This Is Why Stock Market Crash Could Be Ahead

Remember this: the higher the key stock indices go on the back of poor fundamentals, the bigger the stock market crash is going to be. Investors are getting too complacent these days. Be very careful.

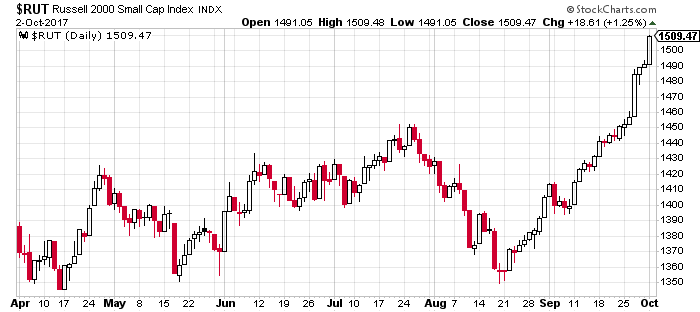

Have you seen indices like the Russell 2000 Small Cap Index?

In the last 30 trading days, the index-tracking performance of small-capitalization companies has soared over 11%. Just look at the chart below. There has been an almost vertical move to the upside on the index.

Chart courtesy of StockCharts.com

If you listen to the stock pickers, they will have you convinced everything is fine and more upside could be ahead.

Surely, in the short term, we could see a spike. I believe this could happen because we could see an exodus from the bonds market, and investors could be seeking shelter with stocks. What we are seeing on the Russell Index could be a slight trailer for that.

But, I ask, what happens to the stock market returns over the next five years? Could stocks provide the same returns in the next five years as they did in the last five years? It’s very difficult to see that happening. In the last five years, the S&P 500 has increased 74.46%, the Russell 2000 Small Cap Index has soared 79.89%, and the Dow Jones Industrial Average has increased 67.52%.

Keep in mind, you need fundamentals to keep improving for stock markets to soar.

After the previous stock market crash, fundamentals actually improved. We saw economic growth in the U.S. economy. This resulted in higher revenues and profit. Ultimately, this phenomenon led to a massive rise in the stock market. Also, companies were buying back their stocks.

Going forward, not a lot is working in favor of stocks. In fact, one could even say that the stars are lining up for a stock market crash.

Deteriorating Fundamentals Calling for a Stock Market Crash Ahead

Know that the U.S. economy is performing very poorly. American consumers are struggling. Economic growth is questionable and recession could be likely.

One example of American consumers struggling could be in Darden Restaurants, Inc.‘s (NYSE:DRI) most recent quarter financial results. It’s a company that owns several restaurant brands.

Its Olive Garden franchise increased the price of its “Soup or Salad and Breadstick”—one of the most attractive traffic drives for the restaurant—by just $1.00. This caused a drop in traffic at Olive Gardens. Just $1.00! It says American consumers are becoming very price sensitive. (Source: “How a $1 price hike scared Olive Garden customers away,” MarketWatch, September 28, 2017.)

Look at other consumption data as well. It says things are not looking good for the U.S. we see auto sales declining, auto inventories increasing, more foreclosures, and more bankruptcies. This is not good.

As for companies, know that the biggest reason they were buying their stocks was to engineer financial performance. They borrowed money and bought back their stocks.

Now, the cost to borrow is increasing. So their buying will probably cool off a bit. We already see it happening.

In the second quarter of 2017, S&P 500 companies repurchased $120.1-billion worth of their own shares. If you compare this figure to the first quarter of 2016 figures, buybacks were 25.6% lower. Compared to the first quarter of 2017, they dropped by 9.8% and declined 5.8% compared to the second quarter of 2016. (Source: “Q2 2017 S&P 500 Buybacks Fall 9.8% from Q1, to $120.1 Billion,” PR Newswire, September 18, 2017.)

What the Next Stock Market Crash Could Look Like

Dear reader, for the next little while, it may be fine to be active and taking on risk. But keep the big picture in mind.

I will be bold here and say this: the next stock market crash, whenever it is, could be big. We could see severe selling in the midst of it. I will not be shocked if key stock indices crash 20%-30% in a short period during the sell-off.

I repeat; be very cautious going forward. Market sentiment could change very quickly and as fast as stocks are rising, they could be coming down at the same speed.