Do We Have to Wait for a Stock Market Crash Before the Silver Price Goes Up?

Gold prices have started to move up. The gold price has started to beat the Chinese yuan. Geopolitical events are supporting gold, but the silver price should have outperformed gold first. Why hasn’t it?

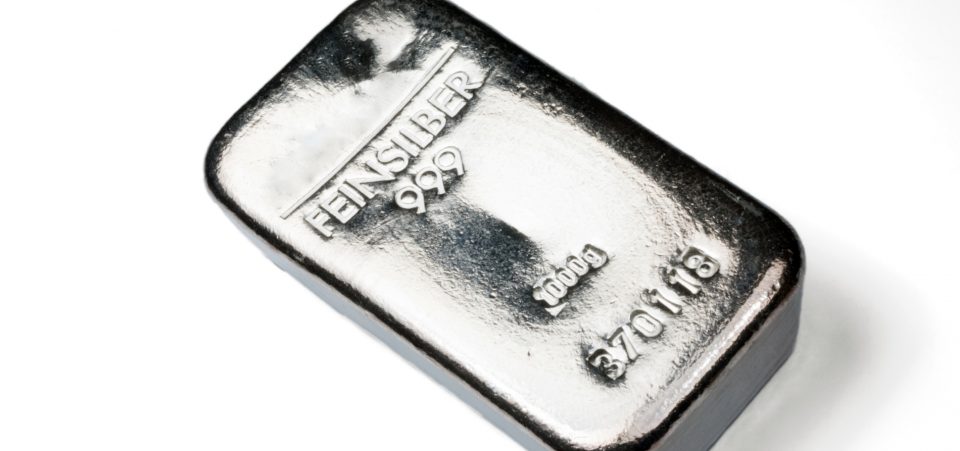

The silver price also incorporates a less “speculative” component than gold. It benefits from considerable industrial demand. In fact, it’s an unstated expectation that, ideally, silver should not go up too much: doing so would hurt the overall economy.

One explanation for the generally bland performance of precious metals after the big resource rally in 2010-2011 is the emergence of cryptocurrencies and blockchain “products” that have distracted younger investors, the so-called millennials.

Millennials—those born in the 1980s and 1990s—have never experienced a major crash.

They were too young to get caught in the sub-prime crash of 2008. And they are too young to understand what it means to trade with interest rates higher than two percent.

In other words, there’s a whole new generation of investors who have a skewed idea of risk. Indeed, they may have no clue at all about the inherent risk of the stock market—let alone the new instruments that fulfill utopian fantasies like cryptocurrencies.

The silver price, even more than the gold price, has suffered from this overall outlook. It may take a major stock market crash or the next financial crisis for the younger folks to discover the value of precious metals.

What Will It Take for the Silver Price to Move?

Returning to the relationship between the gold and the silver price, there is a perception of harmony, or synchronicity, between the two. The operating word here is “perception.”

Like many aspects of the markets, whether precious metals, stocks, bonds, or any other instrument, perceptions are not rules. Sometimes, the market completely overturns an accepted maxim.

And often, the perception maintains validity, just not the speed. And that’s what, I believe, is happening with the silver price.

The appreciation of gold has not solidified yet. Or, if you prefer, the gold rally has not started yet. Thus, the silver price has not made any significant moves.

Therefore, the fact that gold has sped past silver should not prompt concerns. Gold has started to regain strength because of key factors entirely rooted in its role as a safe-haven asset.

An ever more mutable, or temperamental, sentiment on Wall Street has started to shake equity investors’ confidence. And that has woken the appetite for gold, which has sat idle for the past few years.

Yet, the appetite is still at the appetizer stage. That’s why gold has made a small step; it is not yet at the level it was at the start of 2018.

Interest rates have triggered higher-capital market volatility. But the actual—rather than inflation-driven—interest rate has kept gold in the shadows.

The rising U.S. dollar has not helped, even if a now all-but-declared U.S.-China trade war has begun while eurozone instability intensifies.

The general picture, therefore, is that many ingredients contributing to the recipe that typically draws investors to an appreciation of precious metals are coming together.

The inflation factor is what’s slowing down the bullish effect.

The Gold-Silver Ratio

The gold-silver ratio measures investor appetite for silver. The higher the ratio goes (the ratio is based on the price of gold in U.S. dollars per ounce divided by silver), the lower the appetite for silver.

The gold-silver ratio remains around 84. And it has stayed around this level for some time.

Historically, when the ratio remains over 80, investors are undervaluing silver compared to gold. If that ratio drops to 50 or 40, for example, then the opposite is true: silver is overvalued against gold.

The gold-silver price ratio has generally dropped since the 19th century (it was as high as 100 or the equivalent at the peak of gold-backed currencies).

The main reason was that silver has industrial applications—and therefore, its value gets lost in the overall value for all industrial metals, like copper for example. And in general, these metals have suffered from the rising value of the U.S. dollar.

Thus, it should surprise nobody that the silver price has dropped almost nine percent.

The good news is that after falling below $14.00 in mid-September (the lowest since December 2015), it has started to recover, even as the Federal Reserve declared its determination to lift interest rates.

A Bullish Turn for the Silver Price Is Around the Corner

If the dollar’s strength and low demand pushed the silver price down before, something is allowing it to rise again now. Geopolitical concerns have started to influence investors.

They may have gravitated to the U.S. dollar, but the weakness in the stock market has raised questions about the strength of the U.S. economy.

And despite interest rate hikes, the dollar itself is starting to lose its appeal.

Apart from questions about the actual strength of the U.S. economy in the long term, the European Central Bank (ECB) will also start to lift rates in 2019. Thus, the relative strength of the dollar will drop.

Therefore, there’s a change in the trend. The appeal of silver will increase. I expect the silver price to start rebounding and continue to increase in 2019.

If geopolitics and dollar concerns don’t work, all major car manufacturers will start to offer electric vehicles, which should help increase the industrial demand of metals like copper, lithium, and, of course, silver.

It’s not hard to see silver going to $17.00, given that the most bearish price expectations are $14.60 (BMO Capital Markets). Better, in the long term, BMO expects the silver price to hover around $20.00 per ounce with a 60:1 gold-silver ratio.