Will the U.S. Economy Remain Stable as Interest Rates Soar?

Interest rates in the United States are skyrocketing. This could mean a lot of trouble ahead for corporate America and American consumers.

Too often, everyone gets boggled by the rates set by the Federal Reserve, the federal funds rate (FFR). It’s the most basic interest rate, but it’s not the rate that the average business or consumer gets for a loan or mortgage. The FFR is just for the banks.

To get a better idea of interest rates for businesses and consumers, it’s important to pay close attention to the yields on U.S. bonds. Sadly, as it stands, those interest rates are just soaring.

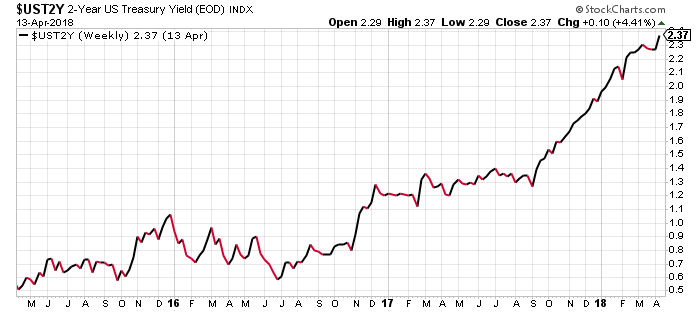

Look at the chart below, for example. It shows the yield on the two-year U.S. Treasury.

Chart courtesy of StockCharts.com

In mid-2015, yields on the two-year U.S. Treasury were around 0.2%. Now it’s 2.37%. That’s an increase of close to 1,100% in a matter of just a few years. The yields on these U.S. bonds stand at the highest level since the 2008 financial crisis. Since mid-2017, they have seen an almost vertical increase to the upside.

Why bother paying attention to the yields on the two-year U.S. Treasury? A business may get a short-term loan based on this rate. In June 2015, the business could have been paying just $0.20 on every $100.00 they borrowed. Now it’s $2.37.

Businesses in the U.S., all of a sudden, could be incurring much more interest expense than they did just three years ago. Remember this: interest rates directly impact profitability. The higher the interest expense, the lower the profitability.

Mortgage Rates Soar as 30-Year Bond Yields Surge

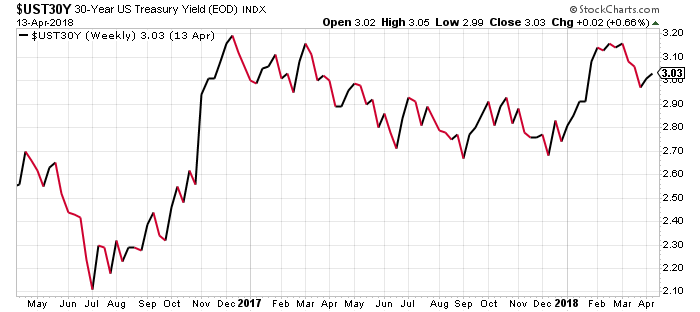

But don’t just stop here; look at the yields on the 30-year U.S. Treasury.

Chart courtesy of StockCharts.com

In mid-2016, yields on the 30-year U.S. Treasury were 2.1%. Now it’s 3.03%. This represents an increase of 44.3%.

Why does the 30-year U.S. Treasury yield matter? Long-term mortgage rates usually move in a similar direction as the yields on 30-year U.S. bonds.

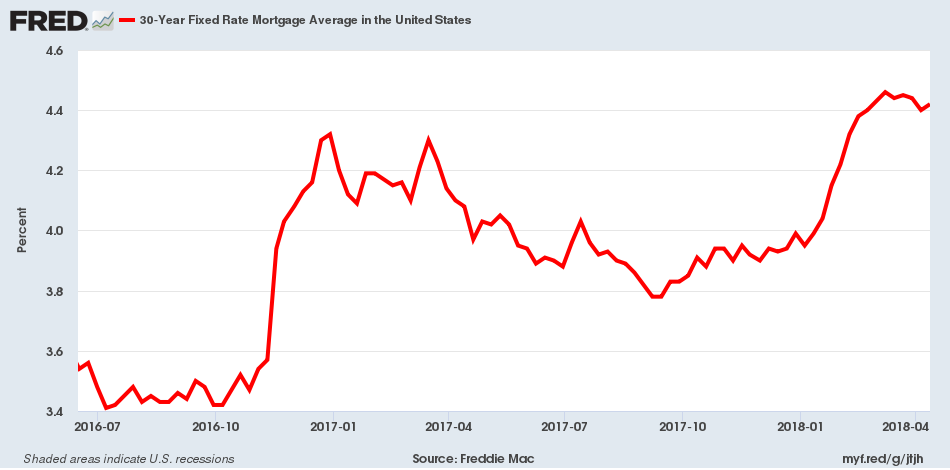

Look at the chart below of the 30-year fixed mortgage rate in the United States.

(Source: “30-Year Fixed Rate Mortgage Average in the United States,” Federal Reserve Bank of St. Louis, last accessed April 16, 2018.)

Notice how similar these two charts are?

Higher Interest Rates Could Send the U.S. Economy into a Recession

Dear reader, Economics 101 suggests that higher interest rates are used to cool down an overheating economy. The U.S. economy is far from overheating, though; it continues to grow at a pace way below the historical average.

Now that the Federal Reserve has increased its benchmark interest rates, all the other rates are moving higher too. They are increasing at a very fast pace.

It must be asked, can the U.S. economy handle higher interest rates?

I remain very pessimistic about the U.S. economy in the coming quarters. I think the topic of rising interest rates is taken too lightly by investors. The rising rates could be the biggest threat right now; they could hurt consumption across the board, which will hurt the U.S. gross domestic product (GDP) immensely.

Let me tell you this: higher interest rates could send the U.S. economy into a recession in no time. In fact, I already suspect that the end of 2018 and the beginning of 2019 may not be so rosy for the U.S. economy.