Silver Prices Face Headwinds

Even after Donald Trump won the U.S. presidential election, it’s still been a good year for silver, up 20.5% year-to-date near $16.60 per ounce. But growing optimism around a Trump presidency is creating headwinds for silver prices. That said, one indicator suggests that silver is poised to surge 32% in the coming months.

For the most part, it’s been a great year to be a precious metal bull. After a record four consecutive years of declines, silver prices rebounded in early January after the markets tanked on fears of a stalled U.S. economy and global recession.

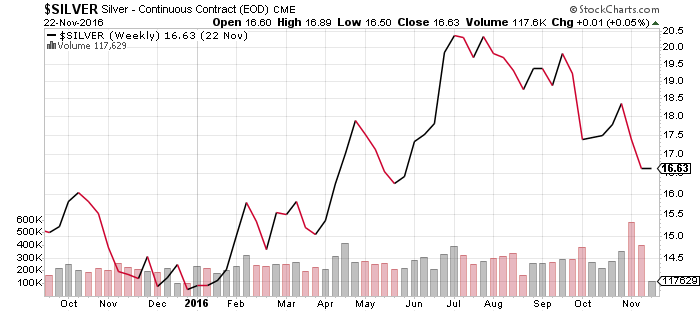

Chart courtesy of StockCharts.com

By early July, silver prices had advanced 54% to a two-year high of $21.23. By comparison, the S&P 500 was up just 2.7%. Over the normally quiet summer months, silver prices fluctuated in a tight range as investors absorbed economic data and mulled over what a Trump or Clinton presidency would look like.

Silver prices took a solid hit after Trump won the U.S. presidential election. Investors were buoyed by hopes that Trump’s planned tax cuts and infrastructure spending would resuscitate a stalling U.S. economy.

As a hedge against economic uncertainty, silver didn’t shine quite as brightly as many thought it would with Trump in the White House. Fears of an unhinged President Trump were also muted around the world as the U.S. dollar index soared. The greenback is also doing well against the yen, pound, and euro. A strong U.S. dollar is putting downward pressure on silver prices.

With Trump not officially taking office until January 20, 2017, it does not appear as though silver prices are going to make any sudden moves to the upside before the end of the year. But that doesn’t mean silver prices won’t be bullish in 2017.

U.S. Economy Not As Strong As It Appears

Nothing material has really changed since Trump won the election. On one hand, the U.S. economy looks decent, unemployment remains low, new orders for U.S. manufactured capital goods rebounded in October, and the Federal Reserve is expected to hike interest rates at its December 13-14 policy meeting.

But that data doesn’t tell the whole story.

Consumer confidence remains low and underemployment remains close to 10%. The official unemployment level may be under five percent but many of the current job growth is coming from part-time and minimum wage jobs. On top of that, the number of Americans lining up for unemployment benefits rose by 18,000 to 251,000 for the period ended November 19. (Source: “Table A-15. Alternative measures of labor underutilization,” Bureau of Labour Statistics, November 4, 2016.)

This comes at a time when the average American household has debt in excess of $130,000. Of course, debt is okay if your income is going up, you’re paying off your debt, and you have a nest egg to fall back on, but that isn’t the case.

A whopping 66 million Americans have no money saved for an emergency. Moreover, 47% of Americans say they could not afford an emergency expense of just $400.00. To cover that kind of expense, they would have to resort to selling something or borrowing the money. Not surprisingly perhaps, close to 46 million Americans receive food stamps. (Source: “66 million Americans have no emergency savings,” CNBC, June 21, 2016.)

The U.S. economy may be growing on paper, but it’s being supported by growing debt, low income, and rising interest rates. And that kind of foundation is apt to crack. This also comes at a time of global economic uncertainty and growing geopolitical tensions.

This Ratio Suggests Silver Prices Could Surge 30%

The bottom line is, despite the strong U.S. dollar and growing optimism on Wall Street, the U.S. economy is not doing as well as most think. This will not just support silver prices over the coming months; it will help propel silver prices higher in 2017.

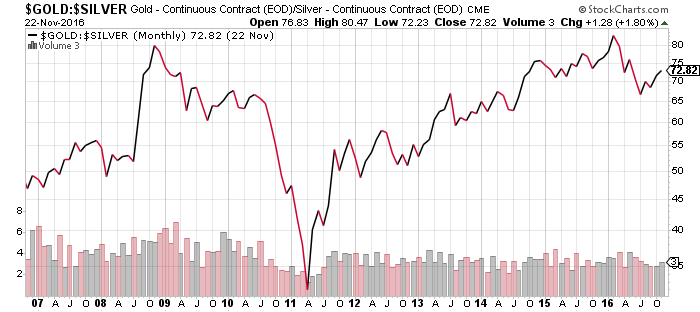

To get a handle on how high silver prices could climb in the New Year, investors need to pay attention to the gold-to-silver ratio. The ratio points out how many ounces of silver are needed to buy one ounce of gold.

The gold-to-silver ratio is important because silver has a historical relationship with gold. The connection between these two precious metals can help investors determine what silver prices should do.

Chart courtesy of StockCharts.com

Silver is currently trading at $16.33 per ounce while gold is being exchanged at $1211.20 per ounce. At the current prices, the gold-to-silver ratio stands at 72.82, the highest level since June. Since 1970, the gold-to-silver ratio has averaged around 55. This suggests that silver is undervalued. If the gold-to-silver ratio recalibrates, silver prices will climb 32.5% to around $21.65 per ounce.

Now, for the gold-to-silver ratio to return to historical norms, either gold prices need to fall or silver prices need to climb. The latter seems more likely. Why? Because there are more than enough catalysts to keep precious metal prices higher.

Stocks are overvalued and the bull market is more than six years old. This wouldn’t be a big deal if stock valuations were based on revenue and earnings growth, but they aren’t. Stock prices continue to be propped up by artificially low interest rates. And we all know what happened the last time the Fed raised rates prematurely.

Even though silver and gold both thrive on economic and geopolitical uncertainty, only silver does well when the economy is doing well. Should the U.S. economy improve under Trump, the demand for silver should increase thanks to its use in a number of industries, including medicine, nanotechnology, batteries, electronics, automotive industry, water purification, and windows and glass.

Silver prices surprised investors to the upside in 2016 and I think everything is in place for the same kind of run for silver in 2017.