Here’s Why Silver Prices Could Rise in the Long Term

The silver prices outlook in the short term may not look rosy, but in the long term, there could be major upside ahead. Don’t rule out $50.00-an-ounce silver yet.

Just like gold prices, silver prices have come under fire from investors. The common belief is that precious metals are the worst investment to hold in times when interest rates are on the rise.

With this sentiment prevailing across the board, silver prices have been trending downwards since August. After rising to as high as $21.00 an ounce, silver currently trades just below $17.00.

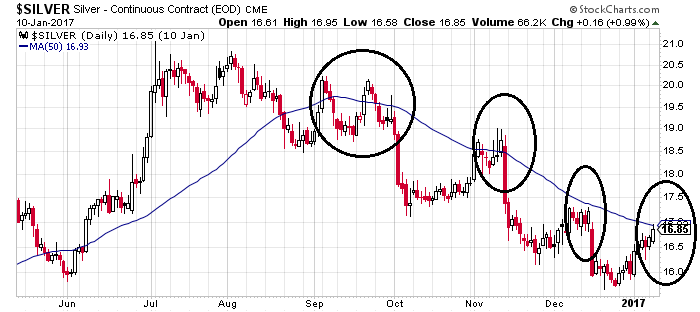

Please look at the chart below and pay close attention the blue line. From a technical analysis perspective, there’s something interesting taking place on the chart.

The blue line represents the 50-day moving average of silver prices. Over the past few months, this moving average has acted as a resistance level. Every time the precious metal price hits this moving average, it drops. This also says the intermediate-term trend is pointing downwards.

Chart courtesy of StockCharts.com

How long could this trend continue?

You see, when it comes to technical analysis, it’s important to know the levels where the price found support previously. When looking at silver prices, since the end of 2015, the $15.00 level has acted as a base. It wouldn’t be shocking to see the price bounce as it hits that level, if it does.

But remember, this is all in the short term.

It can’t be stressed enough; ignore the short-term price action. In the short term, there’s too much noise that causes unnecessary volatility in price. It would be wise if investors think long-term when looking at silver prices.

There’s one thing every investor must know: the demand for the physical precious metal remains resilient. Despite the pessimism, we see buyers remain and buying at an accelerated pace. This is something not being discussed in the mainstream.

Consider this: in the first 10 days of 2017, the U.S. Mint sold 3.7-million ounces of silver in American Eagle coins. In 2016, average monthly silver sales at the mint amounted to 3.15 million ounces. (Source: “Bullion Sales,” United States Mint, last accessed January 11, 2017.) Simply stated; demand for silver at the U.S. Mint is already running higher than the monthly average of 2016. Don’t ignore this.

Investors also have to consider inflation as well. It could be one of the biggest catalysts that drives silver prices to $50.00 or more.

Understand that since the financial crisis, the money supply has increased immensely. This will eventually show up as inflation. As a matter of fact, inflation expectations started to move higher. It wouldn’t be shocking if they rise even more. Keep in mind that as inflation surges, silver prices skyrocket.

What’s Next for Silver Prices in 2017?

Dear reader, just by paying attention to the fundamentals and keeping the focus long-term, silver prices are selling at extremely low valuations, as well as getting scrutiny for all the wrong reasons.

We could see 2017 be the year when investors start to realize the potential gains the precious metal could provide.

In the meantime, the best strategy would be to keep a close eye on silver mining companies. As silver prices have come under fire, the silver mining stocks have declined in value as well. They could provide massive returns as the precious metal prices rise.