Blame Lowered Expectations for the U.S. Economy for the U.S. Dollar Collapse

The dollar has suddenly, but predictably, changed course. It would be reasonable to expect a U.S. dollar crash, as the downward trend has few obstacles in its way. The Federal Reserve’s policy to renew its coffers should have pushed the dollar higher. While Fed Chair Janet Yellen did not mention it by name, Donald Trump’s policies have helped boost confidence in the markets, but not the overall U.S. economy.

One explanation for the recent U.S. dollar collapse is that the Fed has decided to review its interest rate hike program. Since late 2015, the Fed has increased rates four times (three consecutive ones). The last such hike occurred in June, when it went from one percent to 1.25%. The Fed justified the rate increase by citing unprecedented job numbers and an optimistic economic growth outlook.

Also Read:

Ominous Signs of the Coming U.S. Dollar Collapse Abound

Now, a month later, Yellen’s testimony that suggests a wait-and-see attitude for the next hike has done two things. It has fueled more speculation on Wall Street. This has sustained the bull market, at least for now. But, by stalling the rate hike plans, the Fed has betrayed its fear. All that glitters on Wall Street is not gold. In fact, it might be time to get some gold, because the U.S. economy might not be so strong after all.

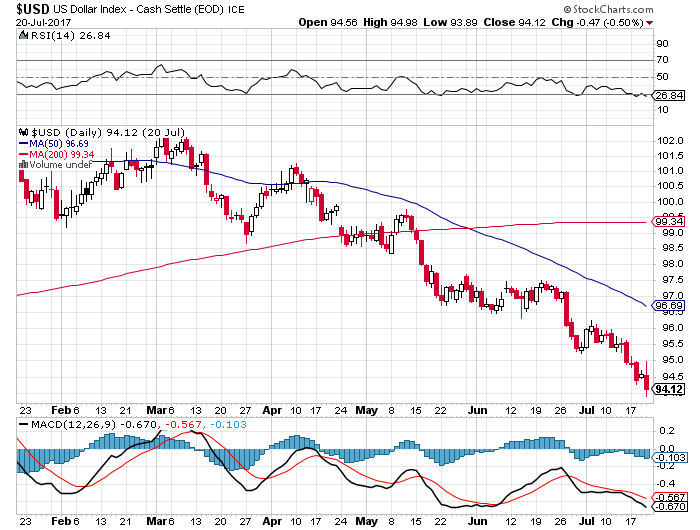

Few could have predicted the trigger for this reversal. Like all such triggers, it always seems unrelated at first. In 2007–2008, some delinquent mortgage holders ended up exposing a toxic “derivative” scheme that brought the whole financial house of cards down. Thus, beware that the U.S. dollar index, which tracks its performance against its major currency counterparts, has dropped to around 94.1, which is the lowest level since June 2016.

Chart courtesy of StockCharts.com

Is the U.S. Dollar Crashing?

The Fed’s retraction on interest rates hasn’t just damaged the U.S. dollar index. It has shifted confidence in the euro, which has hit a new two-year maximum over the dollar, following Mario Draghi’s verdict. The Governor of the European Central Bank has hinted that he would lead a shift away from the zero-interest-rate policy. The shift is possible because of solid signs that the European economy has improved.

In contrast, the greenback has gone on the defensive. In fact, the Fed’s sudden caution raises the question: “Is the U.S. dollar crashing?” Yellen probably thinks so. After all, she’s the one who cooled off expectations of higher interest rates. She probably expected that the dollar would collapse. It’s odd how perspective changes everything.

A month ago, the establishment spoke of how brilliantly the U.S. economy has been performing. You would think that jobs and GDP growth had reached the stage of “endless.” Yet, a reality check has promptly arrived. The latest macro indications about the U.S. economy have not been especially brilliant.

Inflation has not gone up. But, more importantly, the stalling on getting rid of Obamacare has highlighted the many difficulties that the Trump administration has faced in pushing the president’s electoral agenda. The White House also lost another piece in the form of Sean Spicer. Meanwhile, its on-again, off-again shifts over Syria and Russia leave allies in the dark as to how Trump wants to manage the Vladimir Putin account.

At the time of this writing, Trump appears intent on leaving Syria to Bashar al-Assad and the Russians to solve. But, next week, or next month, something might draw him in again, just as what happened in April.

During his first six months at the White House, President Trump has launched numerous slogans, but few of these have come to fruition. The dollar has weakened as, this time, the delay of the repeal of Obamacare was the result of interference from Republicans. They gave Trump a slap. It could be a sign of more slaps to come on the economic front.

There Are Too Many Forces Acting Against Trump…and the Dollar

Repealing Obamacare should have been a proverbial slam dunk. Instead, a split in the Republican Party may have emerged. The fact that Trump is still fumbling with this issue has cast a long shadow on his ability to push through the economic reforms that were supposed to have generated growth. He promised them during the electoral campaign. He came up with a tax cut plan, but there are no indications that this will pass.

Following the second attempt—and failure—at healthcare reform, special prosecutor Robert Mueller, who is investigating so-called “Russiagate,” has switched his attention to Trump’s financial transactions involving Russia, which occurred when Trump hadn’t even made clear he would run for office.

According to Bloomberg, Mueller is investigating purchases by Trump from Russians, the Miss Universe Moscow contest in 2013, a Soho real estate development with Moscow partners, and the sale in 2008 of a billionaire villa in Florida to Russian oligarchs.

The transactions might have nothing to do with Mueller’s mandate, as Trump’s lawyers have insisted, but reality is lost on the mainstream media outlets such as CNN, The New York Times, and The Washington Post.

They will pull every straw to discredit the president instead of focusing on the country’s real problems. That will keep Trump busy trying to discredit Mueller instead of focusing on his agenda. It’s vicious circle that has the American people and the economy as the victims. The dollar’s course is but a reflection of this.

For those who wonder if the dollar can reverse its bearish course, it may happen at the end of 2017. That’s when the Fed might start talking about rate hikes again, provided that the economy and Wall Street are “feeling it.” In the meantime, the euro will probably continue to take strides against the dollar.

Trump wanted a lower dollar. He’s got one now, but the circumstances of the dollar’s decline don’t bode well for the U.S. economy.