Odds of Stock Market Crash Continue to Stack Higher

On a regular basis, we are told that this is “the most hated bull market in history” and that “there’s still a lot of money on the sidelines.” If you talk about a possible stock market crash as key stock indices are soaring, you are ridiculed.

It’s always important to pay attention to the data, rather than just the noise. The data is telling a stock market crash could be a more likely scenario than a massive rally.

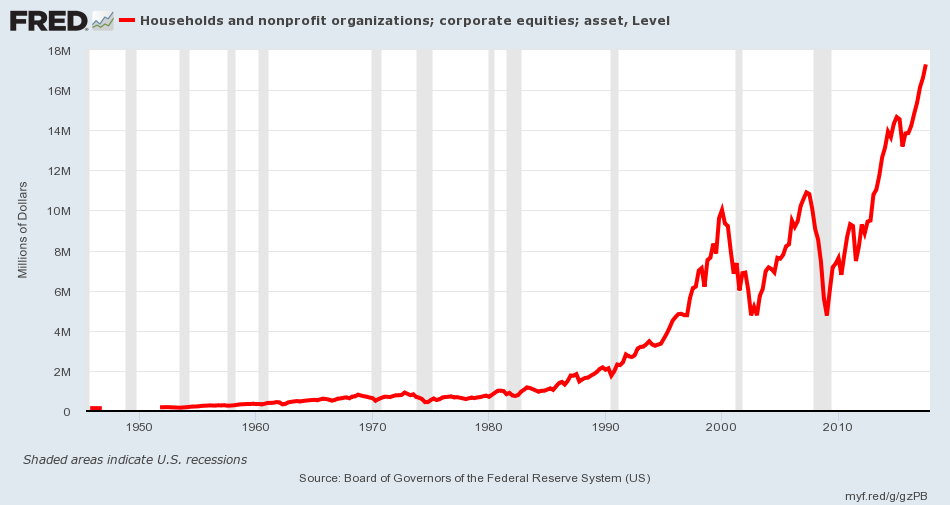

Look at the chart below. It throws the argument of “most hated bull market in history” right out the window. The chart shows the amount in equities held by households and nonprofit organizations in the U.S.

(Source: “Households and nonprofit organizations; corporate equities; asset, Level,” Federal Reserve Bank of St. Louis, last accessed December 11, 2017.)

At the end of the third quarter of 2017, U.S. households and non-profit organizations held $17.28 trillion in stocks. It was the highest ever on record; roughly $7.0 trillion more than the last stock market peak in 2007!

In the first quarter of 2009, their stock holdings were just $4.7 trillion.

If this is the most hated bull market in history, how come stock ownership has seen a significant boost over the years? If you were to do simple math, American stock ownership increased over $12.5 trillion.

Now What?

Stock ownership soaring says that more Americans are involved in the markets than ever before.

Don’t take it lightly. This is a sign of complacency and euphoria.

If there’s even a minor sell-off, it must be questioned if we could see panic kick in. It has to be questioned: As fast as Americans rushed to buy stocks, will they sell even quicker? If this is the case, we could suddenly have a rigorous stock market crash at hand.

Keep in mind, as this is happening, we continue to see valuations go out of hand. They are severely stretched.

The CAPE ratio of the U.S. stock market stands at 31.30. This is the price-to-earnings ratio adjusted for inflation and cyclicality. This figure is roughly 87% above its historical average, and at its highest since the Tech Bubble. (Source: “Online Data Robert Shiller,” Yale University, last accessed December 11, 2017.)

Other valuation measures also say stock markets are overpriced relative to their historical averages.

Where Do We Go from Here?

Dear reader, irrationality can go on for a very long time. So key stock indices could continue to go higher.

But it has to be questioned for how long and how high could they go.

Could the S&P 500 double from where it currently stands without a hiccup? Could the Dow Jones Industrial Average hit 50,000?

I have said it many times in these pages and I will repeat again; it’s very likely that the returns in the next eight years will not be the same as the returns in the last eight years. We could be headed for a steep stock market crash sooner than later.

The current stock market rally we see is not the most hated. It is loved dearly. Don’t buy into the false optimism; it could hurt your portfolio. Remember, when everyone is optimistic, it’s time to pause and reflect.