While it may be hard to fathom today, silver prices could be setting up to soar by 850%.

And it all has to do with the long-term silver price chart. It’s telling us something important.

What the Long-Term Silver Price Chart’s Saying

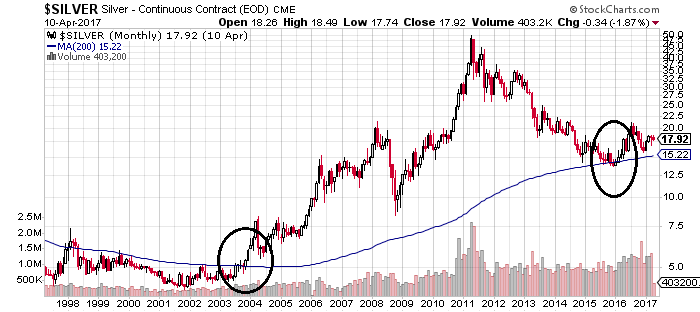

On the chart below, you will see a blue line. It represents the 200-day moving average of silver prices. Notice what happened the last time the price of silver hit this moving average.

The last time silver prices hit their 200-month moving average, it was back in late 2003 and early 2004…just before the bull market in the gray precious metal started. When silver prices crossed over their 200-day moving average, they soared all the way from $5.25 an ounce to near $50.00, which is an increase of 850%.

In 2016, silver prices hit this moving average again for the first time since 2003, and they bounced back above that level. I circled this event on the chart above. (If the precious metal’s price had broken below the moving average, it would have been bearish.)

Chart courtesy of StockCharts.com

What I’m saying is that history will repeat itself. Silver will rise from the $16.60 an ounce it was trading at in late 2016 (when it hit its 200-day moving average) to $158.00 an ounce, which is a gain of 850%.

Silver Prices: Can History Repeat Itself?

Could silver really soar to over $150.00 an ounce?

The last time the price of the precious metal soared by 850%, it didn’t happen overnight. It happened over a seven-year period. And I expect the same thing to happen again, especially given the imbalance of rising demand and tight supply that I see playing out over the next few years.

So, where’s the big opportunity for investors in silver?

I would look at the silver miners, as I believe both senior and junior miners’ stocks are selling at bargain-basement prices. And they will both perform well as silver prices continue to rise.