Silver Prices Are Falling Because of Erroneous Inflation Concerns

Everything in the markets points to higher prices for precious metals. Yet, they’re failing to respond as expected. The situation is not desperate. In fact, gold and silver prices have gone up in the past three months. It’s just that at a time when stock market volatility has reached such high levels and inflation concerns are rising, you expect the price of gold and the price of silver to rise.

The problem, especially in the case of silver prices, is the following. While the markets remain in casino mode, the higher inflation has everyone thinking more optimistically about the U.S. dollar. Inflation, goes the logic, will push the Federal Reserve to raise interest rates, pushing the dollar higher.

Admittedly, the argument makes sense. There’s logic to that. But, on closer inspection, there’s no reason the U.S. dollar should expect to achieve any major gains compared to other currencies (and Bitcoin is not one of these). But, perhaps overly optimistic or pessimistic—it’s hard to tell these days—inflation could reach higher levels than expected. This has left silver vulnerable to a lack of curiosity.

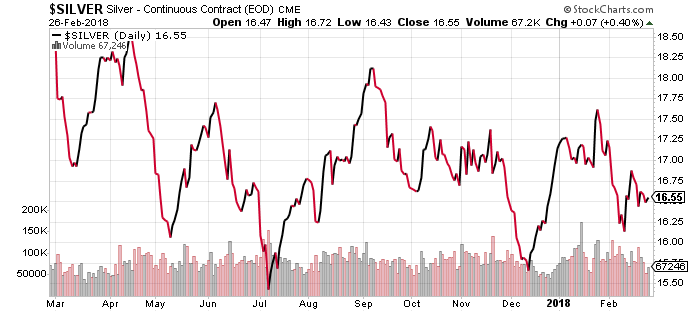

Silver Price Chart

Chart courtesy of StockCharts.com

The greenback appears more profitable, thereby attracting the attention of more traders. Moreover, because silver prices—as all other commodities from gold to oil—are priced in dollars, silver becomes less attractive to foreign buyers. Higher interest translates to a higher dollar value. Buyers from abroad using other currencies, whether euros or Japanese yen, have to pay more for every ounce of silver.

Silver also has some technical applications. It’s used in circuits, coupled with other materials to become a superconductor. It has no substitute. Demand for such products remains high.

The Inflation Concerns Are Bunk

Still, investors and speculators don’t care. They are worried about the key premise that silver bears bring up to explain the low demand. It’s that the dollar will go up. But will it? I don’t think so, and the main reason for my skepticism is that I think all the inflation chatter is nonsense. In the sense, particularly, that salaries are going up and that this will drive consumption.

Salaries may be going up slightly because of the Trump tax plan. But the difference between the rich and poor will also rise—exponentially so. Prices of certain items will rise. But salaries will likely remain at the current level, which is less than what the average person earned before the 2008 financial crisis.

If consumer sentiment were expressing greater confidence—thanks to higher salaries—you’d think that this key statistic would show an improvement. It isn’t, and the statistic in question is the number of new home sales. Since the tax cuts were announced, new home sales have dropped. The drop was rather sharp in the Northeastern and Southern States. In these regions, they dropped 33.3% and 14.2%, respectively. (Source: “US new home sales drop for second straight month,” CNBC, February 26, 2018.)

Moreover, the cause of the lower new home sales is that too few people can afford them. Prices of new homes are rising much faster and higher than most new homeowners can afford. And the shortage of houses is rather noticeable at the cheaper end of the market.

A $400,000-a-Year Salary Is Now Middle Class…

This is driving first-time buyers away. In other words, for all the great and favorable predictions about the economy, the inflation that does exist is coming from shortage and speculation. The unemployment rate is said to have dropped to 4.1%, the “lowest” since the dotcom bubble in 2000. But nobody appears to be questioning the obvious. What kind of jobs constitutes the “increasing” numbers? Perhaps, they are all lower-end service jobs that pay minimum or below minimum wage.

Consider that in Silicon Valley, people consider a salary of $400,000 a year to be “middle class.” How many people can even claim to have a salary that’s a quarter as good as $400,000? (Source: “Silicon Valley is so expensive that people who make $400,000 a year think they are middle-class,” Business Insider, February 20, 2018.)

Sooner or later, the talk about inflation and higher interest rates will stop. Economic growth could drop significantly in the next few years according to the new home sale numbers. Without salary inflation, there cannot be general inflation. Therefore, the dollar is slated to remain low because the Fed will likely not rush to increase rates just yet.

This warrants an entirely different narrative to explain the early February market correction. And again, there’s no need to seek out those trained in the art of crystal-ball readings. The stock market crashed or corrected because price-to-earnings ratios have been getting out of hand. The Trump tax cuts will prove a flop; the rich did not need to become any richer.

Therefore, investors should worry less about inflation and more about the fact that social inequalities are rising at a rate few could even imagine. There are deep social cleavages. More than inflation, Americans should worry about income inequalities that are pushing some prices higher but also driving down most people’s ability to afford the basics.

It’s the whole economy that’s at risk, not just the financial markets. The sooner Americans realize this, the sooner silver prices (and gold) will start rising. It’s time to start thinking about refuge—not just investment.