This Chart Could Be One Reason for a Stock Market Crash

There are several things that are broken in the stock market, and it’s nothing but bad news for investors. Mark my words, a stock market crash could be looming. Don’t be shocked if 2018 ends on a negative note and a sell-off follows in early 2019.

Why such a bearish outlook on the stock market?

Just look at the chart below. It plots the number of S&P 500 companies trading above their 200-day moving average.

Keep in mind that the 200-day moving average is essentially a trend indicator. If a stock’s price is trading above this average, it suggests that the long-term trend for the stock is pointing upward. On the other hand, if the stock’s price is trending below its 200-day moving average, it means the price is trending downward.

Chart courtesy of StockCharts.com

At the time of this writing, just 228 stocks on the S&P 500 were trading upward. In other words, 272 stocks on the S&P 500 were trending downward. That’s over 54% of the entire index!

If you talk to any technical analyst, they will tell you that the trend is your friend until it’s broken.

With this, one has to ask: “If more than 54% of the S&P 500 is trending downward, which way should you trade?” Technical analysts will most likely tell you that you are better off betting against the stock market than expecting it to go higher.

This could be just one of many reasons why we could get a stock market crash.

Active Managers Dislike U.S. Stocks

Beyond that, it’s important to watch how those with a lot of money are behaving. By this, I mean institutional investors. They tend to have massive buying power and the ability to move the markets.

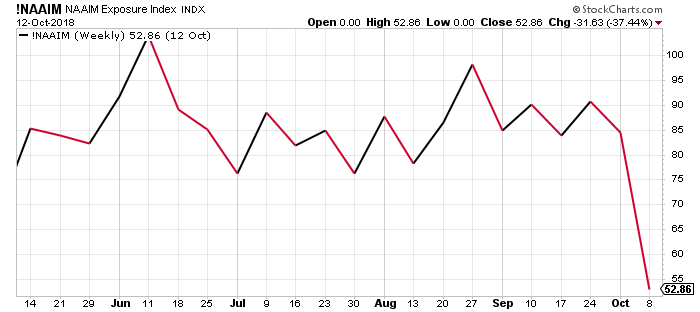

Look at the chart below. It plots the National Association of Active Investment Managers’ (NAAIM) Exposure Index.

At its core, it plots the average exposure to U.S. stock at active funds. For example, a NAAIM Exposure Index with a reading of 80 means that active funds’ portfolios consisted of 80% U.S. stocks.

Chart courtesy of StockCharts.com

In late August, the NAAIM Exposure Index stood at around 100. Now it stands at less than 52.9.

Just a simple extrapolation here: in a matter of a few months, active managers have reduced their exposure to U.S. stocks by half. Does this say they are scared that a stock market crash is likely?

Stock Market Outlook: Investors Could Panic

Dear reader, over the past few years, investors have enjoyed hefty gains in their stock portfolios. But going forward, this may not be the case.

The likelihood of a stock market crash has been increasing very quickly. As I have said several times before in these pages, it would be outright foolish to expect returns in the next eight years to be similar to the returns in the past eight years. I keep this stance.

Earlier, I said we could end 2018 on a negative note. By this, I mean I will not be surprised if returns on major indices are negative for the year.

If this ends up actually being the case, then don’t be shocked if you see investors panic in 2019.

Don’t forget, new investors (those who started in 2016) haven’t really seen negative returns. They have only seen the markets go up and make a lot of money. The remainder of this year could be a wake-up call for them and they could be looking to sell in early 2019.

I can’t stress this enough: Be very careful going into 2019.