Stock Market Rally Stalling A Natural Conclusion To Obscene Stock Prices

What do you get when you combine off-the-chart valuations with a declining economy? Nothing good. In a nutshell, that’s how I would describe the investing environment going forward. The market should struggle given the fact the business cycle is now in decline. There may be a quarter or two growth surprises left, but the trend is undoubtedly down. It’s commonly accepted fact that this current business cycle has peaked. The stock market rally stalling is a natural conclusion to an expensive market past peak economic growth.

By now, so many pundits expect a correction – or worse – it’s hard to keep track. On the contrarian side, we have Marc Faber, John Hussman, Howard Marks, Peter Schiff, Matt Maley, Robert Shiller et al. Investors with solid records of success; even if their bearish calls are sometimes early. Even on the institutional side, where the large investment banks have incentive to sell stocks to clients, they are market apprehensive. Leading the charge are Bank of America Corp (NYSE:BAC) and JPMorgan Chase & Co. (NYSE:JPM), where various analysts dispense the newest gloomy indicator du jour.

Also Read: Warren Buffett Indicator Predicts Stock Market Crash in 2017

So, why do the “alt-investment right” (the contrarians) and mainstream Wall Street agree that there’s a stock market crash coming? What is the common denominator bringing these two sides together? After all, it’s quite rare these two groups see eye to eye, let alone a possible stock market rally stalling. When contrarians investment managers agree with the institutional bankers, we sense something is up.

In a nutshell, there’s common agreement that high valuations, combined with a peak in economic activity, spell trouble. There’s a reason why the price-to-earnings (P/E) ratio is such a quoted market metric: it works. All those talking heads on television telling you “it’s different this time” have no clue. Times change, as do catalysts. But the market has always held true to traditional valuation standards throughout history.

That’s why the market cheerleaders cannot hide their concerns any longer. The stock market is grossly expensive, and it’s impossible not to acknowledge this fact.

Will The Stock Market Rally Stall By The Year End?

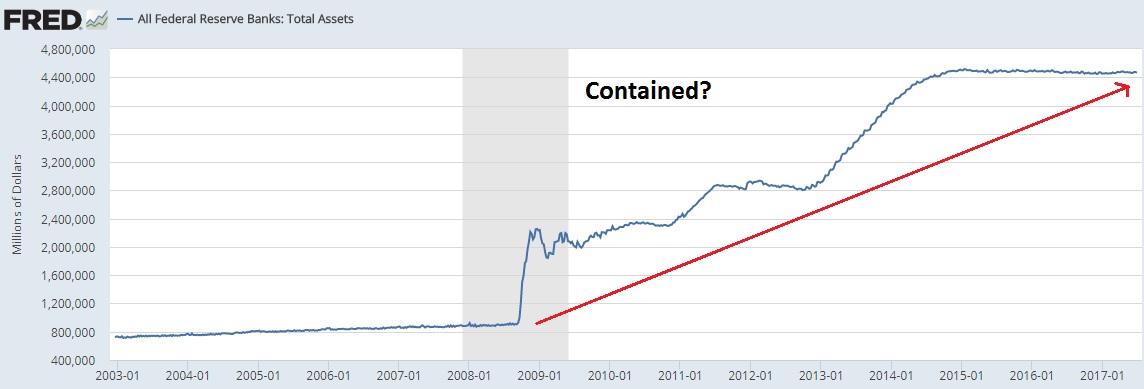

The U.S. stock market rally has obviously come a long way. But every good thing must come to an end. There are structural deficiencies which must be addressed. The market must be priced attractively enough to attract meaningful investment. Federal Reserve liquidity can work longer than anyone thinks, but it’s not a permanent solution. Next month, we’ll see how well the market does without Fed intervention.

Also Read: Stock Market Crash 2017? This Could Trigger a Stock Market Collapse

September is the month when the Fed’s so-called “quantitative tightening” (QT) comes into effect. The Fed will commence letting Treasury securities mature and avoid bond purchases altogether. The goal is to decrease the Fed’s bulging balance sheet. Fed Chairperson Janet Yellen tries to downplay the significance of this event, but nobody is buying it; everyone knows how much excess liquidity has played into this multi-year market rally. And now we’re to believe the market will won’t react negatively when liquidity goes into reverse? The Fed must think we’re real suckers.

The one thing they can’t cover up, however, is the negative goings-on in the real economy. Take retail earnings, for example; this sector is the lifeblood of the American economy. A full 70% of all economic activity derives from the American consumer. Given this, the numbers emanating from Main Street are ghastly.

Of the 114 public companies that retail consultant Ken Perkins from RetailMetrics.com follows, 26 (22%) are expected to lose money; that’s the most since the 2008-2009 recession. A full 61% are expected to post lower year-over-year (YoY) earnings, while 46% should experience YoY revenue declines. Does this sound like a robust economy to you? (Source: “Retailers gird for the worst earnings season since 2008-2009,” CNBC, May 10, 2017.)

Now, it’s true there are mitigating circumstances to this unfortunate trend. Younger consumers are spending money on things like vacations are haircuts–less “material” things and more “experiences.” The rise of private label shopping. And of course, the Amazon.com, Inc. (NASDAQ:AMZN) effect, which needs no explanation. But still, these numbers are quite problematic, coming at the cycle peak. How many retailers will go under once the recession strikes?

Perhaps the most troubling storyline surrounding the retail earnings sector is the rich valuations. The S&P 500 retail sector trades at 24 times expected forward earnings, a ridiculous amount considering the facts above. It’s an apt microcosm of the extreme valuations pervasive in many stock market sectors today–one that must be, and will get, corrected.

My stock market crash predictions envision a sizable correction coming. It’s been 14 months since we had a “small correction” of five percent or more. Look for the streak to break with gusto. But I’m sticking with my long-held theory that it’s all about earnings. If the market gets any sort of whiff that earnings growth is going negative, the floodgates will open. As discussed, the Fed is now starting QT, which means liquidity is being draw out of the market. In other words, the Fed will not save investors this time around. The market will sink or swim on its own.

At these valuations and crash earnings a recession would bring, we’ll put our money on “swim.”