It Would Be Unprecedented in Recent History if 2017 Ends Without a Stock Market Correction

Will there be a stock market correction 2017? There are only four months in the year to find out. If the market is somehow able to sidestep one, it would be most unusual indeed.

After all, the S&P 500 index has experienced at least one 7%-to-10% decline in each year since 1995. For the mathematically disinclined, that’s 21 straight years! With almost everyone, from contrarians to seasoned Wall Street veterans characterizing the market as “overvalued,” a non-correction in 2017 seems like a long shot. (Source: “Commentary: Stocks are about to tumble by 7 to 10 percent,” CNBC, August 28, 2017.)

Also Read: Warren Buffett Indicator Predicts Stock Market Crash in 2017

Furthermore, it’s been almost 15 months since we’ve had a “small correction” of five percent of more (peak-to-trough). The last time it happened was right after the Brexit vote in June 2016. That’s approaching the second-longest streak on record. It seems unbelievable the stock market has been able to scale this wall of worry. But there are powerful forces keeping the rally afloat.

One of the main supporting catalysts is the anticipated Trump tax cuts. The administration is expected to focus on tax reform after the summer recess in Congress. A simplification of the tax code has been floated, and tax breaks to the lower- and middle-class earners are expected. Although Treasury Secretary Mnuchin vows no absolute tax breaks for high-income earners, expect additional business deductions to be introduced. Most pundits feel these tax cuts would be stock market-supportive.

Another shot in the arm for the market: record ETF participation. Record inflows of $247.0 billion in the first half of 2016 show little sign of abating. When you combine this with bottled-up volatility and continued growth in the economy (with little inflation), you have ripe conditions for what is known as a “market melt-up.” That is, a market that marches up relentlessly on generally average to below-average volume.

Could 2017 End Without a Stock Market Correction?

Anything is possible, obviously. Just because the market has declined at least seven percent every year since 1995 doesn’t mean it’s going to happen again. And to be honest, we have to give the bulls some credit here. Stock prices have appreciated much longer than anyone anticipated. It’s been almost surreal to witness.

But there are still four months to go in 2017, and the stock market faces its toughest battles ahead.

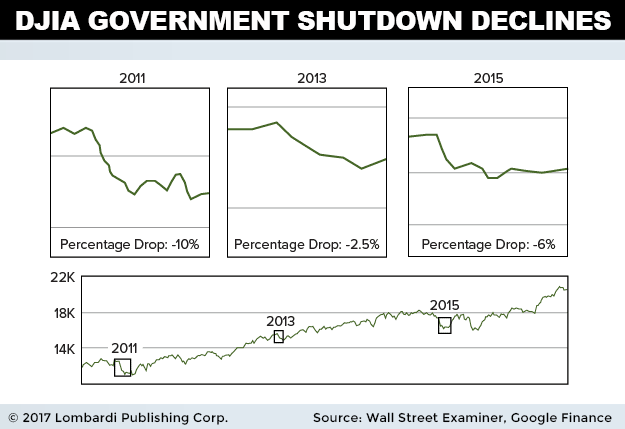

We’ve spoken ad nauseum about the brewing debt ceiling crisis in the past couple of weeks. And with good reason. Odds are, a failure to lift the ceiling before the September 30 deadline would lead to that much-anticipated stock market correction.

It’s not just about a possible credit downgrade and all the other things we’ve talked about. It’s about another black mark on political certainty in this country. If red and blue can’t agree on a critical debt ceiling lift, what can they agree on? It makes tax reform and corporate earnings repatriation much less likely. Or at least, more watered down than Wall Street would prefer.

But whether big, negative shocks like the debt ceiling crisis or North Korean war come to pass, signs are emerging that the S&P 500 is experiencing a fit of exhaustion.

Although the index is up almost double-digits this year (about 9.6%), most gains came before the first half of June. This is odd considering economic data has been getting better throughout the year. For example, second-quarter GDP was revised upwards this week to three percent annualized in 2017, the highest in two years.

Despite this, breadth had been deteriorating and the number of stocks trading below their 200-day moving averages is at cycle lows. There’s a sharp dichotomy between equity prices and index-level investors are attempting to reconcile. Ideally (from a bull’s perspective), breadth and stocks trading above the 200-day moving average would move in tandem with a rising economy. But this clearly isn’t happening here.

That’s why so many investors remain skeptical at these lofty level. It’s virtually impossible to stake a large position at these nosebleed levels, never mind the aforementioned indicator divergence.

Adding to the confusion, gold prices have been rising since July 10. The march higher can best be described as a “melt-up,” echoing the price action in equities. Prices have risen from just over $1,200/oz to $1,323/oz as of this writing. That’s a 10.25% rise in a month and a half.

We believe the upcoming uncertainty in September is behind the investor demand, but we question whether equities can advance when gold is making a sharp move higher. Stock price run-ups reflect expectations of continued economic growth; gold price run-ups reflect a hedge for investor fear. The two don’t normally correlate. The gold run-up could reflect a stock market poised to roll over, even if a temporary reprieve was granted from solid 2Q growth numbers.

It remains to be seen whether stocks can end the year without a correction. It would be most unusual—from a historical perspective and from a “wall of worry” perspective. But stranger things have happened. Either way, I’m not sure how retail investors can stake a position in stocks, considering their overbought nature and upcoming September politicking.

We continue to view risks skewed to the downside.