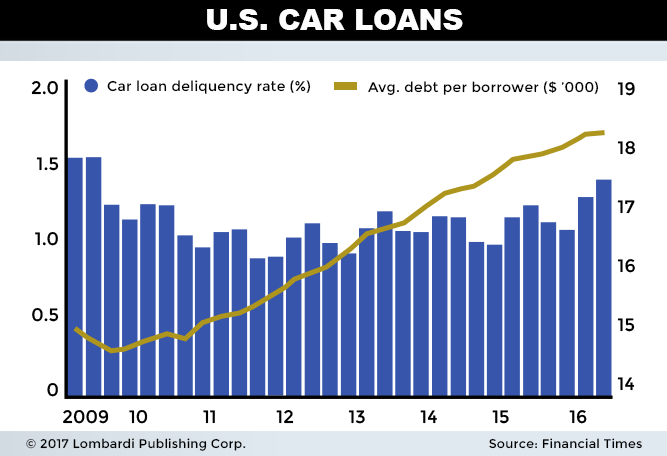

Apart from the derivative risk in fact, Americans still have massive personal debt. Mortgages are going higher thanks to interest rate hikes and an emerging real estate bubble. Then, there is the new phenomenon of the alternative auto-loan market. Independent lenders have arranged thousands of high-interest rate loans that could blow up in the event of a market crash.

The U.S. Economy Masks Harsh Realities

The economy is already masking some harsh realities, such as the retail sector heading into an irreversible coma, given the closures of shops that have been around for decades. And all that even as salaries haven’t moved a cent since the 2008 crisis. The fact that the big tech stocks such as Apple Inc. (NASDAQ:AAPL), Amazon, Microsoft Corporation (NASDAQ:MSFT), and Alphabet Inc (NASDAQ:GOOGL) (also known as Google)—add Tesla Inc (NASDAQ:TSLA) to that list as well—have risen so much and so quickly over the past months, as if they represented some new form of gold or government bond, means that any crash would begin with a massive sell-off of those securities.

Thus, these big tech stocks would lead the decline in all other stocks, amplifying the thunderous noise of their crash. Later, the final blow would come from the explosion of derivatives. Does Comey care about this? Indeed, does Congress? They probably don’t lose much sleep over this. They have nice cozy government salaries.

And, if it hasn’t become clear yet, the past presidential election campaign showed that most politicians—especially those who wantonly seek power—choose to enter politics not from a sense of responsibility. They do so out of a narcissistic drive for self-fulfillment and ambition. So don’t expect the various political and judicial parties now going after Trump to reflect on the effects of their actions on you. They care more about grandstanding.

The political future of the United States, the most powerful country in the world, is staring at an unprecedented situation of potential chaos. Being investigated does not mean necessarily that President Trump is charged. Moreover, even if formal charges were made, there are still many legal steps to overcome the extreme consequences of the impeachment. But uncertainty is the mood killer for the markets. That’s what could cause a financial crash in 2017 and an economic crisis to boot.